The Rise of MoveVM Chains

How the MoveVM, Aptos and Sui Aim to Revolutionize Blockchain Development

Remember Diem aka Libra?

That ill-fated attempt by Facebook at a crypto project?

When it was first unveiled, Libra promised a new currency tied to a basket of fiat currencies and securities, backed by a group of tech giants and financial powerhouses. The list of supporters was impressive: Visa, Mastercard, Stripe, PayPal, eBay, and the list goes on.

It seemed like Facebook was poised to revolutionize the financial world.

Alas, it was not meant to be.

Regulators from the United States, Europe, and beyond raised concerns about Facebook's potential control over global financial rails. The general public, already wary of Facebook's influence, baulked at the idea of Mark Zuckerberg extending his reach into the financial realm. This was, of course, before Zuckerberg's rebranding as a judo-practicing, trad-family-posting, based individual, but that's another story.

As the pressure mounted, the Libra Association's supporters began to jump ship. Within months of the project's announcement, most of the big names had withdrawn their support, leaving Facebook to fend for itself. Despite multiple attempts at saving the project, like pivoting to a US-stablecoin or renaming to Diem, the project eventually shut down, and its assets sold off.

That seemed like the end of the road for Facebook's blockchain ambitions. But the story was far from over.

You see, during the development of Libra/Diem, a lot of groundbreaking work had been done, much of it open-source. The Diem codebase, for example, was made publicly available, as was the work done on a new smart contract language called Move.

The talented developers who had poured their blood, sweat, and tears into the project weren't about to let their efforts go to waste. They left Facebook, determined to bring their vision to life leveraging the open-source work that was available for anyone to use.

Two projects are touted as the successors of Diem: Aptos and Sui. But before digging into them, we are going to turn our attention to Move and the Move Virtual Machine (MoveVM).

Move has generated a lot of buzz in the crypto developer community, but what makes Move so special? Why are people so seemingly excited about it?

To answer that, we need to take a closer look at Move and the problems it aims to solve in the world of blockchain development.

Move and the MoveVM

Ethereum introduced smart contracts, Solidity and the Ethereum Virtual Machine (EVM) to the world. A virtual machine (VM) is a software emulation of a computer system that can execute programs like a physical computer would. In crypto, it is what allows smart contracts to be executed on-chain. Solidity is the programming language designed to build smart contracts.

Over the past 7 years, Solidity and the EVM have dominated the Web3 space due to strong network effects.

However, as the industry matured, the limitations and vulnerabilities of the EVM and Solidity became increasingly apparent.

Solidity and the EVM have earned a reputation for being prone to exploits, making it challenging for developers to create secure smart contracts. The history of Ethereum is littered with high-profile hacks and exploits, resulting in the loss of millions of dollars. Just take a look at the rekt leaderboard.

If you're writing smart contracts that anyone can interact with, that are open for the world to see, and that could potentially control eye-watering sums of money, you'd better be damn sure your code is secure. The last thing you want is a gap between what you think your code does and what it actually does. That's how you end up with hacks, exploits, and a whole lot of angry investors.

That's where Move comes in.

Move was designed from the ground up to address the shortcomings of Solidity and the EVM, focusing on enhanced security and expressivity.

Move's primary strength lies in its ability to help developers write safer smart contracts. By incorporating features like memory safety and resource management, Move significantly reduces the attack surface of smart contracts. Additionally, the Move Prover, a formal verification tool, allows developers to ensure that their code behaves exactly as intended, minimizing the risk of unexpected behaviour or exploits.

Move also offers developers a more expressive language. Instead of storing assets in hashmaps that are permanently locked in a contract like Solidity, Move allows users to define their own types for custom-built digital objects. These objects can then flow through smart contracts by being passed in as arguments and returned by functions. This is more intuitive than Solidity’s method and makes it easier to build complex applications.

While the Diem project may have met an untimely end, Move and the MoveVM live on. Not only through Aptos and Sui but also in projects trying to bring Move to existing ecosystems, like Movement building an Ethereum L2 usign the MoveVM or Eiger bringing Move to the Polkadot ecosystem.

Aptos: The Blockchain Built on Diem's Ashes

Aptos is built on the bones of Diem, leveraging its architecture and the Move programming language with some improvements to create a high-throughput blockchain.

The team claims that Aptos can handle a whopping 160,000 transactions per second (TPS),

And look, we can talk about the tech developments that make this possible, but unless you are building distributed systems this is probably not that interesting to you and won’t certainly help much in valuing Aptos as a project.

And here's the thing: despite all the hype and promise, Aptos has been live for over a year and a half now, and the actual performance has been a bit... underwhelming.

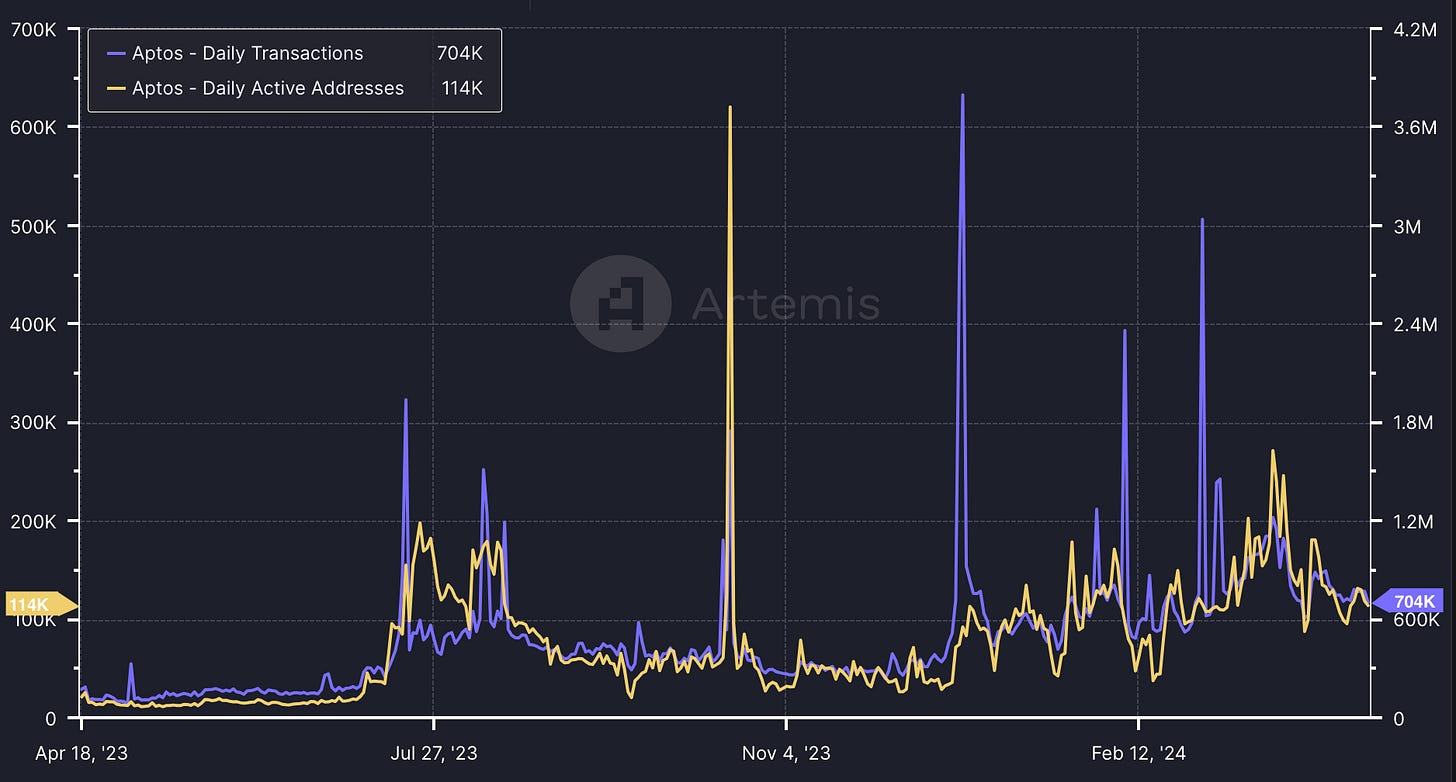

On an average day, Aptos processes around 700,000 transactions, which sounds impressive until you realize that's only about 8 transactions per second (TPS). For comparison, Ethereum chugs along at around 15 TPS per day. Ethereum L2s see 30-40 TPS on any given day, and Solana sees 600-900 TPS.

Now, to be fair, Aptos has shown that it can handle more when pushed. On December 24, 2023 (maybe everyone was buying last-minute Christmas gifts with crypto?), transactions spiked to 3.8 million, or around 440 TPS. This far exceeds the maximum throughput of EVMs (around 60 TPS) and Ethereum (22 TPS), but still below Solana’s typical TPS, and way below the high throughput that was promised.

So, the chain is capable of higher throughput than we see usually see. How much, we are not sure. But why is the chain not being pushed to its limits?

Well, the issue seems to be that there's just not enough going on in Aptos Land to drive activity. So, even though the chain is capable of more and we have not yet seen it tested to the limit (probably not even close) until activity picks up it is tough to gauge if it lives up to the premise.

We see this lack of activity in other metrics too.

This trend is also reflected in the number of daily active addresses, which hovers around 150,000 – comparable to Optimism but far below Ethereum (400,000) and Solana (1.5 million). Good, but we’d like to see it pick up.

But wait, there's more! (Or less, depending on how you look at it.)

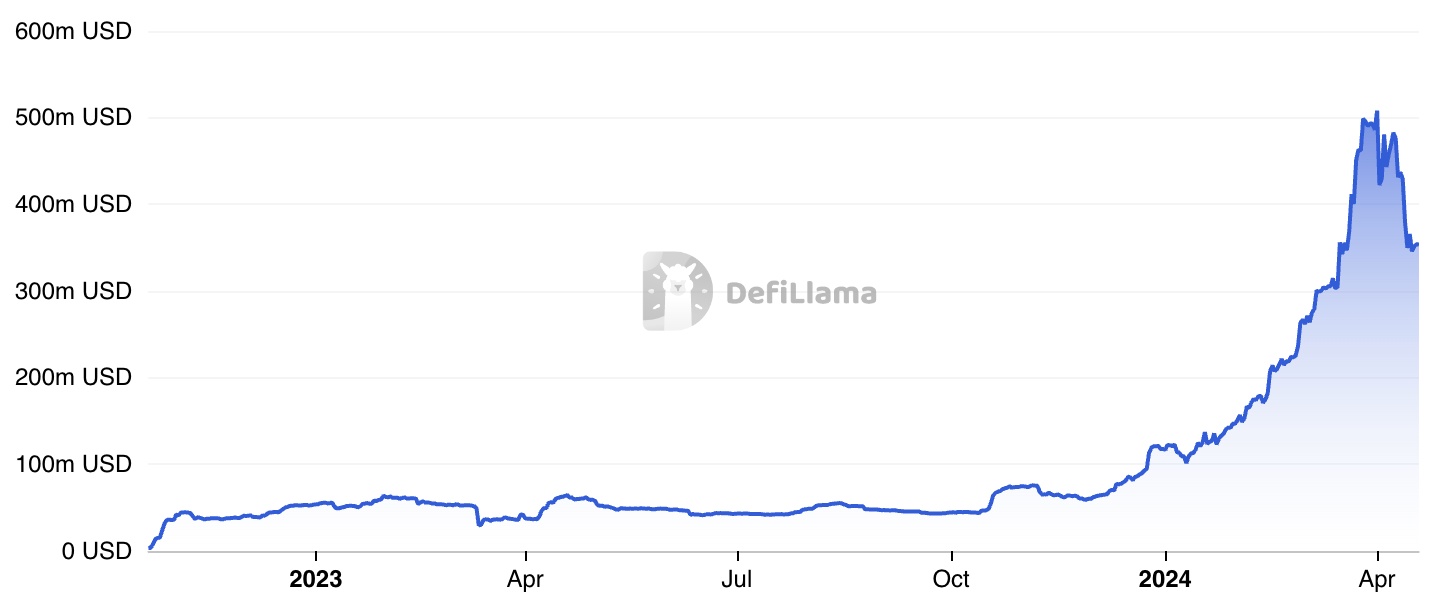

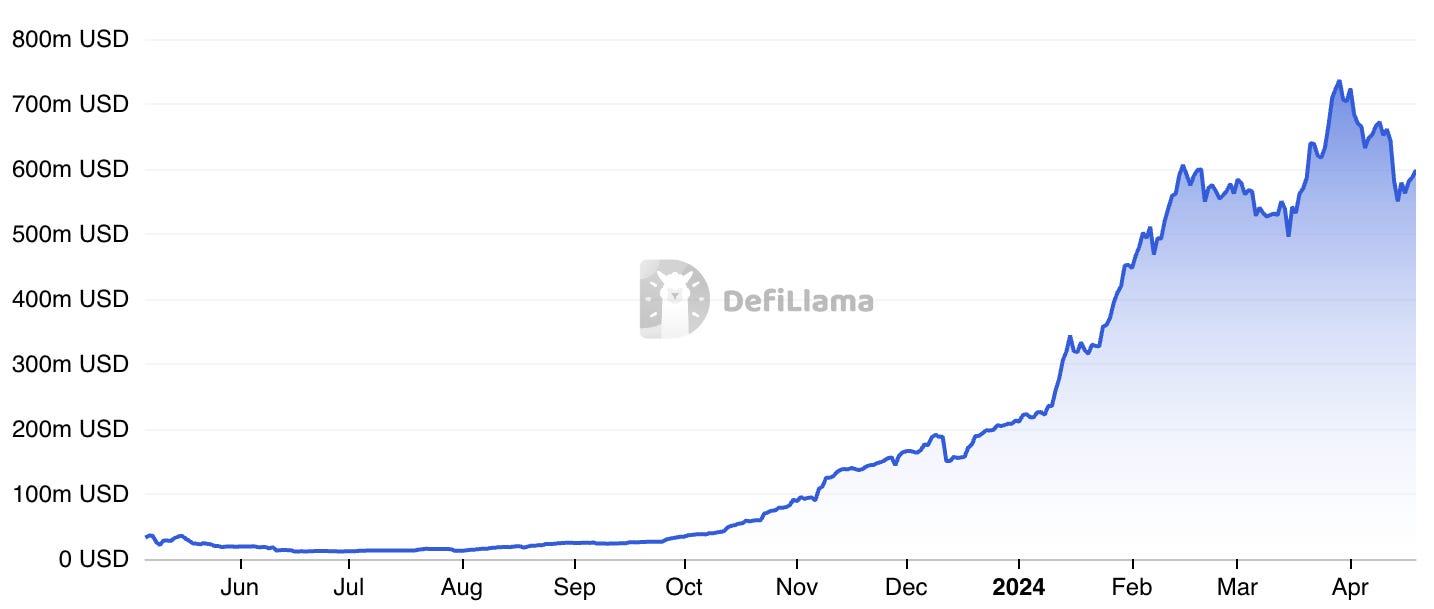

The adoption of DeFi in the chain has also been somewhat disappointing. The total value locked (TVL) in Aptos currently sits at $350 million

To put this in perspective, Base and Blast, two Ethereum scaling solutions that launched more recently, already have TVLs of 1.5 billion and 1.4 billion, respectively. Sure, they benefit from the network effects of Ethereum, but still, Aptos' TVL is only slightly higher than that of Cardano or Near, which are often considered underperformers in the DeFi space.

Solana and Ethereum seem very far off, at $3.7 billion and $50 billion respectively.

DEX volumes are not great either. They were between $1-5 million a day until February, and are between $15-30 million now. That’s similar to Starknet or Near, and way below chains like Optimism ($100 million) and Arbitrum ($500 million to $1 billion).

But hey, it's not all doom and gloom for Aptos.

For instance, Aptos is making a push in the real-world assets (RWA) and tokenisation space.

The project has created the Aptos Fungible Asset Standard, which enables the tokenization of various assets, including commodities, real estate, and financial instruments. This standard could drive financial innovation on Aptos, similar to what we saw with ERC20 and ERC721 on Ethereum.

One RWA initiative is Aptos’ partnership with Ondo Finance, which offers liquid exposure to an ETF of short-term U.S. Treasuries via its USDY token.

There are also a few DeFi protocols showing some promise, like Aries Markets -the main lending protocol-, or Amnis Finance -the main liquid staking provider-. Aries is incentivizing some of its lending pools, with its main stables giving out over 15% APY over the last 30 days and its ETH pool around 12%. Cellana, the first Ve(3,3) DEX on Aptos, is also incentivizing some of its pools, with APT-LST pools giving out 5-20% and APT-stables giving out 50-75%

But perhaps the most interesting protocol on Aptos is Thala, which offers a decentralized exchange (DEX), liquid staking, and the overcollateralized stablecoin Move.

While these developments are promising, they haven't yet translated into the kind of activity and liquidity that Aptos needs to truly thrive.

But Aptos isn't the only blockchain built on the Move language that's trying to shake things up. Enter Sui, a project that's taking a different approach to scalability and smart contract design.

If you are enjoying this article and want to access more in-depth research on the broader crypto space, consider joining the Humble Farmer Army (HFA) Premium. Led by the OG Humble Farmer himself, Taiki Maeda, HFA Premium gives you access to exclusive research articles and videos, airdrop farming strategies, and asymmetric risk/return opportunities. We’d be thrilled to have you as part of our community.

Sign up using this link to support my work.

Sui: The Blockchain That's Making Moves (Pun Intended)

Aptos launched a full 200 days before Sui and, for a while, it stole all the headlines. It was the first blockchain to launch with the Move language, the “successor” to Meta's ill-fated Diem project and had a clear first-mover advantage over Sui.

But while Aptos was basking in the spotlight, another blockchain was quietly building in the shadows. That blockchain is Sui, and it's starting to make some serious waves.

Sui is the creation of Mysten Labs, a team of ex-Meta researchers Unlike Aptos, which pretty much just took the Diem codebase and ran with it, Sui was built from the ground up, with some pretty significant changes to the Move language and the underlying architecture.

Sure, Sui still uses the Move programming language, but it's implemented in a way that's quite different from Aptos or the original version of Move.

The key difference? Sui's use of an object-centric model.

In Sui's world, everything is an object. Tokens, smart contracts, NFTs – you name it, it's an object. Each of these objects comes with its own set of attributes, like the address of its owner, read/write properties, transferability, and functionality.

This object-centric approach has some pretty cool implications. For one, it means that most on-chain activity in Sui is done by modifying the data associated with each object. So when you want to transfer something, you only need to update the ledger once, rather than the usual two times (once for the sender and once for the recipient). It might not sound like a big deal, but when you're dealing with millions of transactions, those little efficiencies add up.

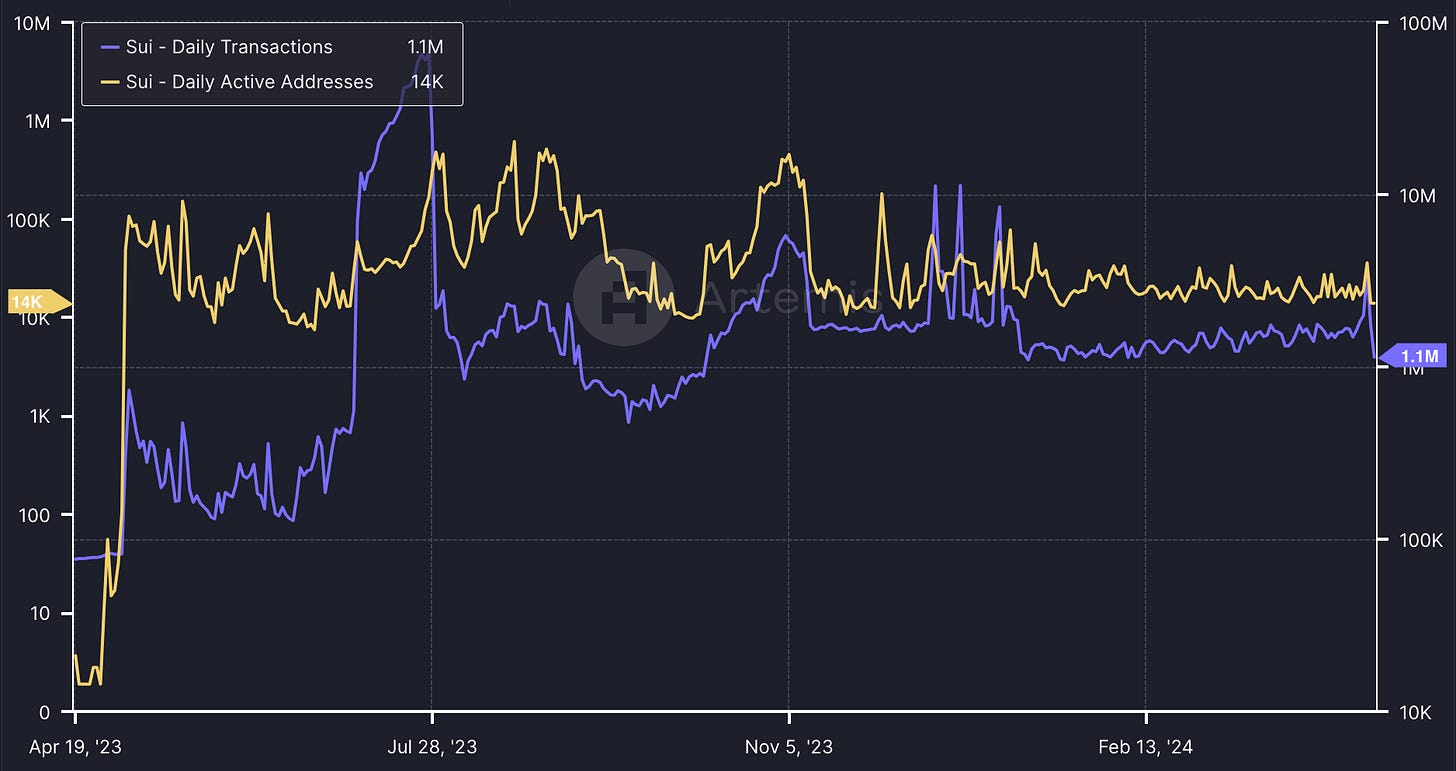

Speaking of transactions, let's talk numbers. Sui is currently processing around 1.5 million transactions per day, which works out to about 17 transactions per second (TPS). That's about double what Aptos is doing, but still pretty low for a blockchain that's supposed to be all about high throughput.

But here's where things get interesting. Unlike Aptos, Sui has shown that it can sustain high TPS for extended periods. Back in July 2023, when a game on Sui got really popular, transactions per day shot up to over 10 million (or 115 TPS) for two whole weeks, even hitting 60 million (a whopping 700 TPS) for a couple of days. We saw similar spikes in November 2023 and January 2024, with sustained activity between 5-10 million transactions per day.

So while Sui's average TPS might not be blowing anyone's socks off, it's proven that it can handle the heat when things get busy.

Where Sui does not particularly shine is in its number of users. At fifteen thousand, Sui has 1/10th the number of daily active addresses as Aptos and 1/100th that of Ethereum.

On the DeFi side, TVL is currently sitting at $600 million. That's about 2/3 of what Optimism and Polygon have, and if Sui can keep up its current growth rate (it's up 24x in native SUI terms and 50x in USD terms since August 2023), it could be knocking on the door of the top 10 blockchains by TVL before we know it.

Sui also has some interesting projects, like Bluefin for derivatives and Aftermath as a DEX and liquid staking provider. Sui also has Ondo already deployed. TVL is rather small still ($6 million) but it is another case of Sui delivering while Aptos seems to be more focused on making announcements to drive attention.

The two main money markets, Navi and Scallop, have yields of around 25-30% for lending SUI and stables, 30-40% for SUI LSTs and around 30% for ETH. Some pools in DEXs like Cetus or Turbos are also incentivized, with some of the main pools for stables or SUI-USDC/USDT having reward APYs of 30-100%.

These incentives are often paid in SUI. And they seem to be working.

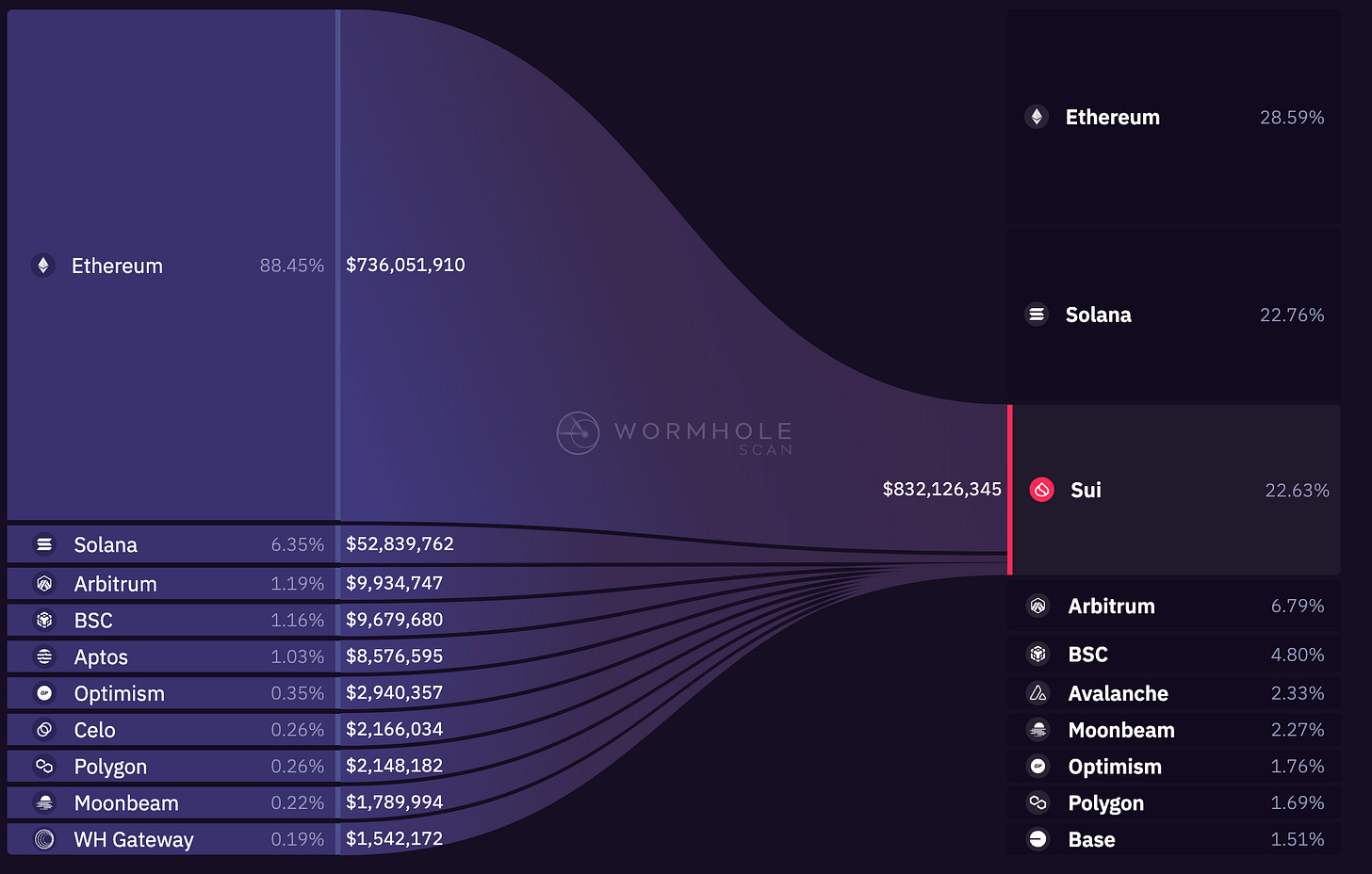

Data from Wormhole shows that in the last 90 days over $730 million bridged to Sui from Ethereum alone, with a total of around $820 million from all chains. That equates to a net inflow of $130 million in total and $180 million from Ethereum. Not too shabby.

And all of this activity is translating into real usage and adoption. Sui-based DEXes are consistently seeing daily trading volumes of $50-150 million, which is comparable to what we're seeing on Optimism and 3-10 times what Aptos is currently doing.

But Sui's ambitions go beyond just DeFi. The project is also making moves in the gaming and social spaces, partnering with the likes of ByteDance (TikTok's parent company) and announcing a handheld gaming web3 console called SuiPlay0x1 in collaboration with Playtron.

Of course, it's still early days for Sui, and a lot can change. But from where we're standing, it looks like Sui is carving out a unique position for itself in the blockchain landscape.

Closing thoughts

So, where does all this leave us? Is Move poised to dethrone Solidity and the EVM? Are Sui and Aptos the blockchains that will make it happen?

Let's start with Sui.

Its tech is seemingly better, and it is besting Aptos in TVL, DEX volumes, and transactions. The only metric in which it is trailing Aptos is in number of users. At a $1.8 billion valuation, it's looking like a bargain compared to some of the other L1s and L2s out there.

However, Sui's tokenomics are a bit of a red flag. Only 13% of the supply is circulating, and a big unlock coming up in June could cause serious sell pressure. And if we look at fully diluted valuation (FDV), Sui is trading at $13 billion, which is more in line with other successful L1s.

Aptos, on the other hand, has 40% of its supply unlocked, and with a $4 billion market cap and $10 billion FDV looks cheaper here, with potentially fewer insiders waiting to dump tokens on your head.

Aptos is also seemingly better at “playing the game”, that is, building a community and making them rich. Aptos's airdrop was much bigger and better executed than Sui’s, and unlike Sui, it drove attention and a big rally shortly after launch while Sui was down only for months.

The choice seems clear.

If you want a chain that can outperform in the short term, with more attention to community building and better token economics, but with somewhat worse tech and more prone to chest-pumping announcements than actual building, choose Aptos.

If you want a chain that is trying to create an ecosystem from the ground up, starting with a good experience for developers, with better tech and (for now) better "fundamentals", but where price action could be underwhelming for months to come while major unlocks happen, choose Sui. It really depends on your style and timeframe.

Looking beyond Sui and Aptos, the rise of Move is an exciting development for the blockchain space as a whole. For too long, the EVM and Solidity have dominated smart contract development.

Move represents a fresh approach, one that prioritizes safety, scalability, and expressiveness. And with its platform-agnostic design, Move has the potential to become the universal language of blockchain programming. For instance, Movement is building an Ethereum L2 with the MoveVM instead of the EVM.

Of course, overtaking the EVM and Solidity won't happen overnight.

But as more projects adopt Move and the MoveVM, and as the limitations of the EVM become more apparent, the balance of power could start to shift.

In the end, the future of blockchain programming will likely be multi-chain and multi-language. There's room for the EVM, Move, and other smart contract platforms to coexist and even interoperate.

But one thing is clear.

Move is here to stay.