Canto - Neofinance update

Long-form research reports published by the HFA Research Team. 100% Free.

Having first covered Canto in a report published in early October, touching again on the thesis in mid November and recently addressing the launch of 1155tech, we wanted to provide an end of year update on their Neofinance ecosystem. We strongly recommend reading the 1st and 2nd reports to understand the context and some of the key concepts which this update builds on.

Neofinance Coordinator

Amongst other adjustments to emissions across the ecosystem, a recent blog post and subsequent governance votes put forth incentives of 1.09 CANTO per block for the “Neofinance Coordinator”.

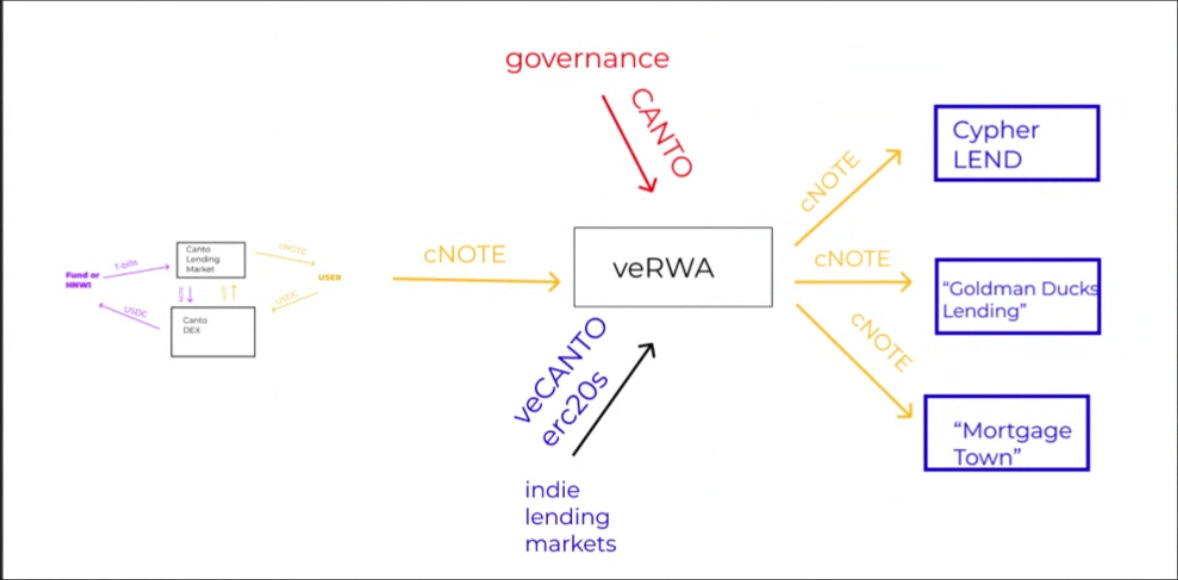

A Neofinance Coordinator section has recently been added to the Canto documentation which details the role of this new protocol. At a high level, the Neofinance Coordinator is responsible for incentivising the supply of cNOTE to whitelisted third party lending markets.

This plays into the above schema which we explained in our second piece. Importantly, while CANTO is sourced from chain governance (example), the distribution of CANTO for incentivisation purposes is determined by a weighted governance process according to a vote locking mechanism. Users can lock CANTO for a fixed 5-year period to receive veCANTO which provides gauge voting rights. The guages in this case represent third party lending markets which will be vying for cNOTE inflows to allow the growth of their respective lending markets.

Similar to Curve’s veCRV model, it is expected that protocols and perhaps large market participants will lock CANTO as veCANTO in order to direct emissions to their benefit. While the contracts are deployed, the Neofinance coordinator does not yet have a front end. This will likely be built out as additional lending markets are launched and demand for veCANTO ramps up accordingly.

Vivacity Finance

Another key development on the Neofinance side has been the launch of the first whitelisted third party lending market, Vivacity Finance:

As explained in our prior article, these third party lending markets require cNOTE to be supplied in order for NOTE to be borrowed against a wider set of RWA collateral (only T-Bill collateral can mint NOTE on the official Canto Lending Market). As is visible from the screenshot above, for now whitelisted buyers can supply hyVWEAX (HiYield’s short term diversified medium and lower-quality corporate bond RWA) as collateral and borrow NOTE against it at a 4.83% rate.

On the other side of the market, cNOTE depositors are being paid almost 47% + Viva Points (most likely for some future airdrop) to supply cNOTE to the market. There is currently around $1m of hyVWEAX as deposited as collateral and $4m of NOTE suppled to the market.

Summary

With the Neofinance efforts now underway, the coming months will be pivotal for Canto. Much of the CANTO price action leading to this point has been speculation and front running surrounding the launch of these various Neofinance pieces. Now that much of this is live, the real test begins; either TVL and attention will flow into Canto or not...

While we believe the yields on offer are attractive, with recent price action in other pockets of the market, it is not clear that the market cares about yields on dollar-pegged assets like NOTE. Monitoring TVL growth and Canto inflows will be essential to determine what the future might hold for Canto.

If you enjoyed and want to see more content like this, feel free to check out the Humble Farmer Army premium discord here.

You’ll get access to:

Weekly Premium Content

An Exclusive Community

DeFi Yield Strategies

Degen Farms & New Launches

DeFi Education & Analysis

And Real-Time DeFi Alerts

Humble Farmers Rejoice!