Metaplex - The ultimate infra play on Solana

Discovering whether MPLX has diamond in the rough potential

Since the beginning of the year, Solana has made an incredible transition in terms of how Crypto market participants view the chain. It has transitioned from one of many Alt L1s to a chain which people discuss as a genuine Ethereum competitor, SOL is now considered by many as one of the Crypto “majors”.

Despite the success of Solana and the native token SOL, there has not been an abundance of tangential plays one could make to bet on the success of the chain - especially with high quality projects like Jito and Jupyter launching at such high FDVs.

We believe Metaplex (MPLX) could buck that trend. With HFAResearch being known for our legendary bottom call on MKR (MakerDAO: the Sleeping Giant) and follow up reports (Part 2, Part 3), we are big fans of on-chain fees being distributed in-kind or as buybacks and creating real token value accrual - this is a central part of our MPLX thesis.

Introduction to Metaplex

Representing a core piece of Solana infrastructure and having been incubated by Solana Labs, Metaplex was spun out to operate as a standalone entity in 2021.

At a very high level, Metaplex is involved in the creation of tokens on Solana, both fungible, non-fungible and hybrid tokens. They allow this through a variety of tools implemented as on-chain infrastructure and applications which allow developers to create tokens.

For example, Bubblegum, Metaplex’s most popular offering is a program for creating and interacting with compressed Metaplex NFTs, which are secured on-chain using Merkle trees. Bubblegum allows massive numbers of NFTs to be created very cheaply.

Another example would be Token Metadata. Metaplex’s 2nd most popular offering is a program deployed on Solana which can be called by developers to attach additional metadata to their fungible or non-fungible tokens. For NFTs this could be the name, symbol, URI, traits, royalty fees, etc.

Thanks to the low fee environment, Solana is a chain of abundance where NFTs and Tokens can be created extremely cheaply, this has a strong tailwind for Metaplex which was demonstrated during their May Round Up thread posted a couple of weeks ago:

895k Token Metadata “create” instructions were called which was driven by a surge in fungible tokens created on Solana. 56% of Token Metadata usage was driven by fungible tokens:

In fact, Token Metadata usage for fungible tokens has been a big growth driver for Metaplex:

834k unique wallets directly signed transactions with the protocol in May, the highest month of all-time:

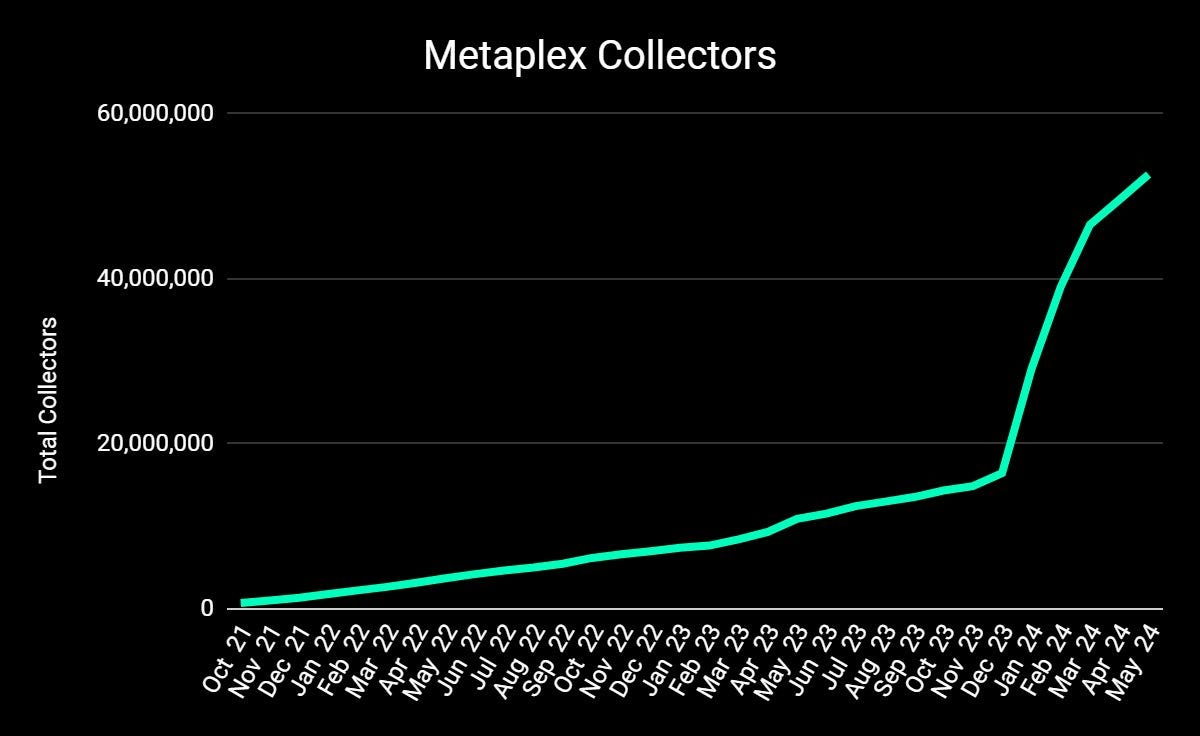

As of May, the total number of Metaplex collectors reached 53 million unique wallets, an increase of 3.1 million wallets month-over-month, the fourth largest monthly increase of all-time and a 6% increase month-over-month:

Clearly, there is a strong and continual demand for the on-chain services which Metaplex offers. Metaplex are constantly building new programs and standards for the developer community to leverage too. For example, they recently launched the Oracle plugin which allows assets to react to real-world data, affecting lifecycle events such as create, transfer, burn, and update.

MPLX

In most cases when you find a project with strong traction like Metaplex, the thesis for buying the token is just that the token represents a way to bet on the success of the underlying project and is a bet that eventually, their traction will convert to a sustainable economic model which will convert to value accrual. Many mental hops have to be made to justify investing in a token at the app-layer (note the use of the word investing, not just buying to flip a few weeks later).

In a similar way to what we saw with MKR last year, MPLX has a sustainable economic model which is generating real cashflow which is destined for token buybacks.

Metaplex charges a SOL-denominated fee for the various different services they offer:

At current rates, Metaplex is making on average 2000 SOL per week which is $270k/week or $14m/year.

In late March, Metaplex announced that 50% of all protocol fees (including all historic and future fees) will be used to buyback MPLX (repurchased MPLX will sit at MPLX DAO). This introduces a direct value accrual component to the MPLX token.

As of July 1st, Metaplex announced that buybacks had commenced with 50% of the Metaplex Protocol’s May fees (4,490 SOL) and an initial small portion of the historical fees (5,510 SOL) used to purchase MPLX in June.

Conclusion

Historically when we looked at Metaplex (initial thread here), it was difficult to build significant conviction given their metrics demonstrated a heavy reliance on NFTs at that stage. This fact combined with an unclear future for Solana NFTs made it difficult to build conviction. Over the past few months, the non-NFT-related demand for Metaplex’s offering has become clearer and with the products they have in the pipeline (e.g., Oracle), one can expect their future revenues to be even more diversified.

Strong metrics, an expanding product suite and ~$7m of buybacks all wrapped up into a $350m FDV is about as attractive of a token as this market has to offer, in our view. It is very possible that the wider market still views MPLX as an NFT-related protocol, we would expect a rerating to begin as the market begins to appreciate Metaplex as a full-stack token creation suite or as buybacks slowly impact the market price.

Resources:

If you enjoyed and want to see more content like this, feel free to check out the Humble Farmer Army premium discord here.

You’ll get access to:

Weekly Premium Content

An Exclusive Community

DeFi Yield Strategies

Degen Farms & New Launches

DeFi Education & Analysis

And Real-Time DeFi Alerts

Humble Farmers Rejoice!