Canto - the next RWA darling?

Long-form research reports published by the HFA Research Team. 100% Free.

Having nailed our MKR call earlier this year (Part 1, Part 2), we are now focused on tangential plays in the RWA sector which can benefit from MKR’s success and more importantly the “higher for longer” expectations in traditional rates markets. This week we’ll focus on Canto as a potentially overlooked and undervalued RWA beta play.

Intro

Canto was all the rage in January of this year following an investment from Variant and excitement about their new way of incentivising builders and users alike. Canto began life as an EVM-compatible chain built on the Cosmos SDK with its innovations being less on the technical front but more on the economic incentives side with public goods and Contract Secured Revenue.

Canto launched with certain public goods being built into the chain itself, notably: a DEX, lending market and native stablecoin (NOTE). NOTE is an overcollateralised stablecoin which can only be minted by USDC/USDT and which uses an algorithmic interest rate mechanism to ensure peg stability. The term public goods is accurate here given that these products were implemented without a fee nor fee switch. Liquidity and usage is incentivised using CANTO emissions to attract LPs, lenders and NOTE minters.

The real economic incentive “innovation” was Canto’s Contract Secured Revenue (CSR). CSR allows a certain % of gas paid to the network when users interact with smart contracts to be directed towards the developers of said smart contracts, this acts as an incentivisation mechanism for app developers to build on the chain. The revenue accrues to an NFT which can be minted by the smart contract deployer.

On a final introductory note, Canto launched in a very “crypto-native” way with no presale or venture funding and 80% of all genesis token supply being allocated towards liquidity mining. For more general Canto background reading, Variant’s memo continues to be a good resource despite the incoming changes to the technical infrastructure which we touch on below.

The state of Canto

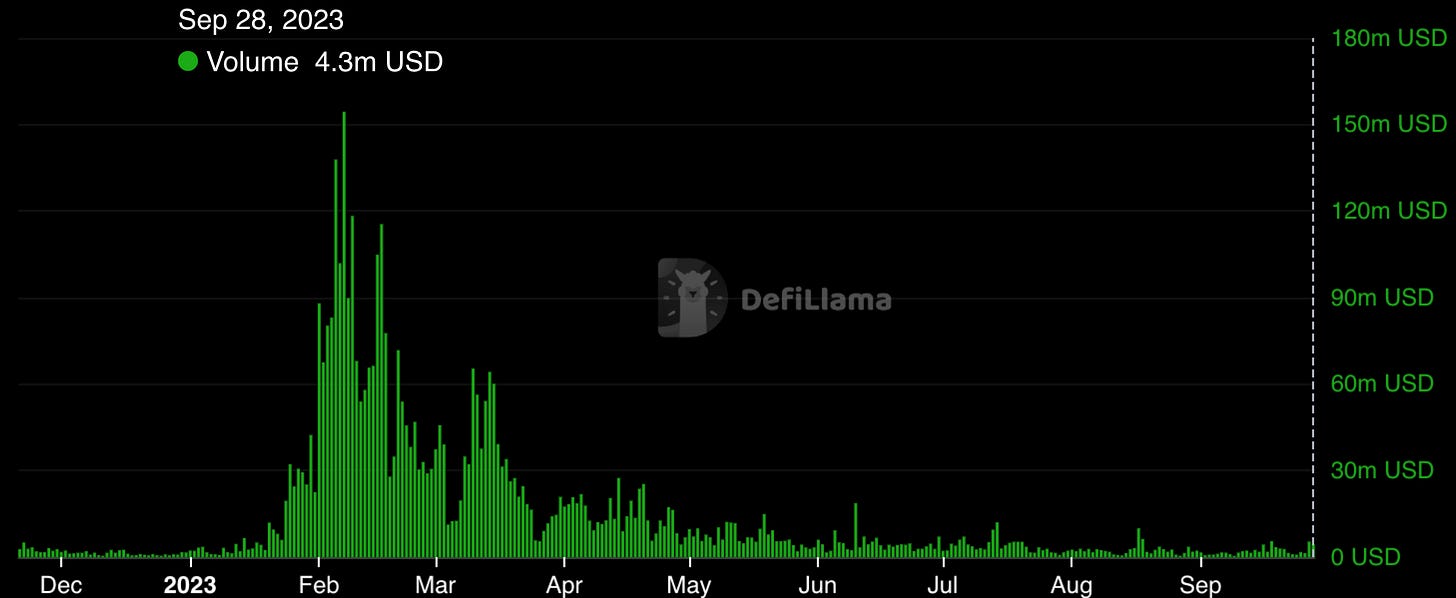

Following the hype period earlier this year when Variant announced their investment, Canto metrics have largely been in a downtrend:

To a large extent the ecosystem has been stagnating with a lack of developer and user interest. However, with some recent announcements from the team, we think this could change in the near future. The first (and in our view less impactful) announcement is that Canto is building to migrate to ZK L2 on Ethereum using the Polygon Chain Development Kit:

The second and more impactful announcement is that Canto will be adopting a RWA (or as they call it “Neofinance”) strategy. Canto have partnered with Fortunafi as their initial launch partner:

They will also be working with Hashnote in a similar capacity as per this announcement.

What is the “Neofinance” strategy?

At its core the RWA thesis revolves around stablecoin issuers taking the assets backing the stablecoin and buying short-term government issued debt (e.g., T-Bills) while creating some mechanism for the yield to flow on chain to a yield-bearing stablecoin and/or governance token. Tether has proven this strategy works while internalising the yields, Maker has shown this strategy works while passing yields to DAI and MKR (in the form of buybacks), will Canto be the next in line?

As mentioned above, Canto is partnered with Fortunafi and Hashnote to do the same thing for NOTE as what I just described. The following schema shows how their RWA strategy will be implemented:

Essentially through a layer of KYC’d participants who are able to buy T-Bills and borrow NOTE at a 99% LTV permissionlessly on Canto, cNOTE lenders will be able to earn a yield close to that being paid on T-Bills.

The Neofinance launch is currently in audit phase and rumoured to be imminent, i.e. launching over the next few weeks. veCANTO is also being planned whereby CANTO can be locked and holders can to direct emissions within the “Neofinance” ecosystem. This opens the door for stablecoin yields in excess of 10% depending on where veCANTO holders vote to direct emissions.

Risks?

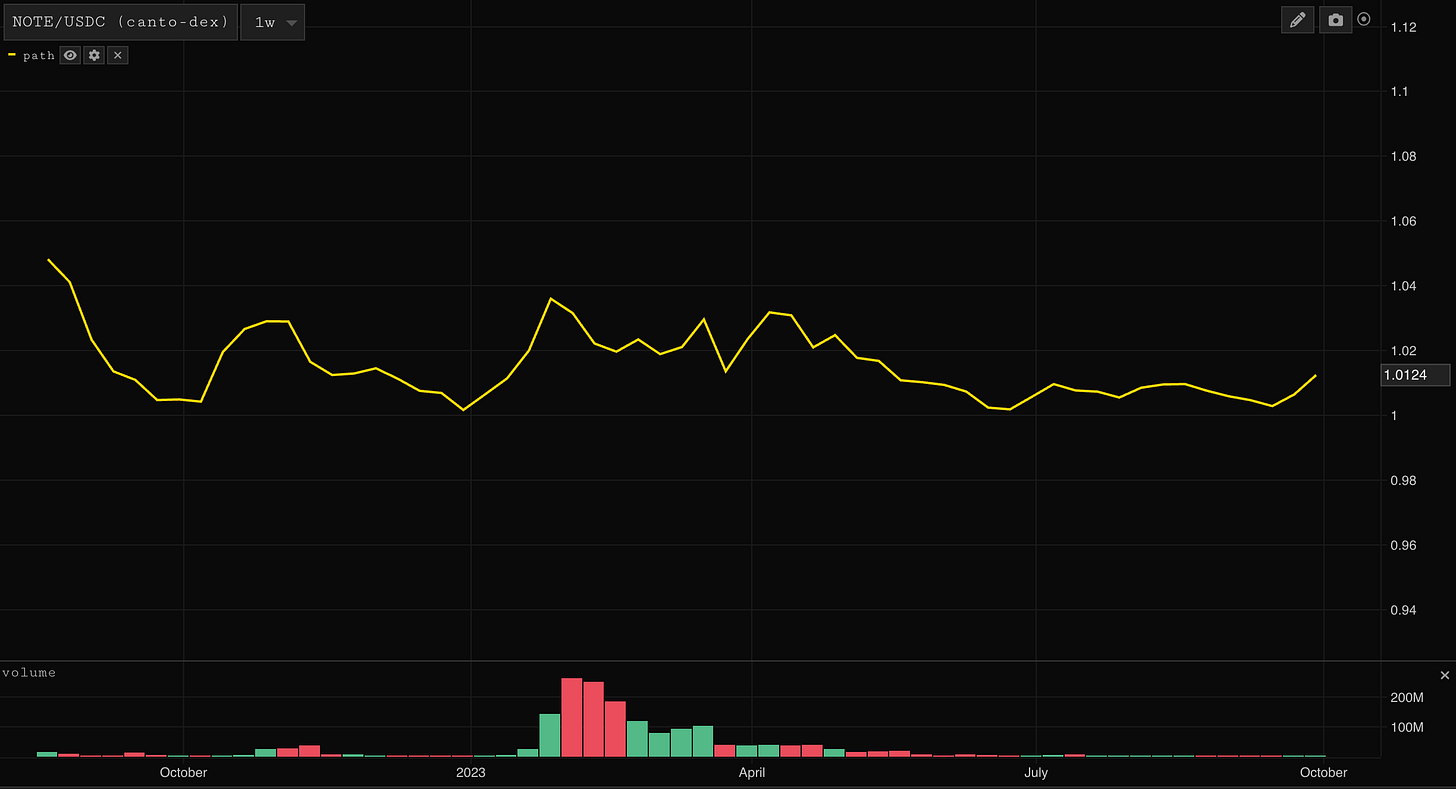

One potential risk is that NOTE does not have a peg stability module and simply relies on its algorithmic interest rate policy to control peg. Despite this, NOTE has been relatively stable during it’s existence:

Another risk is the aggressive farming emissions, with just over 50% of supply emitted, the supply side continues to be dilutive. However, the team seem to be aware of this with consistent governance proposals to reduce farming emissions:

The Canto Pitch

While it seems like insiders front-ran the Polygon ZK L2 announcement, we expect that there could be something more sustainable here as their Neofinance plans roll out.

From our perspective, paying ~$140m FDV for an alt-L1/ZK L2 which issues its own stablecoin and is about to embark on a RWA strategy seems like a reasonable bet to make… Granted it has historically been a farm token with very high emissions hence the cheapness but with multiple catalysts on the horizon and real yields flowing into the ecosystem we think there could be value here (it’s worth noting that most alt-L1/L2 tokens are farm tokens anyway).

A potential kicker from a trading perspective is the fact that Canto is not currently listed for spot or perps on any major CEX. If we expect such an event to occur at some point in the future, buying here looks increasingly attractive. Either way, Ambient Finance will look to fork their DEX over Canto and the Canto core team are building a concentrated liquidity AMM - both of which should improve liquidity for NOTE, cNOTE and CANTO even in absence of a CEX listing.

In terms of getting exposure, there are plenty of attractive LPs which pay abundant APRs, staking CANTO pays ~8.5% but is subject to a 21 day unbonding period or one can simply hold spot.

Resources

If you enjoyed and want to see more content like this, feel free to check out the Humble Farmer Army premium discord here.

You’ll get access to:

Weekly Premium Content

An Exclusive Community

DeFi Yield Strategies

Degen Farms & New Launches

DeFi Education & Analysis

And Real-Time DeFi Alerts

Humble Farmers Rejoice!