Before you get mad at me, I am not claiming that Celestia is a ponzi. In fact, I think it’s one of the most important technological advancements we’ve seen in a long time. This written piece only explores the supply/demand dynamics that are in play with the $TIA token, and why I think it has similarities with OHM’s (3,3) narrative that appealed so much to retail during the 2021 bubble.

This report will be done in multiple parts:

What is Celestia?

What’s the narrative for the $TIA token?

What similarities does $TIA have with $OHM and (3,3)?

So what am I doing?

What is Celestia?

This report will be too long if I try to explain Celestia to you, so I’ll just provide this great piece written by Nosleepjon. The TLDR is that Celestia breaks down the blockchain stack and specializes in the Data Availability layer. This makes it easier and cheaper for new projects to deploy new rollups and blockchains. For example, Manta Network has experienced 99.8% reduction in fees by using Celestia for DA instead of Ethereum!!!

What’s the Narrative for the $TIA Token?

I believe Celestia is the purest play on the airdrop narrative. Celestia is built using the Cosmos SDK, and they airdropped to OSMO and ATOM stakers in November 2023. We’ve already had two big airdrops in Dymension and Saga.

Celestia makes it easier for new rollups to launch. These rollups should airdrop part of the supply to TIA stakers. L1/L2 tokens command a premium in the market. So the narrative is this: “It doesn’t matter what the price of TIA is because the airdrops will more than make up for it.”

Now, this statement can be both true and wrong at the same time. Through my TIA staking operations, my $DYM airdrop has already covered my initial cost basis of my TIA buys. So hypothetically, if I were to dump my DYM airdrop at launch, I basically got my TIA position for “free.” Now I’m not going to because I think DYM will also have a strong narrative, but that’s a topic for another discussion.

This is actually a reflexive cycle. One of my criticisms for the Cosmos community is that they are really bad at communicating their value proposition to the crypto/normie community. They are in their own bubble and as a result, the token price and community suffers.

Airdrops, ironically, fix this. Devs can do a generous airdrop, and the entire community of bagholders can figure out what the narrative for the token is. This is beneficial for all parties because the community will do all the work for the devs. Devs can dev, and the community can shill. This is why teams small airdrops are bearish.

The above tweet is kind of a joke, but it’s also serious. The SAGA team and VCs tried so hard to make the airdrop as hard to get as possible, such as taking a snapshot of TIA stakers on 12/1 with a minimum stake of 23. The point of airdrops is to reward the community. Do they seriously think a Celestia community would form in under a month after the TIA token launch? The Celestia community is now just starting to form, so future projects should stop midcurving the airdrop by taking extremely early snapshots. The SAGA airdrop was extremely midcurve by the team and VCs.

On the other hand, DYM was an egalitarian airdrop that took a snapshot on 12/19 and the minimum TIA stake was 1. That means you could’ve staked $20 worth of TIA and received an airdrop worth ~$1000. They also airdropped to the Pudgy Penguin and Solana NFT community. Just look up “$DYM” on Twitter/X and you will already see a strong community, even before the token launch! This is how it should be done. Here’s a good discussion on how much DYM should be worth.

I am extremely bearish SAGA, and extremely bullish DYM.

Why Celestia is the new (3,3)

You might realize that this is a reflexive narrative. The stronger the Celestia community becomes, the more incentivized teams are to airdrop to the $TIA community. After all, that’s the ethos of the Cosmos ecosystem, right? As the market expects more airdrops, the more price insensitive buyers become. And if you stake TIA for airdrops, why should people ever sell…?

Therefore, the valuation of TIA can be thought of in this way:

Price (TIA) = Value Accrual to the DA layer + Monetary Premium of TIA as “Modular Money + value of all future airdrops

Now, no one knows how to calculate the value accrual and monetary premium because it just launched. So naturally, people turn to the value of the airdrops as the reason to hold $TIA. The DYM airdrop was huge because people faded it. But as more airdrops get announced, people will buy TIA to stake (remember there’s a 21 day unbonding period for staking TIA). Do you want to guess when DYM claims went live?

So clearly, over time the airdrops will be diluted over time. However, Celestia just launched 2 months ago, so my guess is that we’re still early in the airdrop narrative. The truth is, most people in crypto live on CEXes and don’t actually know how to even stake Celestia. So just fade them. There will be a time where it would be rational to unstake TIA, but I don’t think the time is now.

The truth is, retail loves the airdrop narrative. Why shouldn’t they? The promise of staking $100 to receive $100,000 seems like the future of finance. Look at these thumbnails and look at those view numbers! If you expect retail to come back through YouTube, they will buy and stake TIA. And as TIA continues to airdrop and go up in price, surely we will see a new cohort of YouTubers and TikTokers that repeat the same fallacies as they did with OHM:

“Price of OHM can go 99% because the APY will make up for it.”

“Price of TIA doesn’t matter because the airdrops will make up for it.”

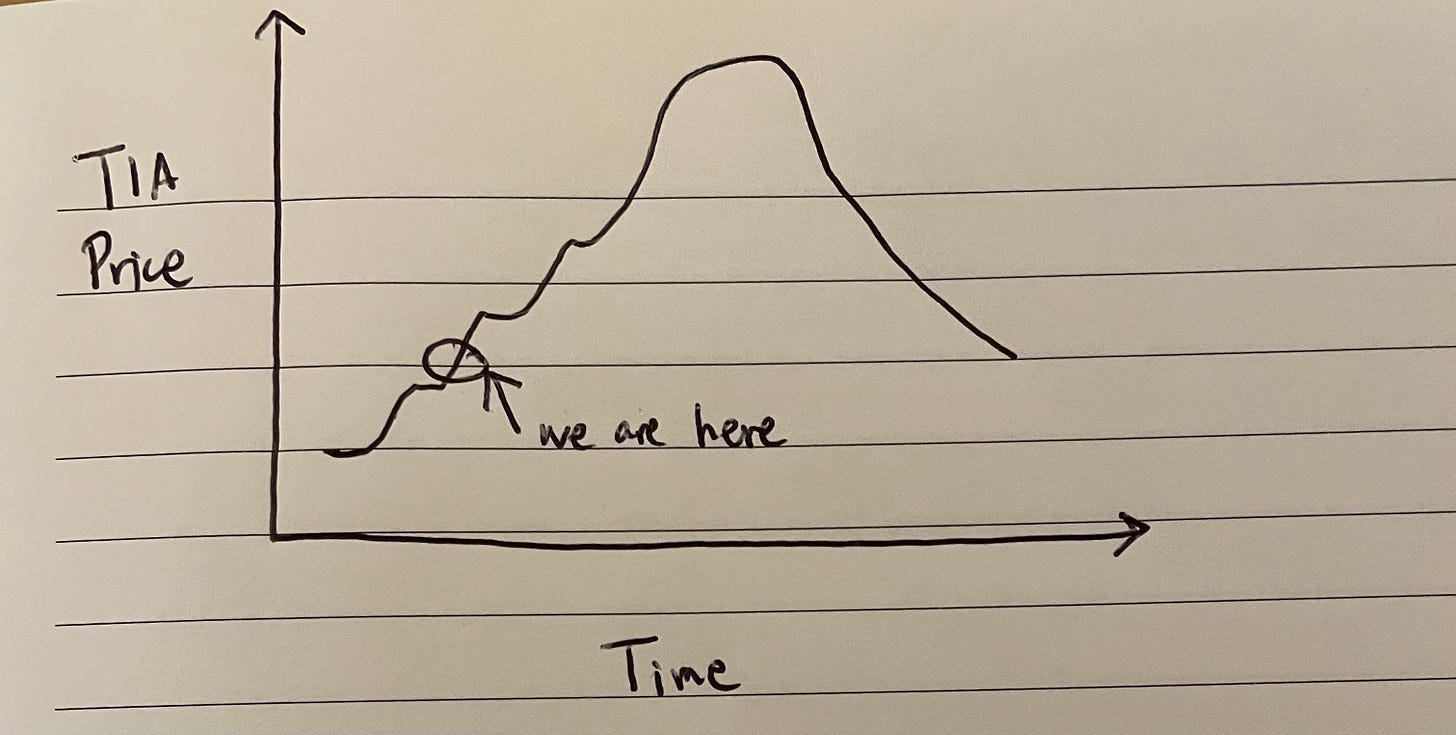

You see? Of course I believe TIA to be one of the most important innovations this cycle, but that doesn’t mean that number will be up only forever. I predict that this will happen again, because human greed is predictable, and the allure of influencers to shill this to their audience is inevitable. Of course, you can argue that I am one of them. But I also believe that TIA staking in these early stages of a bull market will be very profitable. I am just warning you at what might happen so you can prepare yourself. I am also writing this to remind myself in 12 months that I need to be humble and take profits, even if the narrative feels indestructible. Here’s how I think the TIA price action will go in this coming cycle:

I drew this in 30 seconds. Of course there will be pullbacks. I could be wrong. I think TIA is going to be an amazing bull market hold, and an extremely painful bear market hold, as people will unwind once they realize the valuation doesn’t make sense. The 21 day unbond period will make this even a harsher reality.

So what’s the Plan?

I am staking TIA for this upcoming cycle. I will hold some airdrops, I will sell some airdrops. I expect this to be profitable. But when do I sell? Honestly I have no idea. My current plan is to start unwinding my TIA positions once Coinbase is the #1 on the Apple app store, or when majors start hitting ATHs.

I am also writing this on January 13, 2024. If you are reading this in the future, my opinions may have changed. I also am really bad at predicting short-term price movements. Only time will tell!