GM Humble Farmers!

The market is slowing down, which makes now one of the best times to farm yields on your blue-chip tokens.

To help, here are our Farms of the Week.

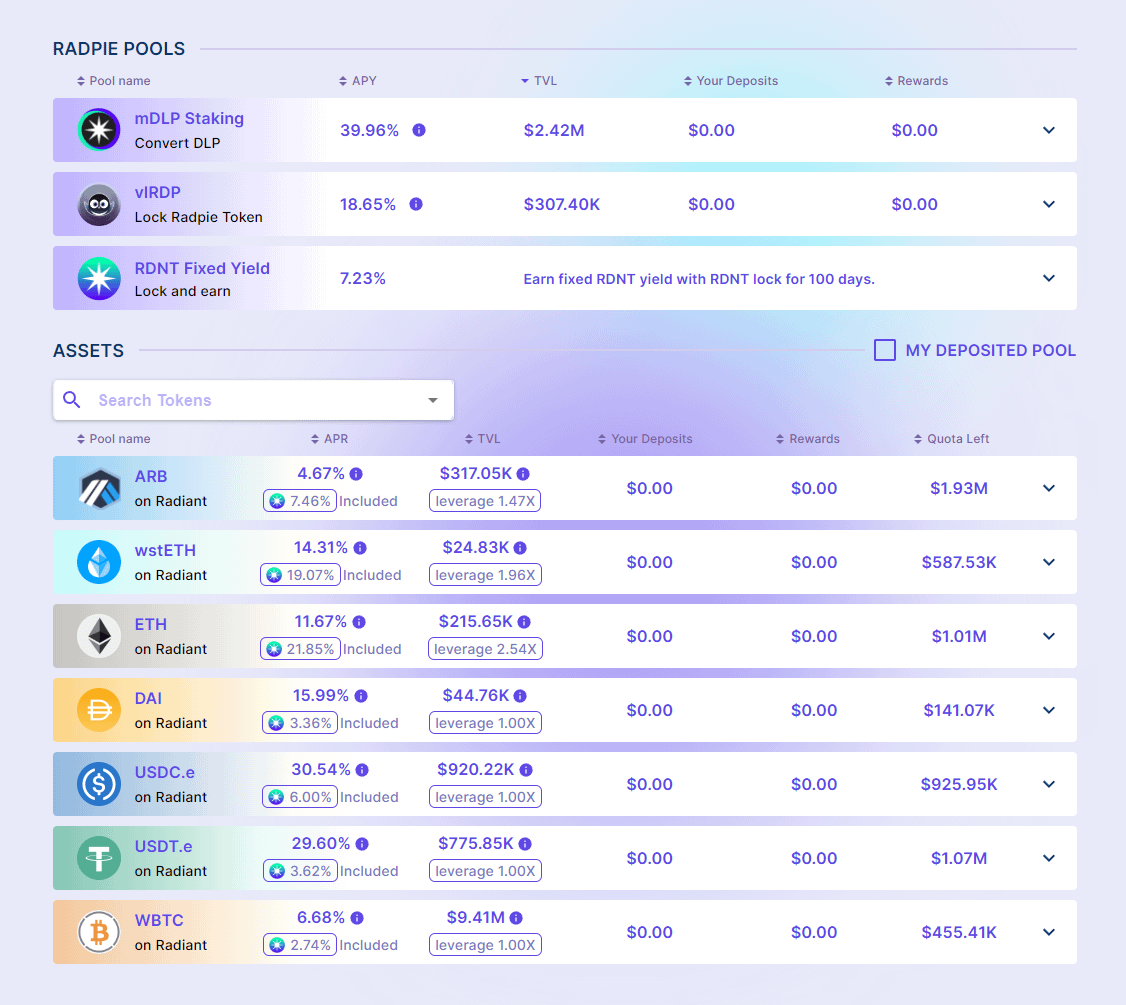

1. Radpie

Our first farm of the week is Radpie, a liquid locker and yield booster built on top of Radiant.

Users can convert their DLP to mDLP for liquidity as well as extra rewards in the form of RDP tokens, or you can simply farm blue-chip assets for lucrative APRs.

These yields are pretty attractive at the moment, and some of our favorites are...

• 70% APR on mDLP

• 50% APR on BNB

• 31% APR on USDC

• 29% APR on USDT

Our next farm of the week Florence Finance, a Euro-based RWA protocol on Arbitrum.

Users can lend their stablecoins for lucrative yields backed by real world borrowers in Europe, all while earning airdrop points.

Depositors are currently earning 7-10% APR on their stablecoins, while also qualifying for the upcoming airdrop.

TVL is still relatively low, which could bode well for the potential airdrop rewards in the near future.

3. MUX Protocol

Our first farm of the week is Mux Protocol, a perpetual exchange and aggregator.

We're sure you're all familiar with MUX, and MUXLP has proven to be one of the most stable sources of yield over the past couple of months.

When purchasing MUXLP, you're buying into a yield-bearing index of blue-chip tokens such as...

• 50% Stables

• 28% ETH

• 14% BTC

• 8% Alts

Plus you're currently earning a 39% APR paid in ETH and MUX tokens.

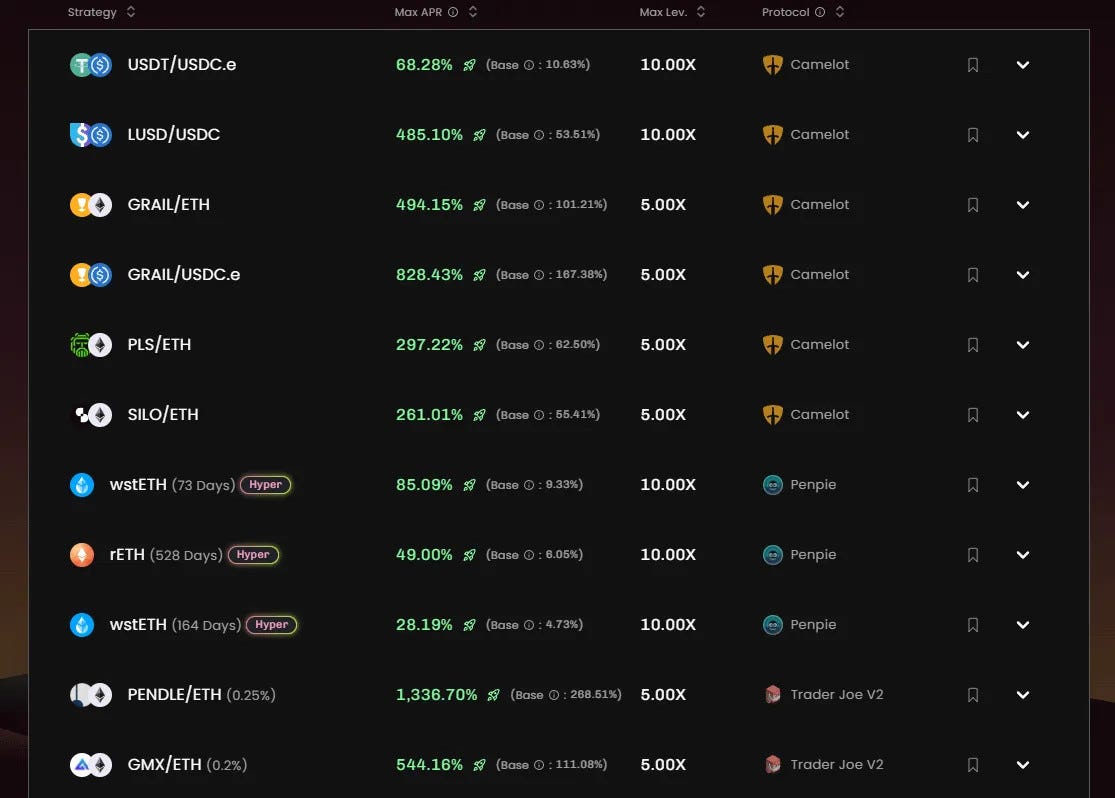

4. Stella

Our next farm for the week is Stella, an Arbitrum-based leveraged yield farming protocol.

Users can either lend their tokens for double-digit APRs, or farm blue-chip pairs with up to 5-10x leverage.

Stella has also been distributing ARB incentives, and there are plenty of lucrative yields for the degens as well as the risk-averse farmers.

Some of our favorites are...

• ARB/USDC @ up to 1413% APR

• PENDLE/ETH @ up to 1336% APR

• wstETH @ up to 85% APR

• USDC @ 21% APR

5. Trader Joe

Our last farm of the week is Trader Joe, a hyper-efficient AMM on Avalanche, Arbitrum, and BNB.

By leveraging the power of the liquidity book, liquidity providers can maximize the efficiency of their tokens.

A combination of sky-high trading volume and plenty of ARB token incentives has made Trader Joe very lucrative to farm.

Some of our favorite pools are...

• ARB/USDC @ 460% APR

• PENDLE/ETH @ 230% APR

• RDNT/ETH @ 191% APR

• AVAX/USDC @ 91% APR

Conclusion

If you enjoyed and want to see more content like this, feel free to check out the Humble Farmer Army premium discord here.

You’ll get access to:

Weekly Premium Content

An Exclusive Community

DeFi Yield Strategies

Degen Farms & New Launches

DeFi Education & Analysis

And Real-Time DeFi Alerts

Humble Farmers Rejoice!