The Bull Case for TRON - the USDT chain

Long-form research reports published by the HFA Research Team. 100% Free.

Intro

We are no strangers to a contrarian bet at Humble Farmer Army Research, in fact many of our high conviction plays this year have fallen into this category (Maker was an extremely hated coin back in July when we we published our first report and Canto is certainly not consensus). Let’s see what we find today as we dive into Tron…

If you mentioned TRX to the great majority of Crypto natives they would probably think you were joking, laugh and retort “What, the Justin Sun chain?” or some similar meaningless and uninformed remark. Meanwhile, Tron has slowly become the most heavily used blockchain for stablecoin activity and TRX has been quietly outperforming:

Following our coverage surrounding the Real World Asset sector, we are increasingly interested by projects solving real use cases. Another DEX with a small optimisation and veTokenomics likely won’t move the needle but a global network for the settlement of offshore dollars, well that just might! With over half of all USDT supply sitting on Tron (source) and plentiful transactional activity, perhaps Tron is that global settlement network.

The Data

“More stablecoin activity occurs on Tron than on any other blockchain. Year-to-date, transactions on the Tron blockchain account for 49% of weekly active addresses, 37% of transactions and 35% of volumes” - Brevan Howard

Transaction volume on Tron has recently surpassed Ethereum as the chain with the greatest volume of stablecoin transfers as it now settles around ~$70bn of weekly onchain stablecoin volume:

Roughly 40% of active addresses sending stablecoins on-chain are on Tron:

The number of wallets holding USDT on Tron has increased roughly 2x YTD growing from ~16m to ~32m:

Total stablecoin supply on Tron is close to hitting new highs, painting a very different picture to Ethereum:

Contrary to the popular belief that Tron is all Justin Sun, roughly 50% of USDT supply on Tron is held outside of the top 500 accounts (source). This indicates a widespread distribution and usage of USDT on Tron.

On a final note with respect to the data, stablecoin usage has historically shown a low correlation with wider Crypto trading volumes indicating that it is not primarily driven by trading/speculative activity. Since their peak, CEX volumes are down ~60% while stablecoin volumes are down ~10% with weekly active stablecoin addresses and weekly stablecoin transactions up 25%+.

stUSDT

stUSDT was launched in July 2023 as a RWA market built on Tron (now available on Ethereum too) whereby users can stake USDT for stUSDT and receive rebasing rewards of 4.73% (at the time of writing). The underlying RWA strategy is not defined clearly; “USD stablecoins staked in the contract will be invested in low-risk RWA with high ratings”. We assume the principal is invested in short term US government securities similar to MakerDAO or Frax Finance.

stUSDT is operated by RWA DAO which is under the custody of JustLend DAO which is indeed one of His Excellency’s (Justin Sun) projects. The only apparent fee is a “promotional” unstaking fee of 0.1% which seemingly accrues to the RWA DAO. It currently has a supply of $72.4m on Ethereum and $2.2bn on Tron.

While stUSDT does not directly accrue value to TRX, it provides a reason for USDT to stay within the ecosystem.

TRX

Tron itself is a blockchain using a delegated proof of stake mechanism for consensus (with TRX) and the Tron Virtual Machine for execution which is is EVM compatible and allows for smart contract functionality. It uses a Resource Model with “Energy” and “Bandwidth” instead of gas, Bandwidth represents the size of transaction bytes to be stored on chain while Energy represents the amount of computation to perform specific operations. Every transaction requires computing resources and therefore a Bandwidth and Energy fee.

Bandwidth Points are distributed for free to all activated accounts every 24 hours and can also be acquired through TRX staking while Energy can only be acquired through TRX staking. TRX accrues a staking APR of around 4% with ~52% of TRX being staked currently.

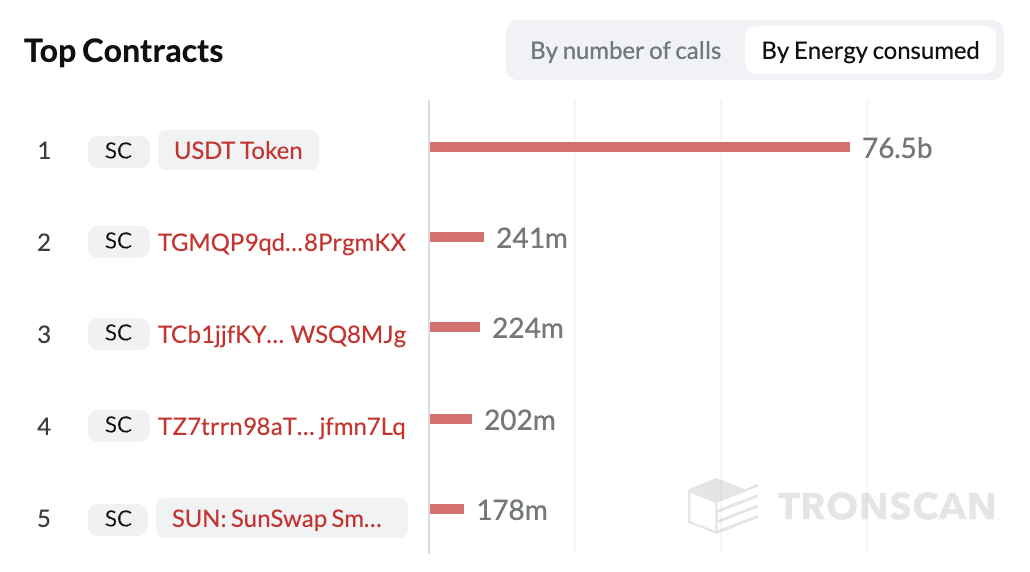

The underlying mechanism of how both Bandwidth and Energy function in practice is a quite complex and dynamic system but the net impact is that more usage of the network leads to more TRX needing to be bought and burned on a short term basis and bought and staked on a long term basis. Essentially when the demand for Energy outweighs what is available, TRX is burned. Equally, if the user does not have sufficient Bandwidth for a transaction, a transaction fee of 0.001 TRX per Bandwidth is applied and burned. The growth in USDT usage is directly driving positive supply dynamics for the TRX token as the USDT contract is the largest Energy consumer by a significant margin:

Not only are there favourable TRX supply dynamics from heavy network usage but also network growth; to activate an account users must pay an account creation fee of 1 TRX (or the equivalent value of TRC-10 tokens).

Both network usage and growth has translated into consistent fees for the TRX network and a persistent state of deflation for the TRX token as demand for Energy outweighs supply:

Conclusion and Key Risks

Many say stablecoins are Crypto’s “killer app”, Tron appears to be the network which has achieved mass market distribution and usage for said app. At an $8bn valuation, TRX is hardly overvalued on a relative basis and is well positioned to benefit from continuing and expanding stablecoin usage on a global scale.

One can argue that a bet on TRX is wholly exposed to underlying Tether risk and they would not be wrong. USDT risk has long been debated and we do not seek to re-surface that here, just note that Tether plan to start publishing reserve data in real time next year alongside increasing investment in technology and opening dialogue with regulators (source).

One additional risk is USDD which currently has a supply of $726m backed by ~$1bn of TRX and ~$400m of BTC. Currently the system is heavily over-collateralised but an unwind could lead to significant selling of TRX should it ever occur. Of course it is possible that USDD just sits there and becomes increasingly overcollateralised as TRX or BTC prices increase, thereby becoming a smaller problem over time. It is still a pertinent risk and one which a buyer should be cognisant of.

The following chart tells an interesting story - are crypto rails slowly replacing traditional rails right under our noses? Perhaps it really is as simple as buying the coin which facilitates payments and the cross-border settlement of dollars for underbanked populations globally.

If you enjoyed and want to see more content like this, feel free to check out the Humble Farmer Army premium discord here.

You’ll get access to:

Weekly Premium Content

An Exclusive Community

DeFi Yield Strategies

Degen Farms & New Launches

DeFi Education & Analysis

And Real-Time DeFi Alerts

Resources

The Relentless Rise of Stablecoins - Brevan Howard

ON–186: Stablecoins Mega Issue

stUSDT: An RWA Market Built on the TRON and Ethereum Networks

Great post. Arguably USDt in Tron is the only crypto product (so far) with a clear product-market fit. Wishing others follow soon, too.