GM Humble Farmers!

It’s a new week, and we’ve discovered a new round of farms to check out.

Here are our Humble Farms of the Week.

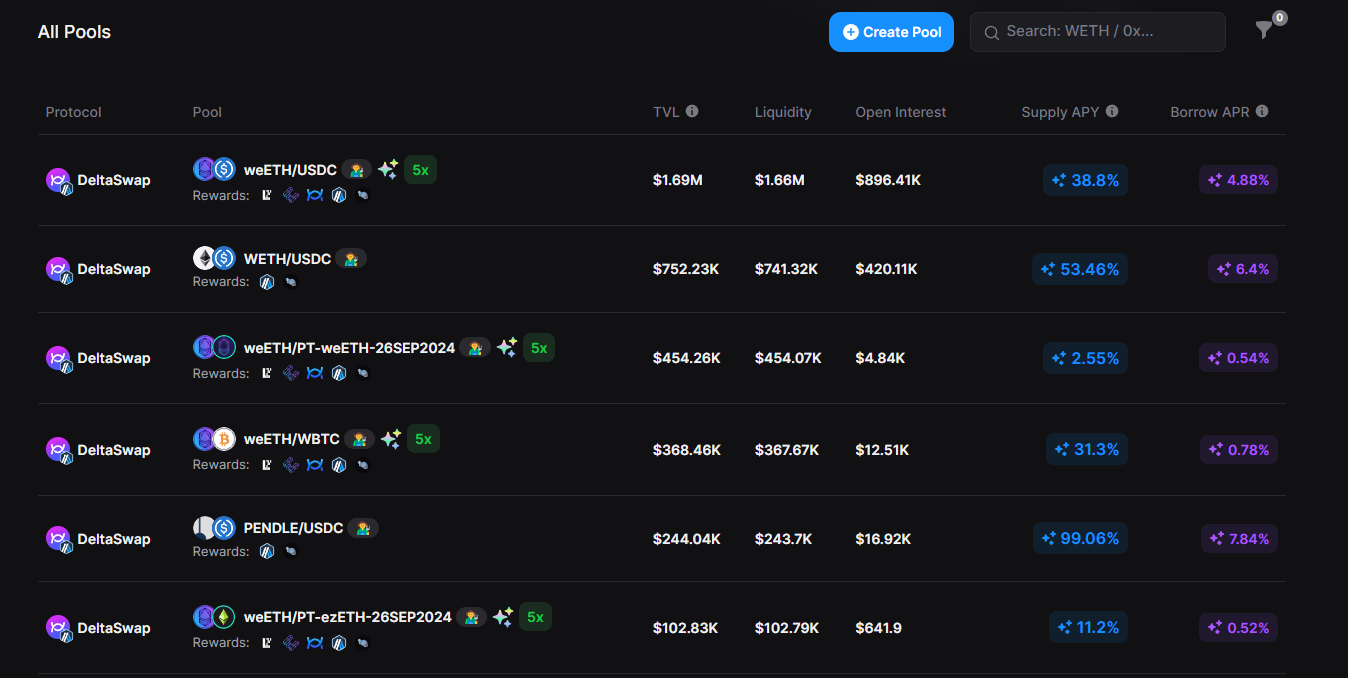

1. GammaSwap

Our first farm of the week is GammaSwap, a perpetual options protocol allowing users to speculate or hedge volatility on any token.

GammaSwap has been very lucrative for farming LRTs and Eigenlayer points, alongside their very own points program.

In addition to stacking points, GammaSwap has been one of our favorite places to earn lucrative yields.

Some of our favorite pools are currently yielding…

• 89% APY on PENDLE/USDC

• 52% APY on WETH/USDC

• 38% APY on weETH/ETH

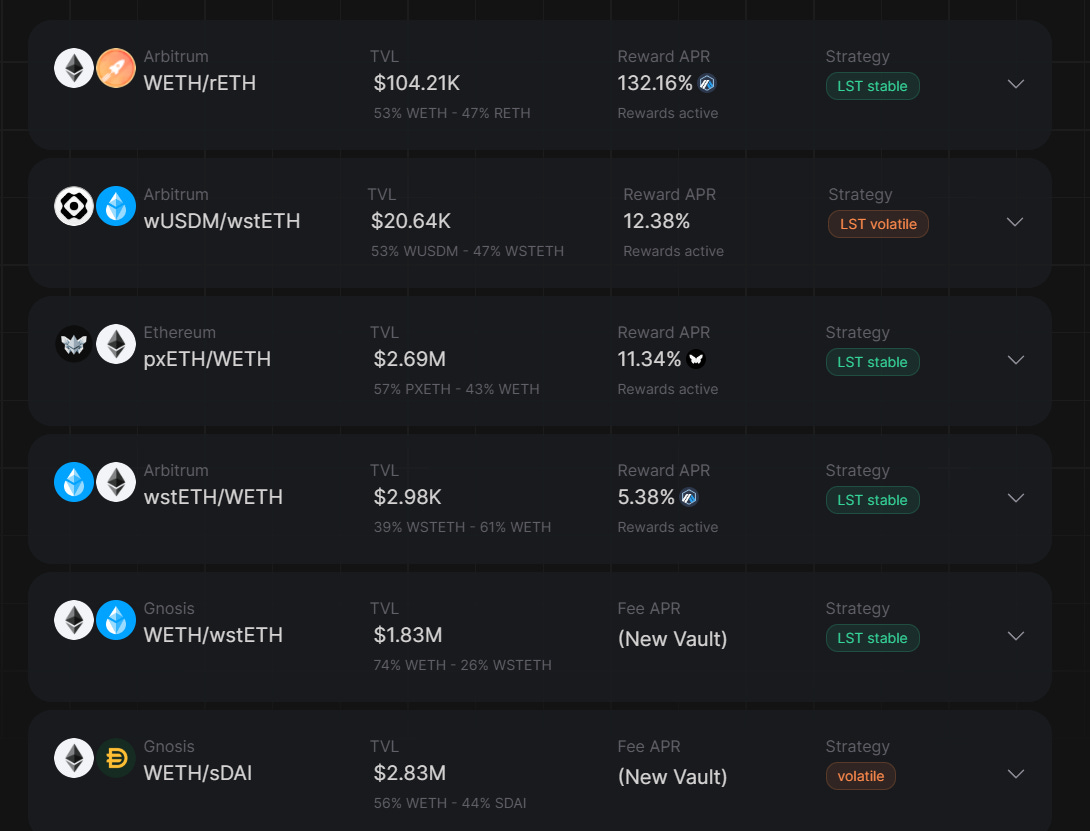

2. Arrakis

Next up is Arrakis Finance, an advanced liquidity management protocol built on Uniswap.

In addition to their liquidity strategies, Arrakis has also recently announced HOT, an MEV Aware intent-based DEX.

Arrakis has received ARB and BTRFLY incentives for their strategies, along with multiple new vaults.

As you can see below, the WETH/rETH pool on Arbitrum is yielding 132% APR in fees and ARB incentives.

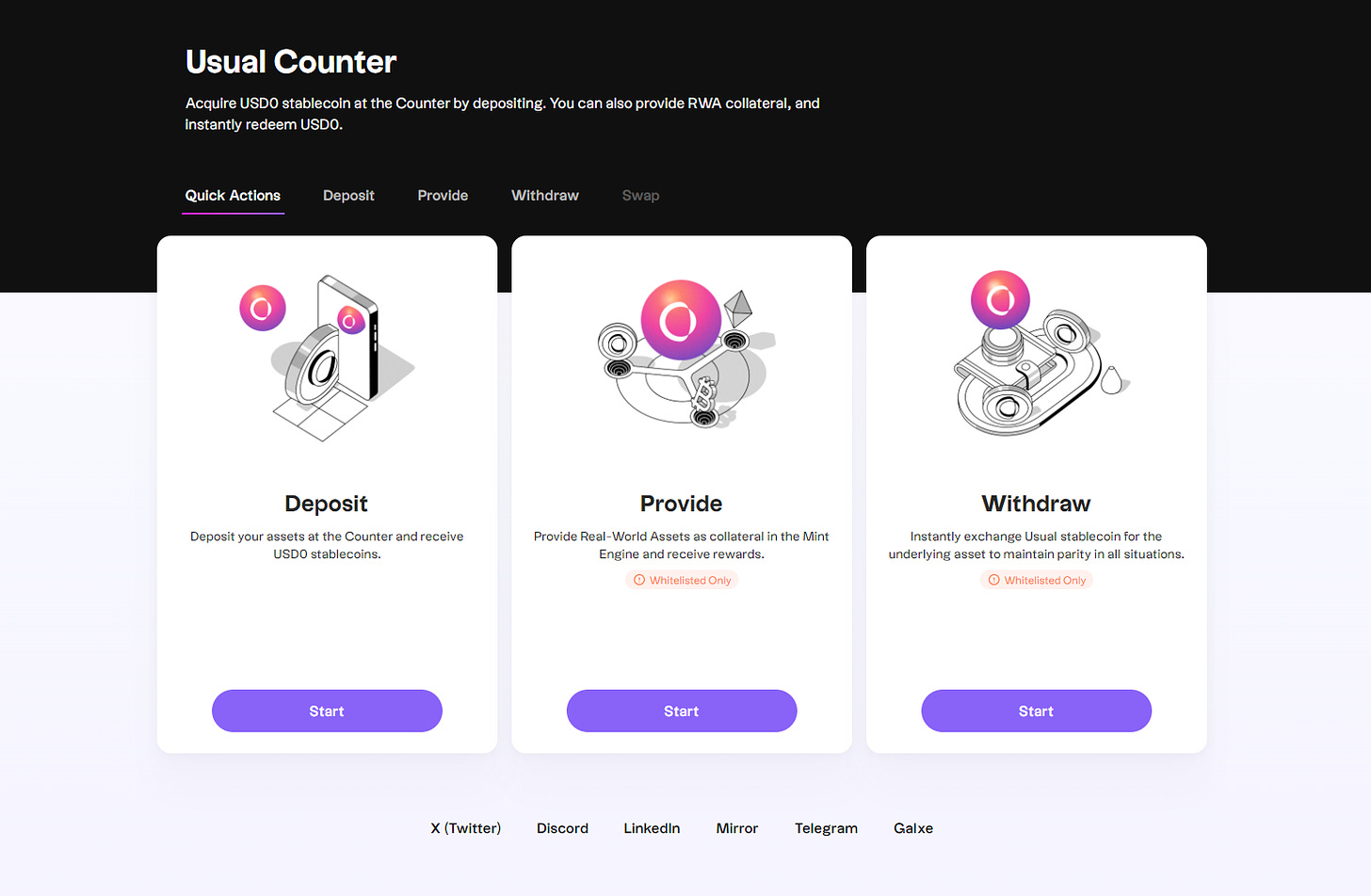

3. Usual

Our next farm is Usual, a decentralized stablecoin leveraging RWAs to distribute yields to holders.

Usual has just launched on mainnet in conjunction with their airdrop program, where you can earn points and yields for holding and LPing tokens.

We’ve seen TVL grow to over $100M since launch, with most capital LPing in order to farm the most points.

To maximize your farm, mint USD0 and USD0++ to provide liquidity in Curve while earning swap fees, treasury bill yields, and 3x points.

4. Timeswap

Up next for this week is Timeswap, a liquidation and oracle-free lending market.

This is made possible by its AMM-based architecture, and Timeswap has been distributing various incentives in the form of ARB, TIME, OP, and more…

Using Timeswap, you can lend and borrow various tokens for lucrative yields.

Some of our favorite farms include…

• fETH/xETH @ 190% APR

• USDC/ARB @ 48% APR

• USDC/OP @ 44% APR

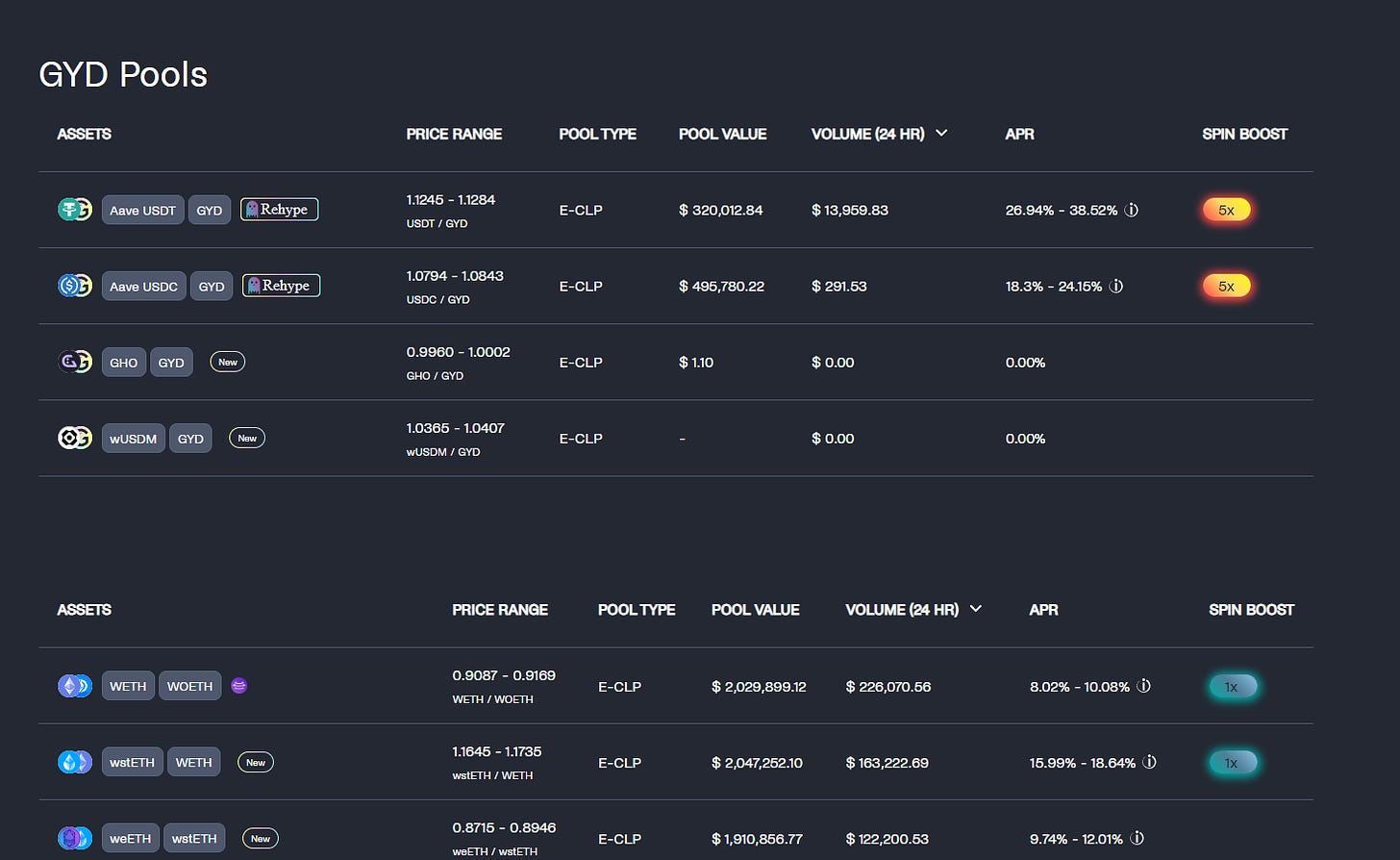

5. Gyroscope

Our final farm of the week is Gyroscope, a capital-efficient and innovative stablecoin protocol.

TVL has quickly grown to over $30M over the past few months, mostly due to the launch of its SPIN points program.

Gyroscope has also received ARB incentives, creating one of our favorite stablecoin opportunities.

You can maximize your yields by LPing in USDT/GYD or USDC/GYD, for a 5x SPIN boost and 20-40% APRs in ARB incentives.

Conclusion

If you enjoyed and want to see more content like this, feel free to check out the Humble Farmer Army premium discord here.

You’ll get access to:

Weekly Premium Content

An Exclusive Community

DeFi Yield Strategies

Degen Farms & New Launches

DeFi Education & Analysis

And Real-Time DeFi Alerts

Humble Farmers Rejoice!