Canto Thesis Update

Long-form research reports published by the HFA Research Team. 100% Free.

We initially addressed the Canto idea in a report published back in early October. With CANTO price roughly 2x from there and the Canto team’s Neofinance vision beginning to play out, we wanted to revisit the idea with an update.

I would strongly advise reading the initial report if you didn’t already as much of this piece will build on concepts explained therein.

A status update

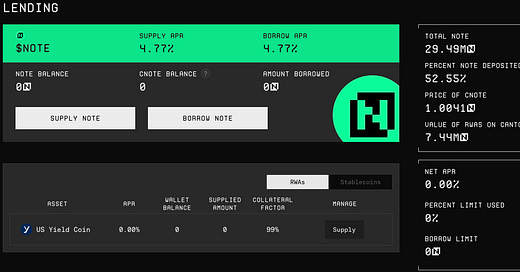

Canto’s Neofinance strategy is now in motion with the first RWA live, USYC (issued by Hashnote) can be used as collateral on the Canto Lending Market (CLM). USYC is a tokenised short-duration yield fund which invests primarily in reverse repo and U.S. Government backed securities. Roughly $7.5m has been supplied thus far on the CLM:

KYC’d USYC depositors are able to borrow NOTE, swap it for USDC, buy and deposit USYC and loop to put on a carry trade which leverages the underlying T-bill yield. This flow has increased the NOTE rate to 4.77% which any user can access in a permissionless fashion and with any size.

TVL on Canto has been in a modest uptrend but nothing parabolic quite yet:

Note that this TVL calculation on DefiLlama does not count USYC or NOTE deposited into the CLM as cNOTE so is understating somewhat the real growth we have seen over the past 1.5 months.

What’s on the horizon?

With FortunaFi’s “Tokenized Asset Protocol” now through audits, the launch of their RWA on Canto and the CLM is expected very soon. Their fBILL (Tokenised Treasury Bills) product is slated to have lower fees (40bps versus Hashnote’s 1000bps) than USYC so this should marginally push up NOTE rates.

Equally, in line with the Neofinance strategy - additional RWA products covering both High Yield Corporate Debt and Private Credit are going to be rolled out by HiYield and Anzen respectively over the coming weeks. These RWAs are being rolled out alongside a new lending market built on Canto called vivacity.finance:

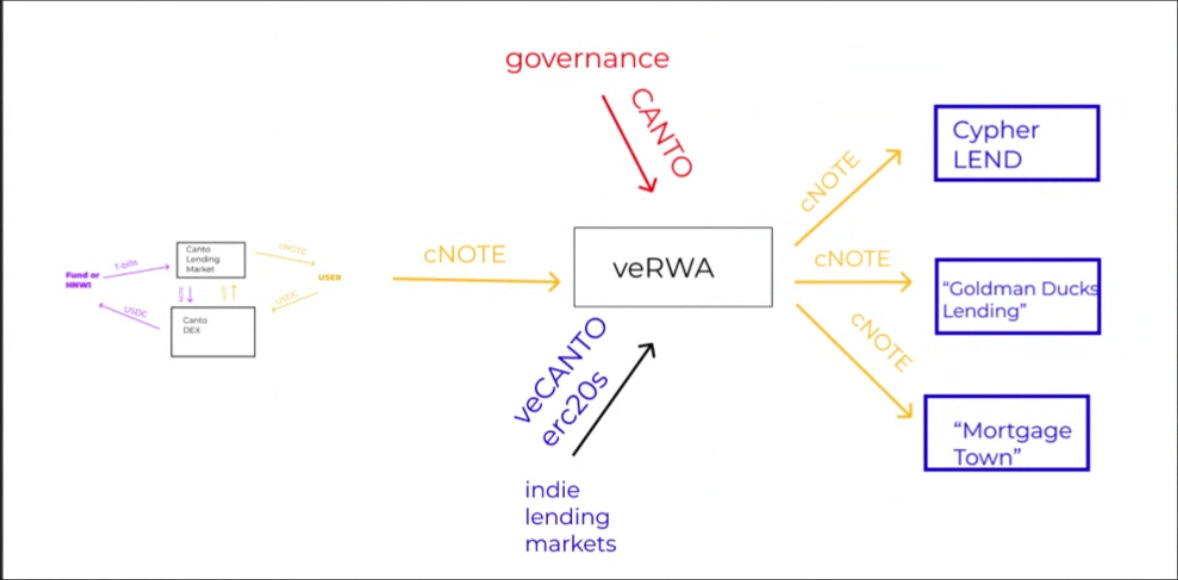

In order to fully understand the Neofinance architecture and why Vivacity is needed rather than having all RWAs as collateral on the CLM, it is important to address this schema:

In order for NOTE itself to maintain solid backing, the CLM only accepts Stablecoins and Tokenised T-Bills as backing and is simultaneously the only Lending Market that can mint NOTE. Other lending markets like Vivacity will allow users to leverage other, riskier real world assets with NOTE being borrowable only on the basis it has been supplied via cNOTE to the market (as you can see from the above schema).

This enables Canto to allow users to access rates close to the underlying rates on a variety of RWAs across the risk spectrum, without marginally increasing the risk of NOTE itself. In a bad debt scenario, the risk is isolated to cNOTE lenders in the relevant lending market and does not risk the solvency of NOTE backing. We find this to be an elegant design which both provides an avenue for growth as users can access higher yields across different lending markets while also maintaining the safe risk profile of NOTE.

Given that the current yield offering is nothing special (one can access similar yields via sDAI on mainnet), we would expect this next iteration of the Neofinance roadmap to usher in incremental TVL as the yields offered should be significantly more attractive than the overnight interest rate.

All of this has been nicely wrapped up into a new v3 interface, ready for what we hope will be a productive next period for the Canto ecosystem:

Equally, with an increasingly positive outlook for MKR (~$10m of expected Smart Burn Engine buy pressure through year end and governance forum murmurs about Endgame), we think it is quite possible that CANTO will trade as high beta exposure should MKR begin to outperform once again.

If you enjoyed and want to see more content like this, feel free to check out the Humble Farmer Army premium discord here.

You’ll get access to:

Weekly Premium Content

An Exclusive Community

DeFi Yield Strategies

Degen Farms & New Launches

DeFi Education & Analysis

And Real-Time DeFi Alerts

Humble Farmers Rejoice!