The Humble Farmer's Digest 10/31

Your weekly dose of Crypto, DeFi, and more...

Hello Humble Farmers, thanks for reading!

This substack aims to share everything we’re paying attention to, including new launches, good farms, tokens, and much more. If any of that sounds interesting to you, please subscribe!

What We’re Watching

Coinbase

While we normally stick to talking about on-chain plays, Coinbase is uniquely positioned to outperform as we get closer to entering the beginning stage of the bull run.

This is for a few reasons, with those mainly being…

Coinbase is the most retail-friendly exchange for US-based participants.

Coinbase has been steadily expanding to various countries across the globe.

COIN is the only way to get high-beta exposure to the cryptocurrency market in Trad-Fi.

Exposure to the growth/profitability of USDC (via their stake in Circle).

Exposure to on-chain growth (through the Base L2 & cbETH).

Custody fees for the Grayscale BTC ETF.

There are risks to keep in mind, but let’s first go a little bit deeper into the bull case…

Coinbase is the most retail-friendly exchange for US-based participants.

With the increasing level of regulatory uncertainty for cryptocurrency exchanges in the US, many of the previous Coinbase competitors have been wiped out (mainly Binance US and FTX). Coinbase is currently known as the go-to “safe” CEX to trade crypto and will likely benefit much more than previously from the new wave of users that is bound to come with a bull market.

Coinbase has been steadily expanding to various countries across the globe.

We’ve already started to see Coinbase expand to countries outside of the US, after recently gaining approval to launch in Singapore. They’ve also begun to offer products such as perpetual futures that are not currently available in the US, and this could start to eat into Binance’s international market share.

COIN is the only way to get high-beta exposure to the cryptocurrency market in Trad-Fi.

Right now, there isn’t an easy way to get exposure to BTC in Trad-Fi. Institutional investors only have a few options: One, roll the dice on GBTC and hope it gets approved one day. Two, purchase low-cap BTC miner stock. Three, place their bets on Coinbase. While this will change with the launch of the BTC ETF, Coinbase is still one of the few ways for institutional investors to get high-beta exposure to crypto.

Exposure to the growth/profitability of USDC (via their stake in Circle).

With the current high-interest rate environment, Coinbase’s equity in Circle has been extremely profitable for the company. In just Q2, Coinbase’s revenue from USDC alone amounted to $151M, which will only increase as USDC’s marketcap rises.

Exposure to on-chain growth (through the Base L2 & cbETH).

While this hasn’t been extremely profitable yet, Coinbase has released various on-chain products such as the Base L2 and cbETH, which will contribute to profits more as usage rises.

Custody fees for the Grayscale BTC ETF.

With the announcement of Grayscale’s BTC ETF, Coinbase was chosen to be the custodial of the underlying BTC. While we don’t know how much revenue this will bring in quite yet, this could set up Coinbase to be the key beneficiary of other crypto-based ETFs further down the line.

That covers most of the COIN bull case, but there are risks to keep in mind, especially given the current regulatory environment in the US. This is definitely a significant risk, but Coinbase has proven in the past that they won’t back down from the SEC.

In conclusion, COIN will benefit greatly from the resurgence of a cryptocurrency bull market and could be the most reflexive bet currently available as institutional investors rush to find the highest beta bet on BTC. This alongside Coinbase’s constantly expanding suite of on-chain and off-chain products could set it up to be one of the biggest winners over the next few years, but as always, do your own research.

Farms of the Week

Upcoming Projects

Stackly (The DCA tool for crypto investors & DAOs. Stack your fav coins at any frequency, reduce risk & build a stable portfolio.)

Splurge Finance (secure, decentralized, and automated investing/trading vaults for any token on any AMM.)

Liquid Layer (When Proof-of-Work meets scalability and liquidity optimization.)

Relay (Revolutionizing DeFi's infrastructure.)

Dupe (The future of Web3 gaming - coming soon.)

0xGambit (The first reliable and smooth prediction market for any ERC20 token on the Ethereum.)

Good Reads

RaaS vs Rollup Framework:

Deep Dive on Data Availability:

Preparations For the Next Bull Run:

Why the BTC Bear Market is Over:

A Brief Introduction to Anoma's P2P Layer:

R.I.P Liquidity Mining: The Epilogue:

Project Updates

dYdX Chain:

Arbitrum Orbit Mainnet Ready:

wstETH on zkSync:

POL Token Upgrade Live:

Introducing Injective Nexus:

Native Staking on Polygon zkEVM:

Astar zkEVM Testnet:

Introducing Akolytes:

Paladin Quest V2:

Contango cPerps Live:

Introducing Alternative DA:

SSV Incentivized Mainnet:

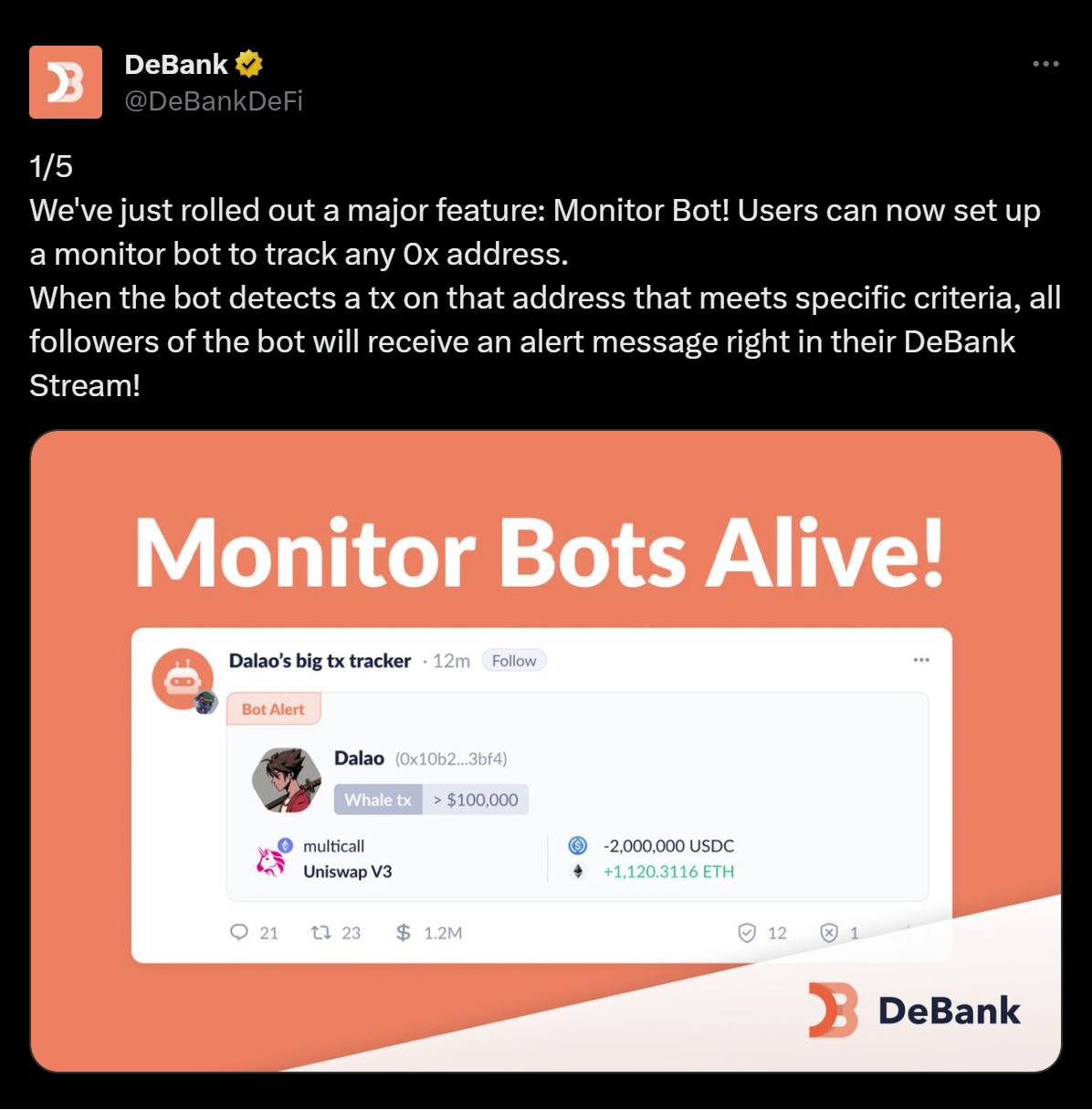

Debank Monitor Bots:

Zeta Z-Score:

ETH Trend Index:

Frame on Arbitrum Nitro:

Introducing 🅉Pass:

Fantom Sonic Testnet:

Celestia Arbitrum Nitro Integration:

Jito StakeNet:

Beefy on Gnosis:

SushiXSwap V2 Live:

Introducing Perpetual Features:

Solana Labs Incubator:

Beta-2 Officially Live:

LUSD on Starknet:

Introducing Nord:

Super SOMM Vault:

Hook on Arbitrum Orbit:

Conclusion

If you enjoyed and want to see more content like this, feel free to check out the Humble Farmer Army premium discord here.

You’ll get access to:

Weekly Premium Content

An Exclusive Community

DeFi Yield Strategies

Degen Farms & New Launches

DeFi Education & Analysis

And Real-Time DeFi Alerts

Humble Farmers Rejoice!