The Eigenlayer Farming Opportunity

Discussing what might be the largest airdrop opportunity of this cycle...

While we may have inadvertently referred to EigenLayer in previous articles, we have not directly addressed the project and the opportunities which lie therein. EigenLayer and restaking is quite clearly the strongest narrative for this cycle when it comes to the Ethereum ecosystem.

If we take EigenLayer out of the equation, while Ethereum remains a hub for DeFi and NFT activity, the growth of the ecosystem and interest from Crypto-incomers pales in comparison to something like Solana. Equally, the L2 scaling roadmap which increasingly depends on alternative DA layers presents multiple questions about ETH value accrual, interoperability and liquidity fragmentation. However, if we add EigenLayer back into the equation as an entirely new primitive which can turn ETH into a yield-machine and bedrock of economic value, we can quickly begin to envisage a stronger narrative unfolding. In the near term, the success of EigenLayer appears to be synonymous with the success of Ethereum.

This report will predominantly look at the best ways to get exposure to $EIGEN today via a variety of airdrop farming strategies, but before we begin, let’s take a look at what EigenLayer is and what problem it solves…

What is EigenLayer?

We are all likely familiar with the concept of staking ETH to secure the Ethereum blockchain under the Proof of Stake paradigm we now live in. This mechanism works because the ETH at stake represents economic value which can be slashed should validators be dishonest. EigenLayer saw the opportunity in this massive pool of economic value to “re-use” this staked ETH to secure additional protocols, applications and/or services beyond the core Ethereum protocol. This is the concept underlying the term “restaking” whereby users change their withdrawal credentials to point towards EigenLayer, allowing their staked ETH to secure more applications/services and earn extra fees/rewards while being exposed to an additional layer of slashing.

Protocols which use EigenLayer restaked ETH as economic security are referred to as Actively Validated Services (AVS). There are 5 key categories of AVS which lend themselves particularly well to using EigenLayer for economic security:

Rollup Services: Data Availability, Decentralised Sequencers, Bridges etc.

Threshold Cryptography (security usecase)

Co-Processors

MEV Management

Other General Decentralised Networks: Oracles, Keeper Networks, Decentralised Front-Ends etc.

One of the first protocols to draw on the economic security provided by EigenLayer will be EigenDA - a Data Availability protocol (competing with the likes of Celestia and Avail) built by the team to prove out the technology. Another example of a promising AVS would be Drosera, a Decentralized Automated Responder Collective which essentially seeks to provide ongoing security to DeFi protocols by securing a portion of their TVL and using restaked ETH as economic security to align the incentives of their operators:

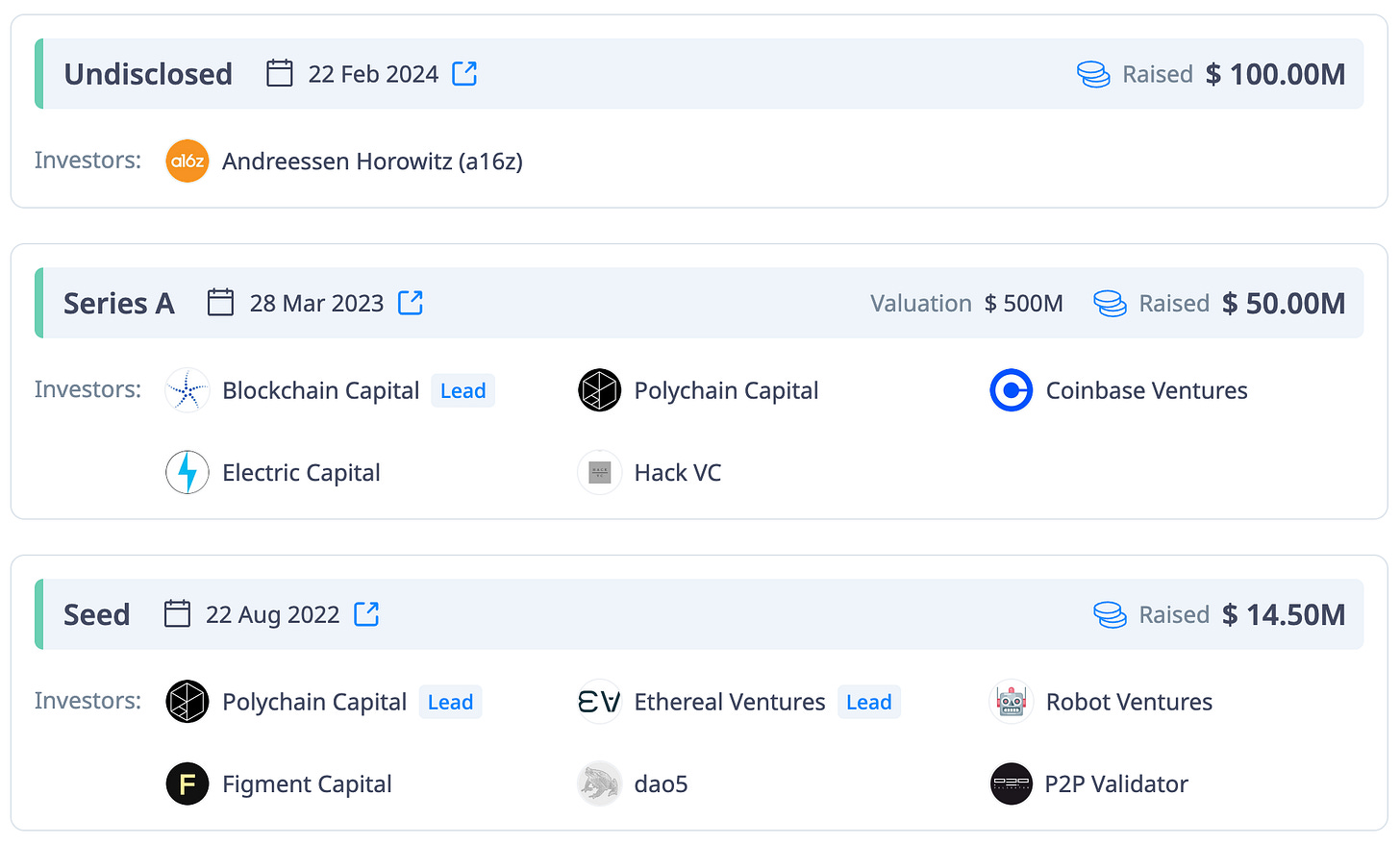

EigenLayer have raised over $160m to date from some extremely heavy hitters in both Crypto and Traditional VC circles. With the founder, Sreeram Kannan, being faculty at the University of Washington and over $10bn of capital deployed into EigenLayer to date, it is no exaggeration to say that EigenLayer sits firmly in the ranks of one of the highest quality and most promising projects in Crypto.

Given that EigenLayer will compete with Celestia but also offers an entire platform for other services to emerge, we think it is highly likely that $EIGEN will trade at least in line with $TIA and likely at a premium which would likely put the FDV at $20bn+. It is for this reason that we believe $EIGEN could be one of the largest airdrops this cycle in terms of total value distributed. So without further ado, let’s look at the different ways to farm a potential $EIGEN airdrop…

How to farm $EIGEN?

The easiest, most direct and safest way to farm $EIGEN would be to simply deposit a Liquid Staking Token (LST) of your choice into app.eigenlayer.xyz and begin farming their “restaked points” which are expected to correspond to some portion of token supply upon TGE.

However, as you can see along the top of the above screenshot, liquid restaking deposits (deposits of LST tokens) are currently paused having hit their respective caps. Only native restaking is enabled which requires some more technical knowledge on the user side. For this reason, we currently see the following options as the best way to farm restaked points. Note that all of these options fall into the “liquid restaking protocol” category and depositing into these protocols has the additional benefit of farming the native token of the project in question along with the underlying Eigenlayer restaked points…

TVL: $2bn

Amount Raised: $32.3m

Key Notes: Ether.fi is the highest quality liquid restaking protocol by some margin. As the lowest risk option (beyond directly restaking on EigenLayer) it is no surprise that Ether.fi has the highest TVL. While the Ether.fi airdrop will be more diluted given the amount of capital within the protocol, it will also likely be the most valuable liquid restaking protocol token in our view.

TVL: $800m

Amount Raised: $3.2m+

Key Notes: Renzo recently received an investment from Binance Labs, note that Puffer Finance (mentioned below) also received an investment from Binance Labs but this was before they pivoted to building on EigenLayer. This effectively makes Renzo Binance’s only direct investment into the liquid restaking protocol landscape.

TVL: $1bn

Amount Raised: $3.75m

Key Notes: Swell started out life as a liquid staking protocol competing with the likes of Lido and Rocketpool but added liquid restaking to their offering once Eigenlayer opened up deposits. They have been around for a while and represent yet another choice for farming Eigenlayer restaked points and a potential liquid restaking protocol airdrop in the form of $SWELL.

TVL: $690m

Amount Raised: N/A

Key Notes: Kelp is the most “grassroots” liquid restaking protocol in that it has not raised from VCs to our knowledge. They recently launched “Kelp Earned Points” which are a tokenised version of Eigenlayer restaked points which have been earned on Kelp which effectively allows these points to be traded.

All of these options are viable and well trusted by the market, one potential strategy is to spread ETH/LSTs across all four - diversifying risk, farming Eigenlayer restaked points and farming all 4 liquid restaking protocol airdrops on top! The only other protocol worth mentioning here is Puffer Finance who would likely be on a similar ranking to Ether.fi in terms of quality but they are subject to the same cap as Eigenlayer in terms of liquid restaking so deposits currently only earn a potential $PUFFER airdrop and no restaked points.

If you already have ETH exposure or staked ETH exposure in the form of an LST, putting that capital to work in one of these protocols makes a lot of sense on the basis you are willing to accept a slight increase in risk. The $EIGEN airdrop will very likely be one of the largest of this entire cycle and the cherry on top are the potential liquid restaking protocols you are farming simultaneously. Additionally, as we have seen with the AltLayer airdrop, it appears that there will also be a trend of projects airdropping tokens to restakers which puts restaked ETH in a similar category to staked TIA.

If you enjoyed and want to see more content like this, feel free to check out the Humble Farmer Army premium discord here.

You’ll get access to:

Weekly Premium Content

An Exclusive Community

DeFi Yield Strategies

Degen Farms & New Launches

DeFi Education & Analysis

And Real-Time DeFi Alerts

Humble Farmers Rejoice!