In recent months, the buzz around artificial intelligence (AI) has taken the world by storm, with AI-related stocks experiencing unprecedented growth, i.e. getting bid up to the heavens. This has spilt over to crypto, where anything that has the slightest connection to AI is getting attention and capital inflows.

For now, most of the attention and inflows have been geared towards compute-related coins, that is, your Render and Akash of the world.

But there’s another sector that the AI fundamentally affects: decentralised storage.

The advent of AI has made decentralised storage more relevant, useful, and investable than ever before. There are three main reasons why:

Data Sovereignty: the rise of AI has made it abundantly clear that individuals and enterprises need to own their data. Large Language Models (LLMs) have crawled the internet, utilizing the data and works of countless people and businesses to create new ventures and enrich themselves. If only there were a way to stop this.

Data Provenance: LLMs have the potential to generate an endless stream of fake data. Being able to trace the origin of the data and verify you are not being fed fake garbage will become paramount in the future.

Increased Storage Demand: the AI revolution means that every human will become a coder, content creator, writer, video producer, and whatever they fancy on the day. What does this mean? A. Lot. More. Data.

We believe that Filecoin is uniquely positioned to solve these issues and that it will emerge as the winning decentralised storage solution in crypto. To understand why, let's dive first into the technology that powers Filecoin.

Understanding Filecoin

At the heart of Filecoin lies the InterPlanetary File System (IPFS).

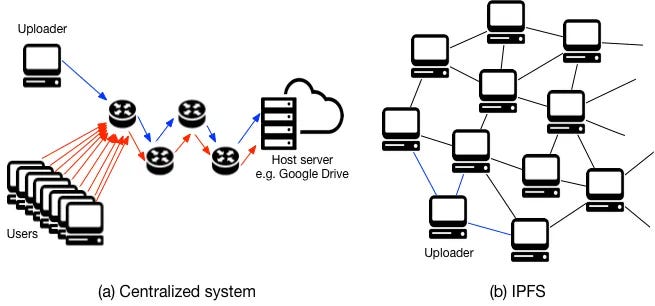

IPFS is an open-source protocol for storing and sharing data in a peer-to-peer fashion. IPFS is a separate technology from Filecoin, it existed before Filecoin was created, and might revolutionise the Internet even if Filecoin is not successful.

To understand the significance of IPFS, let's first look at how data we access data now.

The Web today uses the Hypertext Transfer Protocol (you might know it better by its acronym HTTP). When you type a URL into your web browser, the HTTP protocol translates that URL into an IP address, pointing to a specific server location. Your request is sent to that server, which responds by sending the requested data back to your browser.

This location-based approach means that data is tied to specific servers, and if those servers go down or become inaccessible, the data becomes unavailable. That’s why sometimes a link won’t work, the servers they point to are no longer operational or the data has been removed from those servers.

In contrast, IPFS takes a content-driven approach. Instead of relying on location-based addresses, IPFS uses unique content identifiers (CIDs) to address data.

When you request data using IPFS, the protocol uses these CIDs to find the closest available copy of the data, which could be stored on multiple nodes across the network. This approach ensures that data remains accessible even if some nodes go offline, as long as at least one copy of the data exists somewhere on the network1.

Pretty neat, right?

But IPFS by itself is not the solution. It needs a way of incentivising storage providers to host the data, and for nodes to provide it to you on demand.

What IPFS needs is a business model. Enter Filecoin.

Filecoin is a blockchain-based decentralized marketplace for buying and selling cloud data storage. IPFS powers the decentralised storage bit, and the blockchain serves as the accounting and verification system.

To join the Filecoin network, storage providers must first obtain and stake FIL tokens. Upon doing so, they are permitted to host data. Providers who adhere to the network's standards are incentivized with additional FIL tokens. Adherence is defined by two key criteria:

Continuously offering the storage capacity they claim.

Correctly storing the data assigned to them.

These criteria are similar to the Proof of Work mechanism used by Bitcoin, but in the context of Filecoin, they are referred to as Proof of Spacetime and Proof of Replication. If a storage provider fails to meet these standards, their staked FIL tokens will be penalized.

So, Filecoin the blockchain is built on top of IPFS and uses the FIL token as the economic incentive. Now that we understand Filecoin a bit better, let’s take a closer look at the FIL token economics.

FIL

FIL is the key economic incentive that aligns the interests of storage providers (supply) and users (demand) in the Filecoin ecosystem.

If you were around the last cycle, you might have the idea that the Filecoin token economics are terrible. And rightfully so. FIL was one of the premier examples of the low float, high Fully Diluted Valuation (FDV) trickery.

At its peak, Filecoin had an FDV of $460 billion.

I repeat. $460 billion.

That’s more than the current market cap of Ethereum. It was completely detached from reality and only proved as an incentive for everyone who was awarded tokens since then (investors, team, storage providers) to sell FIL continuously.

The result? A 99% drop in the price of FIL.

Things have improved since then, however, as a sizable portion of the supply is now unlocked. Here is how the original 2 billion FIL tokens were allocated:

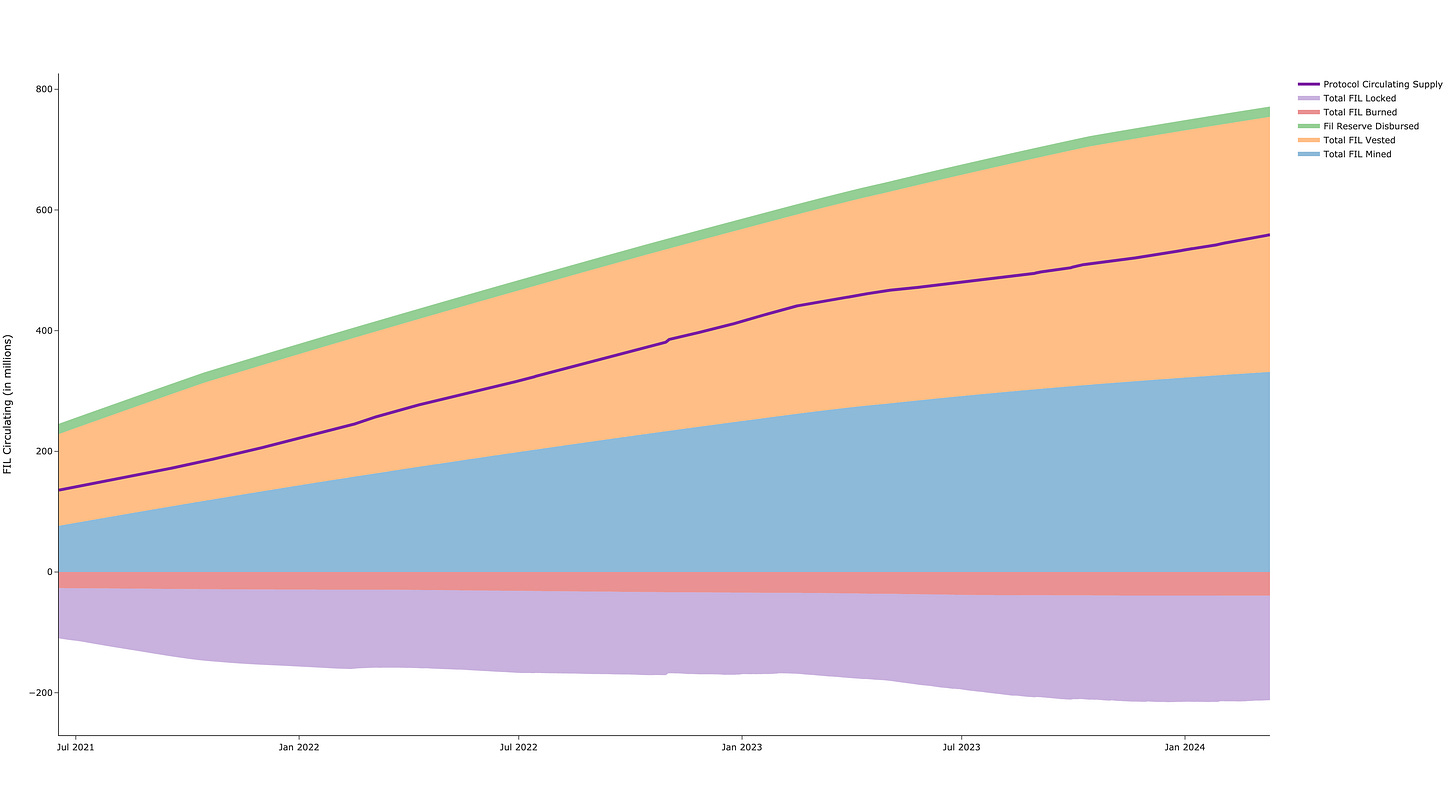

Investors and the Filecoin Foundation are fully vested, while the Protocol Labs team (the team that built Filecoin) is over 50% vested. The remaining token unlocks come from block rewards issued to miners and storage providers.

Inflation has been and continues to be high, but is on a downtrend: in 2022, the circulating supply increased by 66%; in 2023, by 35%; and it is projected to increase by 18.5% this year. But not all FIL tokens hit the market. Filecoin has two main token sinks:

Locked FIL: as we said previously, storage providers must acquire and lock FIL to be able to provide their services to the network.

Fee burn: as much as 90% of storage service fees are burned, in a similar manner to EIP-1559 for Ethereum.

This has resulted in the actual circulating supply being much lower than expected. As much as 7% of the current circulating supply has been burned, and over 30% is currently locked.

In the chart below, you can see the effect of token burning (in red) and locking (in light purple). Without them, the circulating supply would be close to 800 million tokens. The purple solid line shows the actual circulating supply through time, currently at around 560 million.

So yes, Filecoin has high inflation. However, this inflation is necessary to incentivize the supply side of the network and is countered by the demand from users of the network (storage providers, clients that want their data to be stored) and the burning of fees.

All in all, Filecoin's token economics are well-designed and should drive value to FIL token holders as long as storage demand grows.

I can hear you thinking. Yes yes, all of this is very interesting, but do people actually use this thing?

Oh boy, yes they do.

Usage

The Filecoin network has a data storage capacity of 8.7 Exabytes (EB). Just for context, one EB is enough to store the Wikipedia 5000 times over2.

Of these 8.7 EB, 2.1 EB are currently used. This represents a 4x increase in storage usage year on year and a growth in storage utilization from 3% to 24%.

This growth was partly driven by an increase in the number of large clients, from 500 to more than 1800. These clients include research centers like CERN, non-profits like the Internet Archive or Wikipedia, universities like UC Berkeley or the University of Utah, as well as Web3 companies like Solana, Near, and OpenSea.

Okay, I just threw a lot of numbers at you, but it is difficult to know how well Filecoin is doing from this alone. So let’s compare it to the other decentralised solutions.

Filecoin hosts 98% of all data stored in decentralised storage solutions. There’s just no Web3 project currently that can hold up against Filecoin.

So how does Filecoin hold up to its Web2 counterparts?

Although Amazon does not publish data on how much data they are storing, some estimates3 size it between 180 and 800 EB. That’d be 100 to 400 times as much as Filecoin. And while Amazon Web Services is the dominant storage provider in Web 2, it “only” accounts for one-third of the market. Microsoft and Google represent another third, and the rest is divided among smaller companies.

Filecoin still has a long way to go to catch up to its Web 2 rivals.

However, it should gain ground on them fairly rapidly. If you want to store data in size, Filecoin is by far the cheapest place to do so:

But Filecoin is not just about cheap storage. Some recent developments on Filecoin have the potential to take Filecoin to the next level by adding more use cases to the network.

If you are enjoying this article and want to access more in-depth research on the broader crypto space, consider joining the Humble Farmer Army (HFA) Premium. Led by the OG Humble Farmer himself, Taiki Maeda, HFA Premium gives you access to exclusive research articles and videos, airdrop farming strategies, and asymmetric risk/return opportunities. We’d be thrilled to have you as part of our community.

Sign up using this link to support my work.

Recent Developments

There have been four areas of major innovation that can propel Filecoin to the next level:

Programmability: the Filecoin Virtual Machine (FVM) allows for the creation of smart contracts on Filecoin.

Retrieval: making it cheaper, faster and easier to retrieve data from Filecoin.

Compute over data: using existing compute resources in data centres for efficient data processing.

InterPlanetary Consensus (IPC): a new consensus mechanism that allows the creation of subnets.

Let’s examine them more closely.

Programmability and the FVM

The FVM turns Filecoin into a smart contract platform, like Ethereum or Solana. And since it’s built on WebAssembly, it can adapt different virtual machines, like the Ethereum VM, MoveVM (from Aptos and Sui) or the Solana VM.

Launched on March 14, 2023, it combines smart contracts with verifiable storage and allows for the creation of dApps and innovative solutions leveraging Filecoin's storage capabilities. The main development so far is the creation of quasi-liquid staking primitives,

Developed by GLIF, it enables the financialization of storage markets and increases capital efficiency for storage providers.

Now, I’ll be honest with you. There is not that much that you can do today on the FVM. Of the top 8 protocols by TVL, 6 are for quasi-liquid staking, one is for restaking and the last one is a staking pool.

Given the early stage of FVM and how this is the first time that smart contracts have been combined together with data storage, it’s understandable that we have not seen that many different dApps yet. And we might have to wait a bit to see them.

The good news is, that a new ecosystem is starting to emerge, and will likely flourish as more applications are created and as soon as liquidity comes to the chain. Sushiswap is already deployed, and Uniswap plans to do so.

Yes, you will trade Filecoin shitcoins and you will be happy.

Retrieval

Content Delivery Networks (CDNs) are systems that deliver content to users by storing data in distributed locations, reducing latency and improving access speed. When a user wants data from a particular website, the closest node in the CDN delivers that data.

The CDN allows for the quick transfer of assets needed for loading Internet content, including HTML pages, JavaScript files, stylesheets, images, and videos. When you visit a website, a CDN is used to load all the information and images you see on the page. Chances are, this article is being delivered to you by a node in a CDN.

However, CDNs have limitations4. Filecoin's Retrieval Market Initiative aims to address these problems by building decentralized CDNs (dCDNs). The emergence of dCDNs addresses a significant hurdle in the Filecoin ecosystem – the expensive and slow process of retrieving data from the network and delivering it to users.

To compete with its Web2 counterparts, Filecoin must ensure that its data retrieval process is both cost-effective and fast. Currently, two of the most successful decentralized CDNs (dCDNs) are Saturn and Station, showcasing the potential for decentralized data retrieval.

Compute-over-data

At the moment, clients that want to run computing operations on data stored on Filecoin (for instance, interference to train LLMs) need to transfer the data first. This is costly, slow, ineffective, and can face compliance issues among jurisdictions.

Compute-over-data fixes this. It works by using the existing compute resources (CPUs, GPUs) already in the data centres themselves, and supports large off-chain computation that is cheap and with low latency.

We expect various types of compute networks to emerge, built upon Filecoin's data storage infrastructure. These networks will be tailored to support specific functions and use cases, rather than being limited to a single type of computation. One such platform is Bacalhau, which allows users to run arbitrary Docker containers and WebAssembly (WASM) images as tasks against data stored in IPFS and is being used by the US Navy.

InterPlanetary Consensus

Launched in November 2023, IPC enables on-demand horizontal scalability through subnets. Subnets are sovereign networks connected to Filecoin and built with the same building blocks but with their own rules and economics. This allows for the creation of highly customised chains within the Filecoin family and addresses the challenges of performance, decentralization, and security in dApps, which are often conflicting goals.

These subnets use the Filecoin Virtual Machine (FVM) for transaction execution, supporting smart contracts in any programming language and integrating tightly with Filecoin for enhanced data storage solutions. They can communicate with one another and users can bridge between them.

This is an even more recent development, and we still have to see any subnets gathering traction.

Looking ahead

Filecoin’s outlook is very promising, with a clear path towards becoming the go-to decentralized storage solution for the AI era. The network's substantial usage, with a data storage capacity of 8.7 Exabytes (EB) and a growing demand for decentralized storage solutions, underscores its dominance in the Web3 space.

The foundational work laid in 2023, including the enhancements to storage markets, compute-over-data, dCDNs for faster retrievals, the advent of the FVM and customizable subnets through IPC are set to expand the universe of use cases that Filecoin can address. This can all enhance its synergies with Web3 and DePIN networks.

Moreover, Filecoin's architecture will enable it to meet the unique challenges posed by Web2 enterprise storage, which often require end-to-end encryption, certification for data centers, fast retrievals, access controls, S3 compatibility, and data provenance/compliance.

As Filecoin continues to innovate and expand its use cases, and demand for its storage solution continues to grow, its well-designed token economics should drive value for the FIL token and its holders.

IPFS does not only solve issues with broken links. For a comprehensive review of the advantages of IPFS, check this out.

We have chosen to work with Exabytes (EB) and Petabytes (PB) as opposed to Exbibytes (EiB) and Pebibytes (PiB) that Filecoin uses. EB and PB, along with other units like Kilobytes (KB), are based on the decimal system, where each unit is 1000 times larger than the previous one. EiB and PiB are based on the binary system, where each unit is 1024 times larger than the previous one. We believe that it's easier for most people (the writer included) to think in the decimal system.