Long time readers will know that last Summer we went hard on MKR (Report 1, Report 2, Report 3). MKR was hardly a consensus bet at that point in time and has performed incredibly well since. We have reason to believe a similar set up is emerging for AAVE at this current juncture.

Buybacks

One of the most attractive pieces of the MKR thesis last year was their proposed “Smart Burn Engine” which proposed to buyback MKR from the open market and throw it into a DAO-owned LP - placing a consistent secondary market bid for MKR, taking MKR out of circulation and thickening on chain liquidity for the asset too.

In fact, when we look back at the price action in the MKR/ETH ratio. It was this proposal on the 23rd of June (see circled below) which catalysed a more or less straight line 3x in the ratio over the next 2-3 months. The pair has been strong ever since.

Just yesterday, AAVE released a “Temp Check” (a governance forum post) on an AAVEnomics (AAVE tokenomics proposal). Amongst other things the proposal lays out the path for “protocol net excess revenue redistribution to the key actors of the Aave ecosystem” or in layman’s terms, a rev share mechanism.

Currently AAVE stakers (stkAAVE) are rewarded with AAVE emissions sourced from the ecosystem rewards contract. The proposal notes that this ecosystem rewards contract is not infinite. In an attempt to move towards a more sustainable model for stkAAVE, the post proposes that the protocol engages in a “Buy & Distribute” program whereby AAVE is acquired on secondary markets from protocol revenue and is distributed to the ecosystem reserve and in turn, stkAAVE.

A paradigm shift in protocol sustainability and an entirely new source of buy-side demand for AAVE on secondary markets.

It must be noted that these changes aren’t expected to take place immediately, in fact, there are certain milestones which need to be reached before this “Buy & Distribute” program would initiate:

Basically GHO would have to hit 175M supply (at 100m now) and DAO economics have to improve a bit before the program goes live.

One other intricacy of the proposal which is worth noting here too is that under “Umbrella” (a new version of the Aave Safety Module), stkAAVE will no longer be slashable in the event of protocol bad debt. Instead, market participants will be able to stake aTokens (aUSDC, aUSDT etc.) as a form of junior debt which earn a higher yield but risk being slashed first in the event of bad debt. This significantly improves the risk profile of stkAAVE, under this new paradigm the only reason not to stake AAVE is to remain liquid as the 20 day unbonding period still applies to our knowledge.

Going back to MKR, the Smart Burn Engine wasn’t implemented on June 23rd, 2023, in fact it took months to be implemented, but it was the signal that value accrual was inbound which actually bottomed the ratio.

For AAVE, the path towards sustainable value accrual has been telegraphed and if AAVE behaves similarly to MKR, we’d be seeing a bottom being formed in the AAVE/ETH ratio as we speak:

Now, we all know the saying: “bottom pickers get stinky fingers”, but there is a clear line in the sand being formed here. One can make the statement: “if AAVE/ETH doesn’t bottom here, when will it ever bottom…” which lends itself to an attractive risk/reward set up whereby risk can easily be defined.

Revenue

According to https://aave.tokenlogic.xyz/revenue, AAVE generate ~$86m/year in revenue (looking at annualised 30d revenue):

Granted, this is quite a bit smaller than MKR’s revenue which is closer to $300m (if we look at their top line) but AAVE is valued lower than MKR on a Fully Diluted Basis ($1.6bn vs $2.7bn).

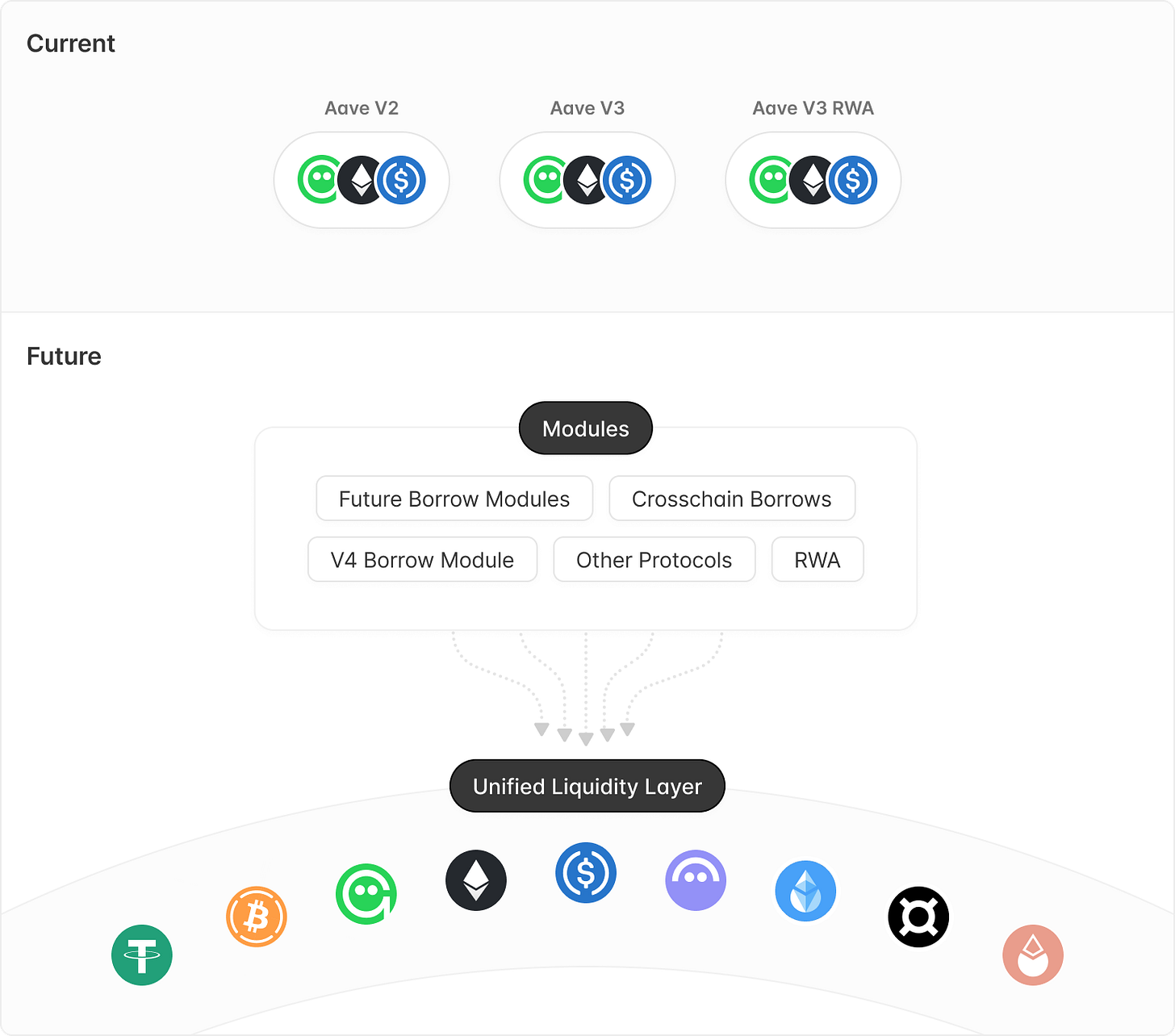

Aave V4 should also allow for greater revenue as it essentially removes a lot of the liquidity fragmentation issues the protocol has previously suffered from - having to boostrap liquidity on new chains. V4 will allow for unified liquidity which should increase Aave’s TAM as users on these chains can tap into mainnet liquidity:

It is also understood that generally Aave’s revenues are more reflexive with movements in the Crypto market. Given they operate a lending market while Maker operate a CDP/Stablecoin business, Aave’s revenues scale more linearly with increases in the prices of majors. Therefore, if one expects a broad based uptrend in BTC and ETH, it is then logical to assume a broad based increase in Aave’s revenues too.

Conclusion

To conclude, the future has never been brighter for our old friend AAVE. A $1.6bn valuation seems like an attractive entry for one of the most trusted DeFi protocols (up there with Uniswap, Lido and Maker) which has a path to sustainable value accrual and a huge protocol upgrade on the way with V4.

“If AAVE/ETH doesn’t bottom here, when will it ever bottom…”

If you enjoyed and want to see more content like this, feel free to check out the Humble Farmer Army premium discord here.

You’ll get access to:

Weekly Premium Content

An Exclusive Community

DeFi Yield Strategies

Degen Farms & New Launches

DeFi Education & Analysis

And Real-Time DeFi Alerts

Humble Farmers Rejoice!