Chances are, if you scroll Crypto Twitter you likely have encountered a lot of negative posts around Polygon and the MATIC token. The argument is that the Polygon has spent countless millions of dollars on ineffective BD partnerships with DeGods/y00ts (ouch), Starbucks Odyssey, and Nike’s Swoosh program.

The criticisms are not unjustified, but whenever sentiment gets so negative it’s natural for market participants to ignore positive catalysts that could act as a white swan for the native token, $MATIC. In this piece I’ll highlight 3 major catalysts that the market is overlooking that could lead to a violent repricing:

Polygon’s New AggLayer

MATIC rebrand to POL & new token utility

The POL Airdrop Narrative

Polygon’s New AggLayer

It’s not issue that the ETH scaling roadmap has a lot of issues, one of them being fragmented liquidity. As we’ve seen with Blast, Manta, and Mode Network it feels as if there is a new L2 launching every other week. Because all of these L2s use ETH as the settlement layer, each L2’s liquidity is silo’d from one another. This leads to a poor user experience and made us extremely bullish on Dymension, which is a RollApp settlement layer that uses IBC to connect different execution layers as a key part of the modular stack.

If you want any social proof, we had Bankless record a two hour podcast with Justin Drake about the issues within the L2 ecosystem. We have teams like Optimism build Superchains which is similar to the Dymension vision, but we feel that Polygon’s AggLayer will be faster-to-market.

As you can see in the graphic above, Polygon aims to create a new “Aggregation Layer” to solve this issue. Right now, all zk-rollups have to post proofs to ETH individually, making the bridging experience quite cumbersome. However, with the AggLayer all the L2’s can now post their proofs to the AggLayer, which can “aggregate” these proofs as one and post it once to a unified bridge contract.

As a result, all L2’s can incorporate the AggLayer to unify liquidity with the other L2’s. This means that chains like Immutable X can share liquidity with Manta Network. This unification will surely create more value accrual on the app layer as devs have more liquidity that they can tap into to create better products.

This type of solution does not exist in the current market, and we can expect the following flywheel:

- Polygon CDK makes it easy to deploy zk-rollups

- L2 composability attracts more L2's

- Potential Airdrops

- AggLayer security increases (positive flows to $POL)

MATIC rebrand to POL

But how does value accrue to the token, and what does POL even do? MATIC will be able to be exchanged for POL 1:1; currently MATIC secures the Polygon PoS chain but once the AggLayer launches, POL can be used to secure the AggLayer.

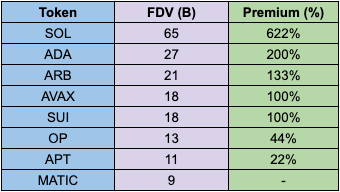

At a $9B valuation the token may not seem cheap, but most of the vesting is over and other L2’s are trading at a rich $10-20B FDV. Below is from a report written by thiccythot:

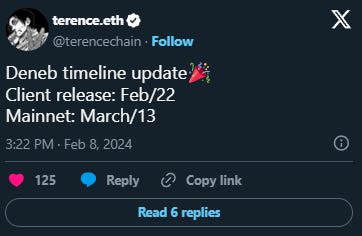

As more teams tap into the AggLayer for its advantages, demand for POL should go up for economic security. MATIC may also benefit from being in the “L2 basket” ahead of the Dencun upgrade on March 13, which introduces EIP-4844 (proto-danksharding). And as the AggLayer establishes network effects, we should see a trend for more L2’s to launch on the AggLayer which presents another interesting bull case…

The POL Airdrop Narrative

At HFA Research, we love the airdrop narrative. Our founder, Taiki Maeda, received a 6 figure $DYM airdrop and our HFA analysts have had similar luck in securing a 6 figure $JTO airdrop by just being active on-chain. With regulatory fears preventing teams from introducing direct revenue-share, we’ve seen tokens introduce “indirect value accrual" with the airdrop narrative. Stake this token to get that airdrop. Stake that airdrop to receive more airdrops!

AVAIL has teased an airdrop to $DYM stakers (which will be very welcomed by the HFA team - make sure to stake your DYM with HFA Research for future airdrops). But we believe that an AVAIL airdrop is more likely to go to MATIC stakers since Avail was spun off of the Polygon brand with a Polygon co-founder leading the developments for Avail. It’s rumored that they will launch their mainnet on the 26th, three days after Polygon’s AggLayer goes live on the 23rd.

Could it be that snapshots may be taken on the day of “Aggregation Day?” If Celestia is trading at a ~$20B FDV, we would not be surprised if AVAIL also trades above $10B FDV. Would be a great airdrop to $DYM and $MATIC stakers indeed.

The Trade

We believe staking MATIC has an asymmetric risk/reward to the upside. Staking MATIC with a validator has a ~5% APY with a 3-4 unbonding period which makes it a more attractive airdrop play than staking TIA/DYM which has a 2-3 week unbonding period (not to mention the higher inflation and VC lockups).

Polygon’s new AggLayer has a reasonable chance of fixing the fragmented liquidity problem in the L2 ecosystem. As more projects build on top of the AggLayer, we can expect more airdrops to POL stakers on top of the inherent staking yield.

What’s the downside? You’re getting 5% APY on MATIC.

What’s the upside? MATIC stakers receive numerous airdrops and potential price upside if the market starts to appreciate the upcoming AggLayer launch