MakerDAO: the Sleeping Giant (Part 2)

Long-form research reports published by the HFA Research Team. 100% Free.

Since publishing "MakerDAO: the Sleeping Giant" at the start of July, the Smart Burn Engine has been enabled, $MKR has been outperforming and we have seen a raft of other prominent market participants becoming vocal bulls. We wanted to write a follow up report with additional details.

Smart Burn Engine in motion

Maker's RWA portfolio continues to drive strong top line revenues which is directly contributing to open market buybacks of MKR every 30 minutes thanks to a successful implementation of the Smart Burn Engine:

Given that the Surplus Buffer is currently in excess of the minimum $50m required for buybacks, the Smart Burn Engine is expected to buyback $8m of MKR per month in Month 1 tapering to $3m/month in Month 3+ as the Surplus Buffer returns to the minimum level. Although buybacks are subject to downside as the Surplus Buffer is depleted, $3m a month is still meaningful, sustained spot buying pressure on a monthly basis. Additionally, this headwind could be counteracted by the potential revenue upside of the RWA portfolio - with only 50% of the BlockTower Andromeda RWA deployed and Coinbase Custody yielding 2.6%, it is not unreasonable to expect revenues and therefore buybacks to grow as these assets are fully deployed and optimised (FCF expected to be $120m+ per annum).

MKR revenue is also subject to upside should the Fed continue to hike and would benefit should the Fed "stay higher for longer" as revenues and buybacks will stay at elevated levels for a longer period. This is partly why we have been referring to Maker as PvE (player vs environment) as it's performance does not necessarily depend on other market participants, rather it is subsidized by US government as interest payments flow through Maker's RWA portfolio into buybacks!

Endgame

One detail we lackadaisically left out of our original post was Maker's Endgame and it's potential implications. This tweet thread and particularly forum post go into far more detail but in short, the Maker Endgame will:

1. Ossify core protocol and move innovation to SubDAOs

2. Rebrand MKR and DAI with new tokens and token split for "NewGovToken" to remove unit bias (1:1200 split)

3. Create farms for the 6 SubDAOs (for 30% of their supply)

4. Introduce AI into governance

Point 3 is particularly interesting as MKR/DAI become farming tokens to acquire the governance tokens of the SubDAOs (think Spark Protocol or summer.fi). This can increase demand for DAI (expanding supply) which increases profitability for MKR. If SubDAO farming significantly increases demand for DAI, this could allow the DSR to be lowered which would further increase MKR profitability - we call this a flywheel. And all of this is just "months away" according to Rune...

There is also the possibility of sDAI (DAI in the DSR) looping as it becomes profitable to collateralise sDAI, borrow stable against and loop. This is increasingly likely as sDAI is integrated as a collateral into money markets like Aave v3 (see proposal):

This would contribute to the flywheel mentioned above as DAI supply expansion is directly correlated with MKR profitability and consequently MKR buybacks.

In preparation for the Endgame, Rune is implementing an Enhanced Dai Savings Rate (EDSR is an enhanced sDAI rate starting at 8%) for a short period, to get the market comfortable using sDAI before SubDAO farming begins later this year.

In theory this would raise awareness of sDAI and reduce the DAI supply bleed. This experimental marketing tactic will carry a short term cost: increasing expenses will reduce FCF and MKR buybacks. While it is possible that remaining RWA deployments and optimisations will offset this increase in expenses, this will depend on the success of the EDSR program and how large it grows.

Ultimately, we have to ask the question: does the market care more about RWA/Endgame narrative and DAI going up or the actual $ value of buybacks? This is unclear and price action following EDSR implementation will be very telling.

Closing Thoughts

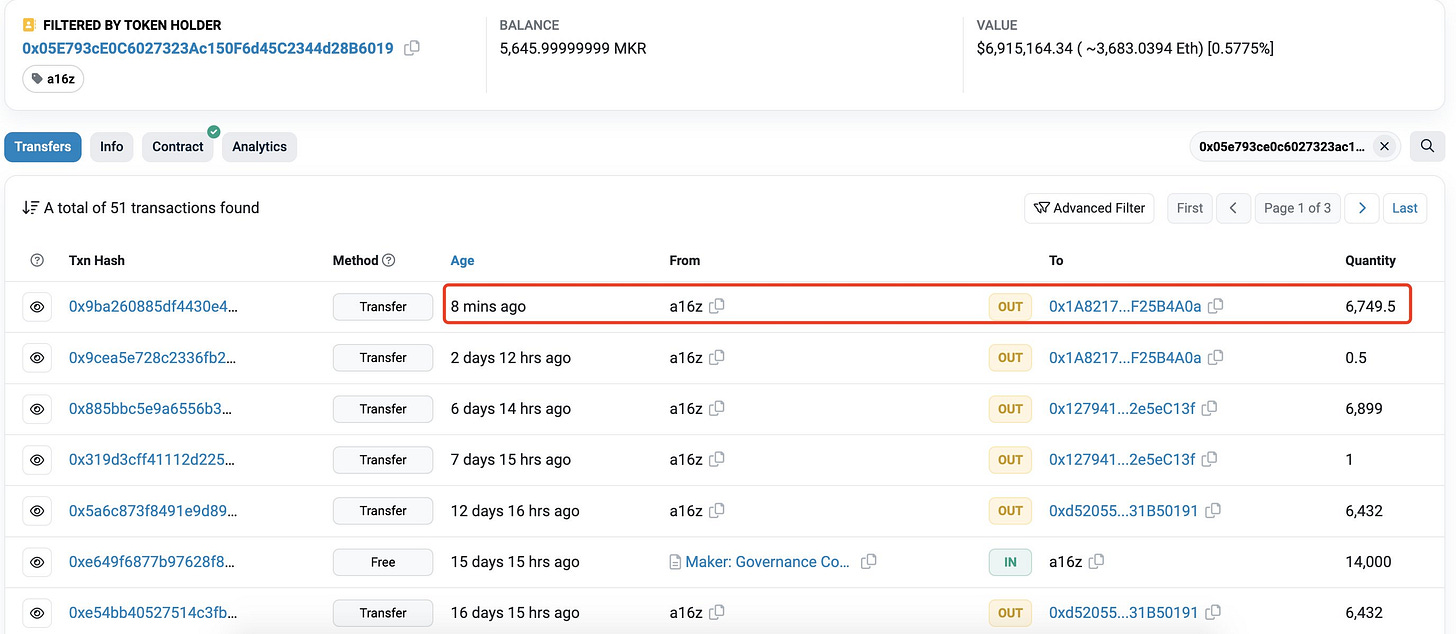

Despite the seemingly positive underlying fundamental developments, a16z have been continuously dumping the token but this supply headwind is expected to abate in roughly 10 days as they run out of tokens to sell. Some speculate that they are selling due to regulatory concerns surrounding buybacks while others cite changes in governance as the likely culprit.

Regulatory concerns are likely a longer term issue should Maker grow significantly but this does not affect the mid-term thesis. As for governance, Rune seems to be taking the benign dictator approach and is going “all in” which presents execution risk.

Another key risk is related to the end of the Fed hiking cycle, as rate cuts would reduce the profitability of Maker's RWA portfolio. This is certainly something to monitor as we approach EOY.

Ultimately, we see $MKR as one of the more compelling tokens to own in a mostly PvP environment (we think of it as a defensive play). While the EDSR could be a short-term headwind to buybacks, in the mid-term the success of EDSR could mean a successful Endgame and a higher DAI supply means a more profitable MakerDAO.

Conclusion

If you enjoyed and want to see more content like this, feel free to check out the Humble Farmer Army premium discord here.

You’ll get access to:

Weekly Premium Content

An Exclusive Community

DeFi Yield Strategies

Degen Farms & New Launches

DeFi Education & Analysis

And Real-Time DeFi Alerts