Following our report on Tron, we have been actively on the look out for tokens which exhibit similar dynamics; strong economics driven by sticky and sustainable real world activity. A recent Vitalik-induced pump piqued our interest in Celo which from first glance looks a lot like an “African Tron”…

Summary

5x increase in daily active addresses in the last 12 months following the launch of Opera’s MiniPay wallet

10x increase in stablecoin TVL, mostly influenced by the introduction of native USDT by Tether on Celo

Currently generating $120k of fees at a $640m FDV ($350m Circulating Market Cap)

Why the current fee situation doesn’t necessarily reflect the fundamentals of Celo (current economic activity is low value but their deep penetration could open the doors for further, higher value financial activity in the future and greater monetisation of their user base).

Introducing Celo

Celo launched as a standalone L1 back in 2017 with an early emphasis on leveraging blockchain to for Impact and progress towards Sustainable Development Goals, this philosophy remains core to the Celo ecosystem today. Their particular focus has been on financial inclusion with a mobile first approach, particularly in emerging markets where decentralised finance can leap frog traditional finance offering a 0 to 1 step function for financial inclusion.

Based on a proposal by cLabs in 2023, Celo has transitioned to becoming an Ethereum L2 in a few months (EOY 2024 or Q1 2025):

The goal here was a combination of cultural alignment with Ethereum, leverage the significant economic security provided by rolling up to Ethereum (including native bridging) and to keep execution costs low:

Celo: The “Ethereum-aligned” Tron

In practice, Celo’s efforts towards improving financial inclusion in emerging markets can be split into three parts:

Payments: allow users to make fast, inexpensive payments, especially across borders.

Remittances: designed to facilitate cross-border remittances, particularly for unbanked populations.

Micro loans: enabling people to access financial services without traditional banking infrastructure.

From a top down perspective, this approach looks to be gaining genuine traction with daily active addresses for stablecoin usage on Celo recently surpassing those of Tron (the so-called stablecoin kingmaker):

While Celo does offer native stablecoins (cUSD, cEUR etc.), the introduction of USDT on the network in late March/early April seems to have supercharged growth in the Celo ecosystem with USDT providing most of the stablecoin TVL growth on the network:

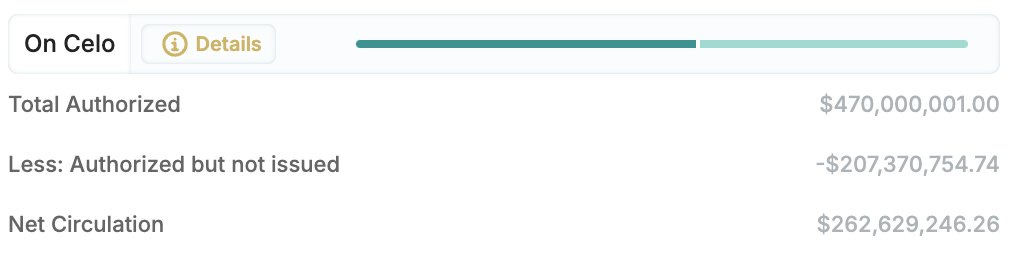

Tether have actually pre-minted a further 200m USDT on the network, perhaps indicative that they expect demand and growth to remain strong into the future:

Interestingly though, while USDT represents the largest share of market cap, cUSD represents the largest share of usage on Celo:

This could be explained by the deep penetration of cUSD into the everyday operations of regular Celo users (payments, remittances etc.) while larger, perhaps institutional players opt to use USDT for liquidity provision and larger transactions

MiniPay built by Opera, seems to have been driving a lot of this growth too. MiniPay is a stablecoin only non-custodial wallet which is built into Opera Mini, a data efficient mobile browser which is popular in mobile first markets like SE Asia and Africa. MiniPay boasts over 3 million activated wallets as of July 2024 and now operate in 4 large African markets: Nigeria, Kenya, Ghana, and South Africa.

MiniPay features key back up with Google, maps wallet addresses to phone numbers, allows for fee abstraction (pay with stables) and has first and last mile FX integrations with local providers like airtime, mpesa etc.

Interestingly, Celo active addresses began to skyrocket in September 2023, indicating that MiniPay has played an important role in this growth story:

One of the team members over at Celo EU sent me this video which they produced on the ground which touches on how Celo is impacting the microloan landscape in Africa:

Haraka and other digitally enables “Chamas” (cooperatives that are used to pool and invest savings by people in Africa), are plugged into Celo to allow global capital to enable local commerce to thrive through the provision of credit. This looks to be relatively small scale currently with Haraka’s pools not surpassing $50k in size:

Nonetheless, it indicates that Celo is powering economic activity above and beyond just basic transfers (payments) which, unless at a huge scale, don’t create attractive economics at a chain level.

$CELO

Targetting impact-related outcomes is a double edged sword; while it is certainly a net positive for the world, it is not necessarily the most profitable business.

Celo’s current usage is dominated by super low fee or even no fee transactions, this limits the blockchain significantly from an economic standpoint in that it only generates around $10k per month in revenues:

While the instant reaction might be that it’s hard to make the case for a $634m FDV asset which does ~$120k/year in revenue on a fundamentals basis, this might be a short sighted take…

The penetration that Celo are achieving with simple payments/transfers could act as a loss leader. If they are able to onboard a significant amount of users, these users can be further monetised in the future as other financial primitives such as lending, insurance and investment are built out and begin to gain traction. These developments would almost certainly lead to greater sequencer fees for the Celo L2. We are already seeing signs of a DeFi ecosystem emerging with Uniswap volume on Celo up a whopping 20x Year-over-Year which may contribute to fees:

The CELO token has fixed total supply of 1 billion with the following distribution:

Celo Reserve: 40%

Community Incentives and Grants: 25%

Validator and Staking Rewards: 12%

Team and Early Contributors: 18%

Investors: 10%

The only notable piece here is the Celo Reserve. The Celo reserve is used to maintain the stability of Celo stablecoins like cUSD and cEUR, the reserve serves as collateral and ensures stablecoins can always be redeemed. This portion of CELO is locked forever to back the platform’s stablecoins.

cStablecoins are all fully backed with exogenous collateral too (according to the Mento Reserve):

Conclusion

Celo is certainly an interesting story and the work they are doing in emerging markets is genuinely important as it pertains to increased financial inclusion. The combination of native USDT and Opera’s MiniPay seem to have put a rocket underneath the chains growth in terms of actual usage and economic value transferred on the network. While this usage is mostly simple low/no fee stablecoin transfers which don’t currently generate excessive revenues for Celo, we are already seeing signs of higher value economic activity taking place on the chain with swaps and lending being built out. Celo has firmly earned itself a spot on our watchlist.

Further reading:

If you enjoyed and want to see more content like this, feel free to check out the Humble Farmer Army premium discord here.

You’ll get access to:

Weekly Premium Content

An Exclusive Community

DeFi Yield Strategies

Degen Farms & New Launches

DeFi Education & Analysis

And Real-Time DeFi Alerts

Humble Farmers Rejoice!