MakerDAO: the Sleeping Giant (Part 3)

Long-form research reports published by the HFA Research Team. 100% Free.

Intro

It’s been a while since we discussed MakerDAO in this forum with our first and second reports published back in July. With the MKR/ETH roughly doubling (from publishing our first report to recent local highs in the ratio), we wanted to provide an update on the idea and discuss potential future drivers.

An update on the metrics

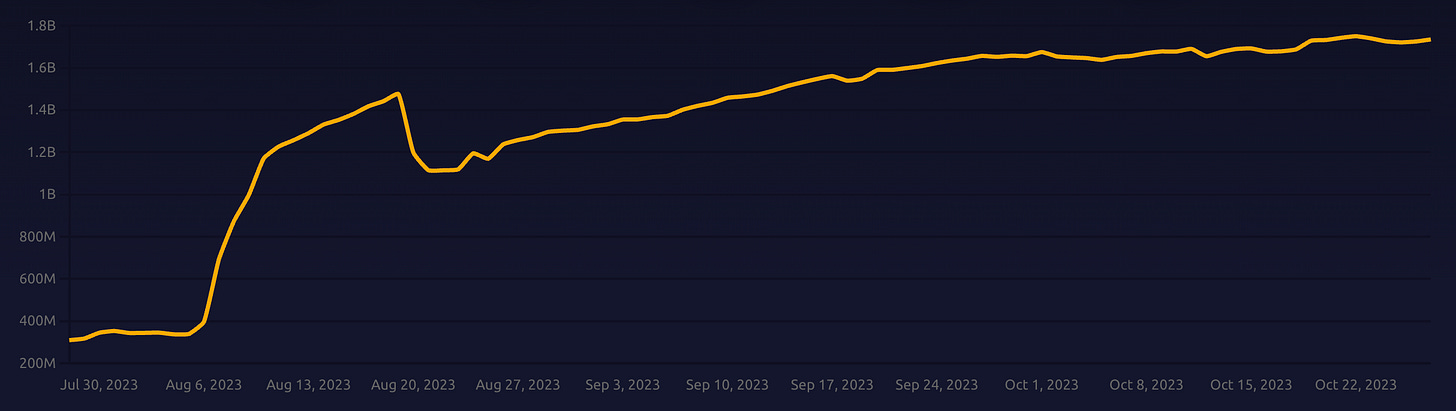

Unsurprisingly, bundling off-chain treasury yields into a yield-bearing dollar has been a successful undertaking as DAI supply and DAI staked into the DAI Savings Rate (DSR) have continued to see growth:

This trend has been accompanied by the emergence of products building on top of sDAI such as Agave Finance on Gnosis Chain:

By placing idle DAI in the bridge into the DSR and opening up a vault for xDAI depositors to access this yield, Agave are enabling access to the DSR on Gnosis Chain. We would not be surprised to see other bridges and idle pools of capital begin to follow a similar playbook.

Equally, the underlying profitability of MakerDAO shows a consistent trend of up and to the right, recently surpassing $200m on an annualised basis:

This continues to drive flows into the System Surplus and consequently on-chain buybacks of MKR via the Smart Burn Engine:

We expect this to continue given increased pressure on the DAO for the yield optimisation of its RWA portfolio along with the passing of a recent proposal to increase the respective Debt Ceilings of the Andromeda and Clydesdale RWA vaults to 3 billion DAI respectively:

While this extra capacity can’t be used immediately given the amount of USDC in the PSM and current supply of DAI, it opens the door to increased profitability on a forward-looking basis.

Endgame

The above metrics are encouraging but we feel they are mostly understood by the market. While increasing profitability and MKR buybacks should support MKR price on a relative basis, we believe Endgame is the catalyst which can power the next leg of significant outperformance.

Endgame represents a significant transition for MakerDAO in a movement towards the ossification of the core Maker protocol while shifting innovation to subDAOs:

Rebranding of MKR and DAI

1:12000 split of MKR (removing unit bias and creating a new chart for MKR)

SubDAO Farming

Rune’s thread for even more Endgame context

SubDAO Farming represents multiple spin-offs of different entities and protocols which currently form part of MakerDAO, e.g., Spark protocol will be one of the SubDAOs. Participants will be able to stake rebranded MKR and/or DAI to earn a share of these SubDAOs. Note that significant interest in farming SubDAO tokens with rebranded DAI will likely lead to DAI supply expansion, DSR outflows and consequently an increase in MakerDAO profitability and MKR buybacks.

We believe Endgame (slated for Q1/Q2 2024) and an associated increase in profitability, will be the next driver of MKR outperformance.

Conclusion

If you enjoyed and want to see more content like this, feel free to check out the Humble Farmer Army premium discord here.

You’ll get access to:

Weekly Premium Content

An Exclusive Community

DeFi Yield Strategies

Degen Farms & New Launches

DeFi Education & Analysis

And Real-Time DeFi Alerts