Frax Finance: FRAX v3

Long-form research reports published by the HFA Research Team. 100% Free.

Given the lack of on-chain activity, low trading volumes, low demand for leverage and simultaneously high interest rates in traditional financial markets, tokenised treasuries are currently the only sustainable source of real yield in the Crypto sphere. For this reason we expect continued growth and strength from the RWA sector until some material change occurs. This week we discuss Frax Finance and the launch of FRAX v3.

Frax Finance

Most readers are likely aware of frax.finance, they are a long standing DeFi protocol whose products cover the entire gamut of related verticals: FRAX (stablecoin), Fraxlend (lending market), Fraxswap (AMM), frxETH (Liquid Staking Protocol), Fraxferry (bridging protocol) and at some point they will introduce Fraxchain, their own L2 execution environment.

We recommend Ouroboros Capital’s Founder Series Interview for a deep dive into their entire product stack and founder Sam Kazemian’s view for the future.

Frax is somewhat like a chameleon as given their wide coverage across verticals they can benefit from tailwinds supporting different sectors. For example, FXS participated during the LSD season earlier this year and frxETH is still a healthy grower:

Is this time different or can Frax also benefit from the RWA narrative? This article will focus on FRAX v3, the newest iteration of their native stablecoin. Historically, FRAX was collateralised in part by Crypto collateral and in part by FXS. Over time, FRAX have been moving away from FXS backing towards a fully backed stablecoin. Their efforts with FRAX v3 take this one step further as they bring on RWAs as collateral.

FRAX v3

Through the incorporation of the FinResPBC (a public benefit corp providing RWA access primarily to Frax), Frax now has an integrated mechanism to bring treasury market yields into its ecosystem. This is the biggest update to FRAX since its launch in late 2020. Unlike MakerDAO which relies on a system of counterparties to access “real world” yield, FinResPBC acts directly on behalf of Frax without extracting rent along the way.

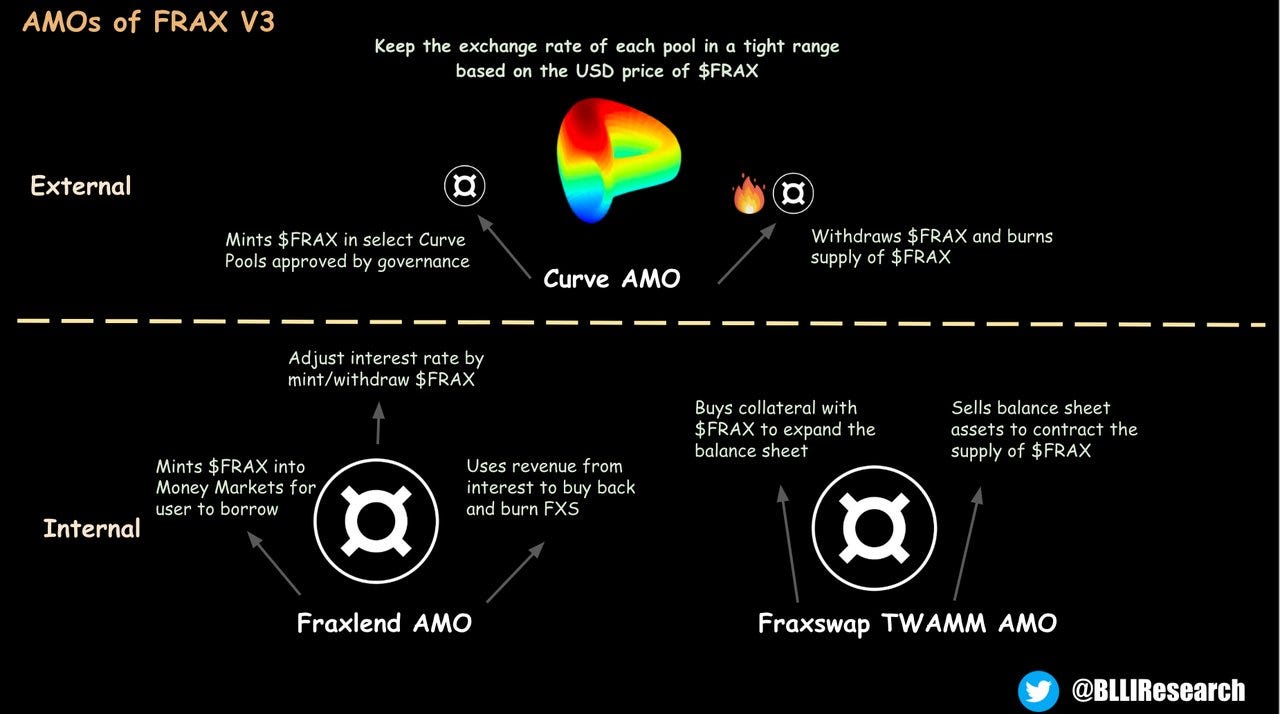

FRAX v3 will still rely on Frax’s AMO mechanisms to maintain peg stability (as shown above) and the DAO’s large influence in the Curve ecosystem to incentivise liquidity, equally FRAX v3 ushers in full on-chain governance using fraxGov (Frax will no longer be subject to multi-sig trust assumptions). However, for us the more interesting development in v3 relates more to the introduction of sFRAX and FXBs.

sFRAX allows FRAX holders to participate in the short end of the yield curve (money market) while Frax Bonds (FXBs) open access to the longer end. sFRAX yields change with the overnight repo rate which is tracked using an oracle for the Interest Rate on Reserve Balances (IORB). The yield paid on Frax Bonds will change with the interest rate on the underlying bonds of matching duration. Each week depending on the amount of FRAX staked in sFRAX and the IORB, Frax will move the necessary amount in/out of RWAs using the FinResPBC vehicle as a conduit. The process for FXBs would follow a similar process whereby Frax deploy a RWA strategy using FinResPBC to match the duration of the on-chain bonds sold. Ultimately, Frax are enabling an on-chain representation of the yield curve to take form.

The first iteration of FRAX v3 went live on Wednesday evening (EST) with sFRAX yielding 7.37% and promising traction so far:

Of course, this yield will go down over time as FRAX flows into sFRAX but the initial adoption is good and confirms our thesis that the yield-bearing dollar has strong product market fit.

Looking to the future

In terms of monitoring the success of FRAX v3, in a similar fashion to DAI growth being indicative of MakerDAO success, the growth of FRAX market cap will be a simple metric to track to gauge success here. Equally, the proliferation and growth of sFRAX as collateral will be key. There is an expectation that Curve will enable sFRAX as collateral to mint crvUSD which could provide a strong growth vector. FXBs are yet to launch but similarly, we expect supply expansion and use as collateral to be key performance metrics.

TVL is often a low signal metric for Crypto projects but in this case growth of the stablecoin market cap drives the growth of RWA backing which is directly tied to an increase in yield and therefore protocol revenue and profitability. While initial excess profits will be directed towards getting FRAX to a 100% collateralisation ratio, FXS will be the ultimate beneficiary. If FRAX v3 is successful and we see significant growth, we would expect the market to price that growth into FXS.

It’s also worth bearing in mind that thanks to FIP -256, the FXS price has somewhat of a price floor around $4-5 which could improve the risk/return of holding FXS vs other RWA-related coins.

Historically, Frax have received criticism for doing too many things at once without being the leader in any one vertical but ultimately their products are highly synergistic and often operate together; e.g., one might be able to use sfrxETH as collateral, borrow FRAX against it on Fraxlend and stake it as sFRAX. Labelling them as “narrative chasers” or similar is denigrating in our view, the Frax team appear to have a long time horizon and are simply building pieces of the stack over time as they see fit.

Conclusion

If you enjoyed and want to see more content like this, feel free to check out the Humble Farmer Army premium discord here.

You’ll get access to:

Weekly Premium Content

An Exclusive Community

DeFi Yield Strategies

Degen Farms & New Launches

DeFi Education & Analysis

And Real-Time DeFi Alerts