Why We're Bullish $UNI ahead of V4

Unichain or a fee switch is closer than you think

Overview

In this post I will discuss the following:

1) Why the DeFi Renaissance is Here

2) $UNI Fee Switch and Unichain

3) Explaining the Trade: Buying the Rumor on UniV4

4) Addressing your Potential Counterarguments

If you are interested in hearing me talk about the thesis in video form, click here. This thesis was first posted on September 12, 2024 on Twitter/X and my YouTube channel.

Why the DeFi Renaissance is Here

DeFi summer in 2020 was the "technology trigger" that led to a huge bubble in 2021 before entering a trough of disillusionment, going down 80-90%. As mentioned in our bull case for AAVE in July at $92, we believe AAVE was the first runner for the DeFi Renaissance and believe $UNI is next.

Uniswap is miles ahead of the competition, capturing 40-50% of DEX volume on EVM chains with zero incentives. As I expect more trading volume to migrate from CEXes to DEXes, it's clear that Uniswap is the category leader.

The main question is whether $UNI can capture any value.

The consensus sentiment is that $UNI will never have a fee switch. I think that's wrong. Let me explain.

The $UNI Fee Switch or Unichain

On Feb 23 of this year, the Uniswap Foundation put out a proposal to turn on the fee switch to those that delegate & stake their tokens.

As a result, $UNI shot up 80% in a single day. Honestly, I was sidelined and in disbelief. In a matter of a few weeks, UNI pumped from $6 to $17 in a straight line.

The market will clearly bid $UNI once there's some path towards value accrual.

Unfortunately, the vote was POSTPONED because a large VC (a16z) stepped in to delay the vote. The community and other VCs like Paradigm was in full support.

So my job is to understand whether or not a16z has changed their mind regarding the fee switch.

Imagine my surprise when I saw this article on the a16z blog a month ago that basically lays out the entire plan on "how to drive cash flow for app tokens."

I'll summarize the article in the following tweets and share my main takeaways.

According to a16z, there are 3 ways to drive cash flows to app tokens in a compliant way:

1) Allow staking for certain jurisdictions

2) Reward behavior (fees go to delegators)

3) Create an appchain/L2

I'll tackle these one-by-one.

Staking for Certain Jurisdictions

If a project had a front-end for Asian users, people can stake the app token on the Asian front-end to receive fees from that activity (just as an example).

According to Mason Hall from a16z, governance suffers no burden and we can buy and stake app tokens in a compliant way.

Reward Behavior for Certain Behavior

Miles Jennings from a16z discusses whether or not having protocol fee accrual will create risks under the Howey test.

He suggests that protocols can consider the DUNA to enable fee models without Increasing risks under securities laws. But what's DUNA?

After some digging, I found another a16z article that discusses DUNA.

The Uniswap fee switch proposal was shot down in May, and DUNA was signed into law with an effective date of July 1, 2024. Perhaps a16z advised the Uniswap Foundation to wait until after July?

Under DUNA, DAOs can engage in for-profit activity and pay compensation to its members in exchange for participation in governance.

The February proposal was to share cash flow to those that delegated tokens. Under DUNA, they can do it in a compliant way.

Additionally, under DUNA projects will be able to maintain or even strengthen their argument that tokens are not securities.

Seems like a pretty monumental achievement for not only a16z portfolio companies, but all DAOs in general.

Unichain

There are 3 costs to trading on a DEX:

1) swap fee (to LPs/front-end)

2) gas fee (to validators)

3) MEV (to market-makers/validators)

Now, Uniswap can only monetize (1). If they were to create a chain, they can monetize (2,3). In my opinion, that would make $UNI a top 10 coin. I believe this is inevitable.

To summarize all my detective work, we can observe the timeline below.

The main takeaway here is that the market likely is pricing in a $UNI fee switch this year at close to 0%. I think it's much higher. I almost think it's a certainty by the end of 2025.

Hooks

Though UniV4 hooks are very interesting (it basically makes Uniswap the liquidity layer and allows DEXes to build on top). But in the interest of not making this report be too long, you can hear my analysis on the implication of hooks here.

The Trade: Buying the Rumor on UniV4

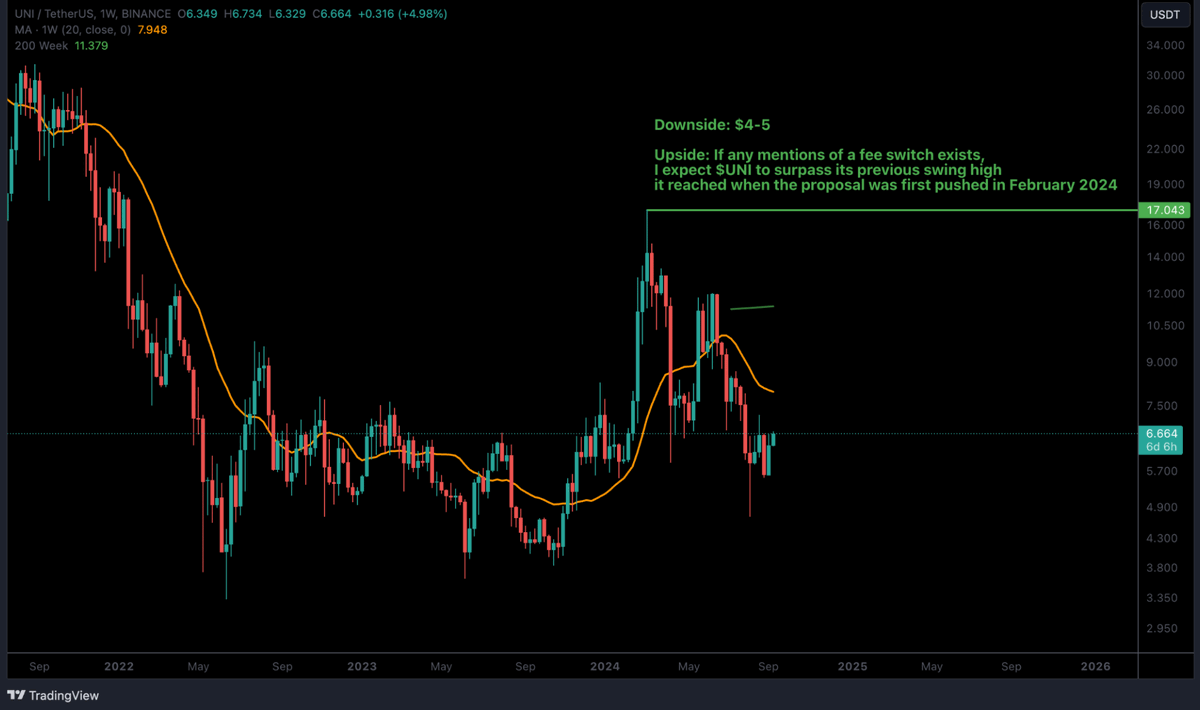

The market has no expectations for V4 or the fee switch, and that's reflected in the price. Upside for any good news is a clear 3-4x from current levels.

Everyone hates $UNI, meaning no one owns it. Downside is capped, upside is a repricing of this token towards a top 10 asset.

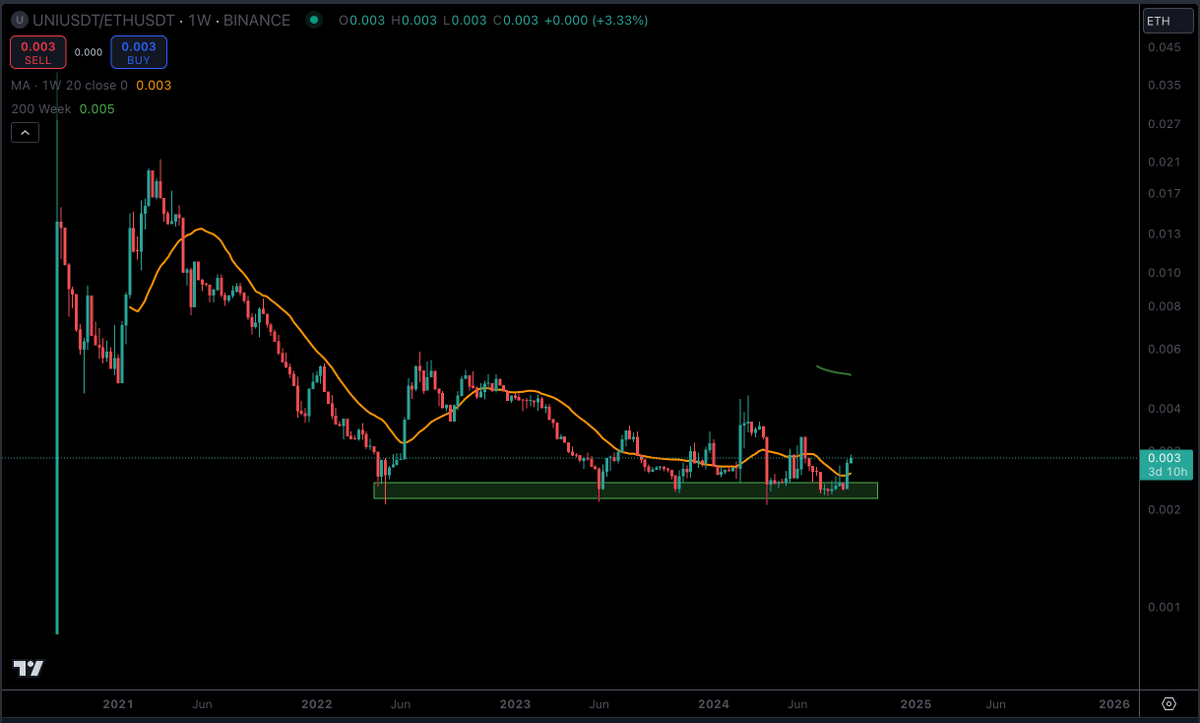

UNI/ETH is also holding its range lows.

The risk/reward for $UNI is incredible both on the USD pair and the ETH pair. If the DeFi Renaissance were to continue, UNI is a clear target given its strong market positioning and potential catalysts.

I've accumulated a very large $UNI position at ~$6.60. If there were to be any good news regarding a fee switch or an appchain, I think it will come with the V4 announcement. If not, then I'm wrong.

Screenshot below related.

Addressing Your Questions/Concerns

Now, let's address some counterarguments you may have:

1) SEC going after Uniswap

2) "VCs/team want value to go to equity, not token"

3) "DeFi to zero if Trump doesn't win"

SEC Going After Uniswap

Many know the SEC's case against Uniswap is weak. In fact, they went after Coinbase making the exact argument and lost. Last week, the CFTC fined Uniswap $175,000 and price didn't budge.

Everyone and their grandmother knows this. It's already in the price in my opinion.

VCs/Team Don't Care About the Token

The argument below is valid, and it presents the biggest risk to my thesis.

But speaking facts, the Uniswap Foundation literally put out a proposal earlier this year to introduce value accrual, with the support of Paradigm. The fee switch is not a matter of IF, but WHEN.

I think this narrative only exists because people are short-sighted and want a reason to hate on VCs/team. That's reasonable, but I hope that this entire report has disproven the misconception that a16z/team/etc isn't doing anything towards value accrual.

The foundation only has runway until end of 2025, which is why they put out the proposal in February, in my opinion.

I think some version of a fee switch likely comes by the end of 2025 for this reason.

"DeFi to Zero if Kamala Wins"

I agree that Trump > Kamala for DeFi.

However, claiming that our industry goes to zero if Trump loses is very defeatist. It means you have no conviction and are not willing to put in the work.

I think crypto goes up 2025+ no matter who's in office. How is that controversial?

Summary

I believe the market is underpositioned for UniswapV4, as it is the perfect time for the team to announce a Unichain or for the Uniswap Foundation to reignite the fee switch proposal. The market is complacent on $UNI thinking that it's a worthless governance token. As a result, positioning is light meaning that buying the rumor on V4 has an asymmetric risk/reward, especially given the "test pump" $UNI had in February where it went up 3x in a single month from the "fee switch temperature check." Long and strong.