GM Humble Farmers!

Are you bored with the markets and not sure where to look for those juicy yields?

To help, here are our Farms of the Week.

1. Solayer

TVL: $161M

Raised: $8M

Our first farm of the week is, it’s a Solana-based restaking platform designed to supercharge validator security and decentralization.

Simply put, Solayer allows users to re-stake their existing $SOL and other LSTs for boosted rewards and Solayer points.

You can then use your sSOL (restaked SOL) within the Solana ecosystem for lending, providing liquidity, and more.

The simplest and possibly most effective farm is simply the Kamino sSOL/SOL vault, for incentivized yields and Kamino points.

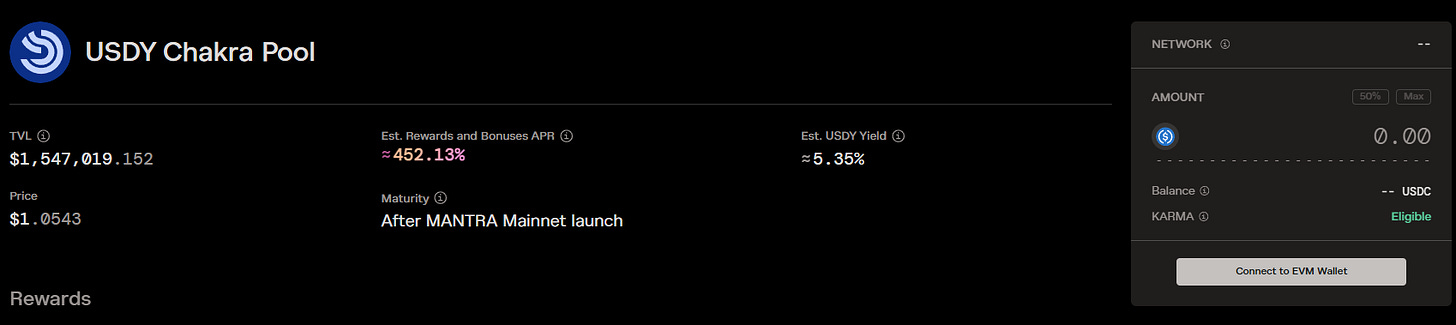

2. Mantra

TVL: $1.5M

Audited: ✅

In case you aren't familiar with Mantra, it is a Layer 1 blockchain focused on supporting real-world assets.

Built as a Cosmos L1, Mantra aims to be a permissionless blockchain for permissioned applications, which you can read more about below.

Mantra has announced its Chakra pool where users can deposit USDC for USDY, an overcollateralized treasury-bill backed stablecoin, which is currently yielding a 452% APR in OM and ONDO incentives.

However, the stipulation is that your deposit will be locked until mainnet.

3. Factor

TVL: $7.3M

Audit: ✅

Next up is Factor, a composable DeFi layer for enhanced and simplified access to yields.

With Factor, users can seamlessly deposit in automatically managed vaults to access various yield strategies with additional token incentives on top.

Factor has been distributing ARB incentives from the LTIPP program, but these rewards will end in a few weeks.

LPs will also earn $FCTR tokens, which are emitted to specific pools based on their vote weight by stakers.

4. Camelot

TVL: $94M

Audit: ✅

Next up on the list is Camelot, a decentralized exchange focused on supporting Arbitrum and various other Orbit chains.

Camelot has been growing recently with the launch of Arbitrum Orbit chains like Sanko, Reya, and Xai.

Here are some of our favorite pools.

• ETH/USDC @ 292% APR

• ARB/USDC @ 151% APR

• uniETH/ETH @ 30% APR

While these APRs aren’t completely accurate since they’re taken with close liquidity ranges, they’re still quite lucrative.

5. Beefy

TVL: $262M

Audit: ✅

Our final farm of the week is Beefy, a multichain automated yield aggregator and optimizer.

Most of the veteran farmers are probably familiar with Beefy, and even today they have a wide array of lucrative vaults.

You can sort through supported pairs based on your chain of preference, but some of our favorite pairs include…

• wstETH/USDC @ 91% APR

• wBTC/USDT @ 61% APR

• rsETH/ETHx @ 45% APY

Conclusion

If you enjoyed and want to see more content like this, feel free to check out the Humble Farmer Army premium discord here.

You’ll get access to:

Weekly Premium Content

An Exclusive Community

DeFi Yield Strategies

Degen Farms & New Launches

DeFi Education & Analysis

And Real-Time DeFi Alerts

Humble Farmers Rejoice!