GM Humble Farmers!

It's hard to find the most lucrative yields for your tokens, but lucky for you, we're here to help.

Here are our Farms of the Week.

1. Blast

Let's start the week off with one of the most talked about farms in recent memory, which is the recently announced Blast L2.

Blast is the newest experiment by @paradigm, and is a DeFi-focused L2 enabling users to passively earn a yield on their deposits.

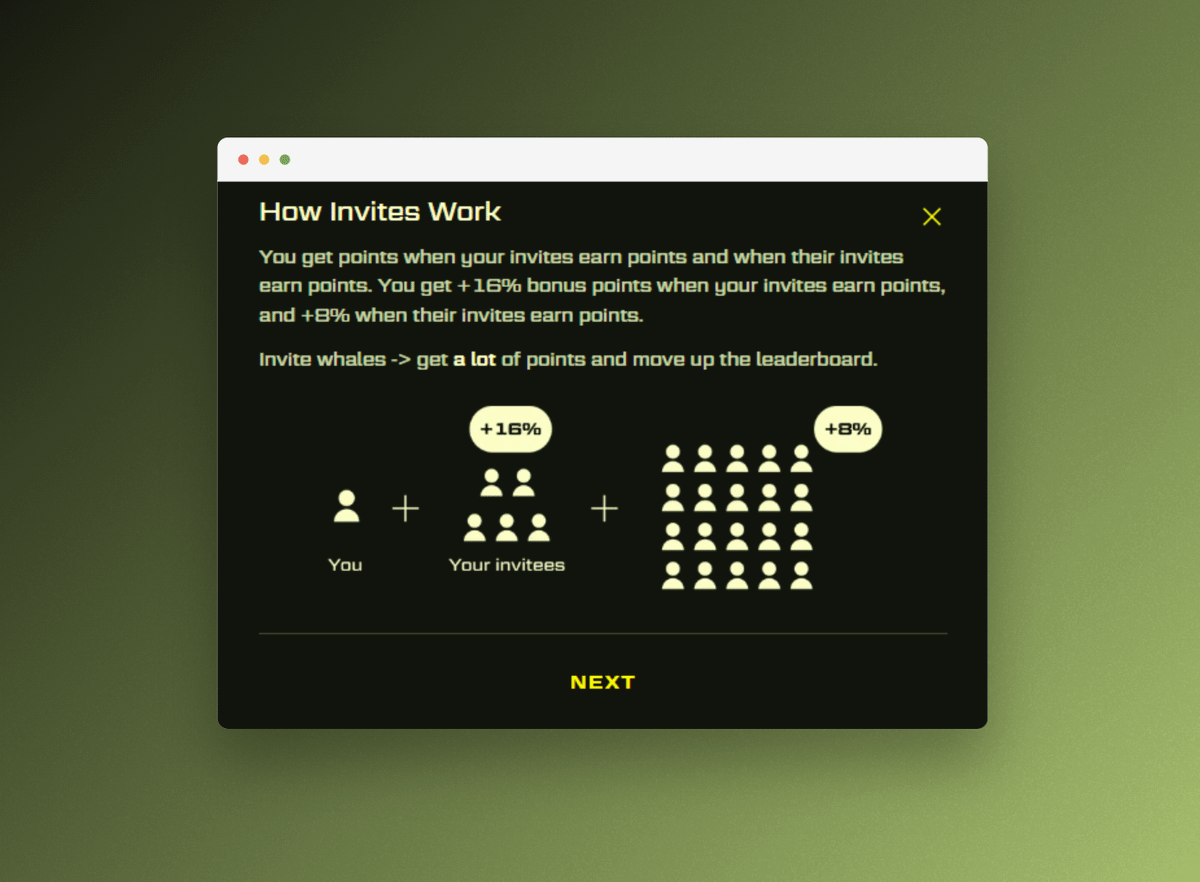

On top of the yield earned on deposits, Blast has already attracted over $400M in TVL through their points program.

Users can deposit and refer others to earn points, which will be redeemable for an airdrop within the near future...

Keep in mind that you cannot withdraw from Blast until February, which means locking up your capital for three months.

Users can also stake $BLUR to farm Blast points, which could be lucrative depending on your outlook on the project.

2. Camelot

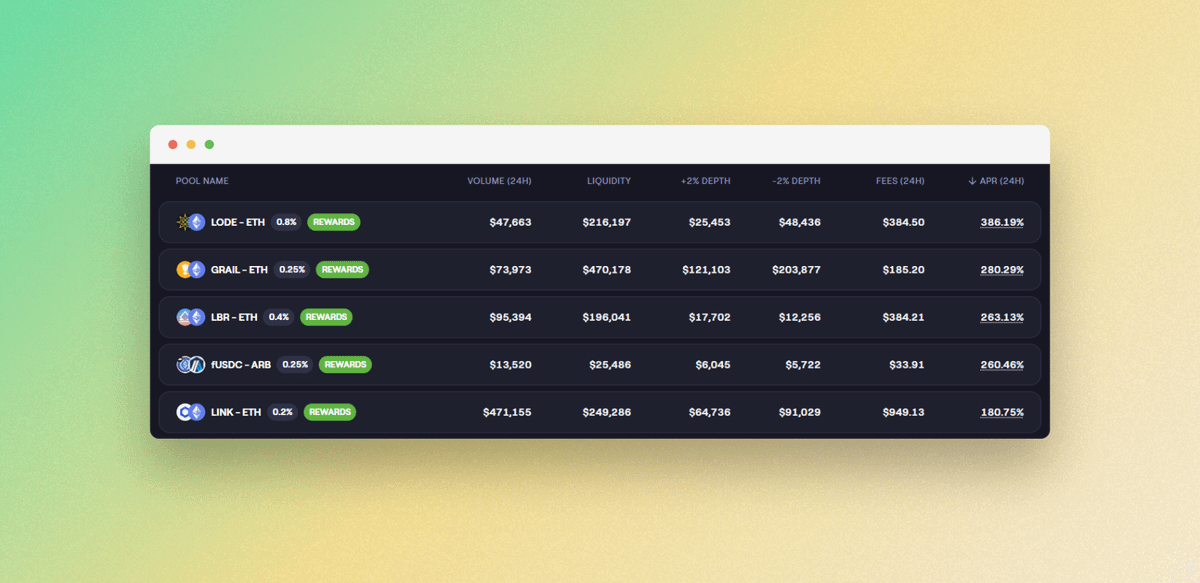

Our next farm of the week is Camelot, which continues to be one of the most lucrative places to earn a yield on Arbitrum.

TVL and volume have been up only over the past couple of weeks, as Camelot continues to cement itself as the trading hub of Arbitrum.

There are a lot to choose from, but some of our favorite pairs to farm include...

• SOL/USDC @ 170% APR

• ARB/USDC @ 125% APR

• ETH/USDC @ 100% APR

• stEUR/USDC @ 33% APR

3. Hyperliquid

Next up is Hyperliquid, an innovative perpetual futures order book on Arbitrum.

We're sure most of you are familiar with Hyperliquid already, as they've recently reached $10B in total volume.

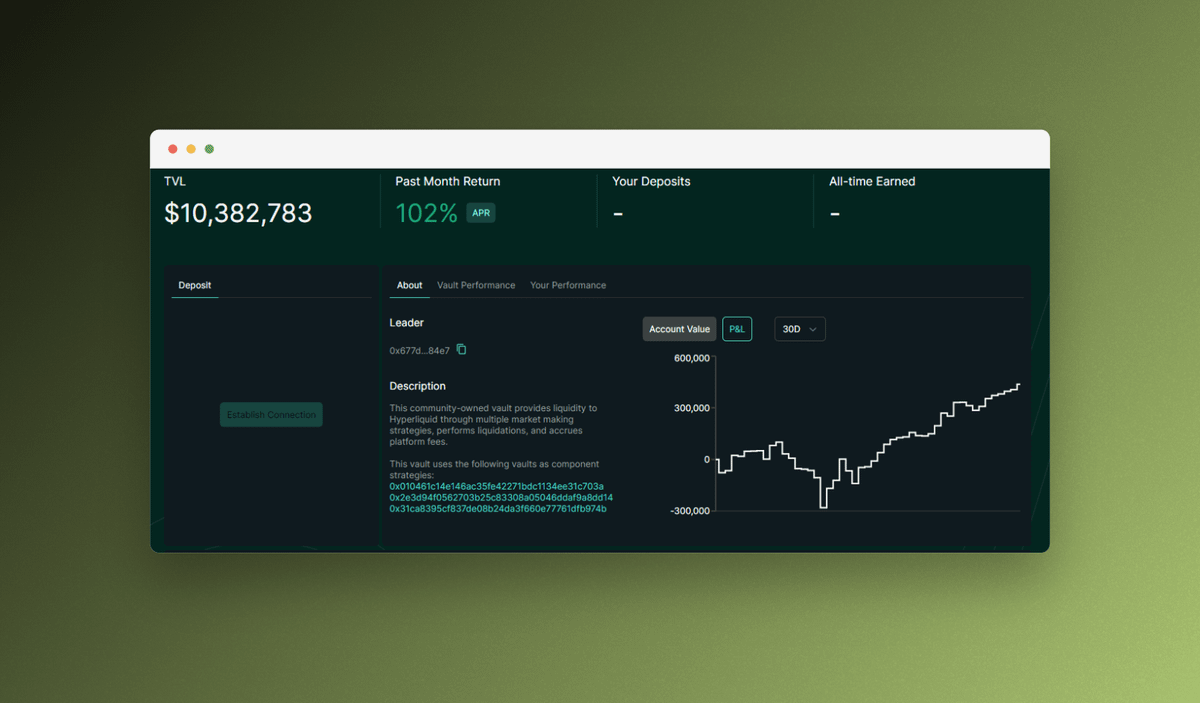

The Hyperliquid HLP vault has been extremely profitable lately, currently earning depositors a 100%+ APY in real yield.

Hyperliquid has also launched a points program, and LPs can earn an airdrop in the process.

4. MUX Protocol

Our next farm is Mux, which has been one of our favorite places to earn a stable yield in ETH while maintaining long exposure.

LPs are currently earning 35% APR paid in ETH while holding a basket of blue-chip assets.

5. Trader Joe

Our final farm for the week is Trader Joe, an AMM on Arbitrum, Avalanche, BNB, and Ethereum.

The liquidity book has proven to be an innovative competitor to standard concentrated liquidity DEXs, and $JOE has also just stopped emissions altogether.

Trader Joe has been incentivizing liquidity with the ARB STIP incentives, and there are plenty of lucrative farms to take advantage of.

We're watching...

• ETH/USDC @ 169% APR

• ARB/ETH @ 133% APR

• USDT/USDC @ 16% APR

• PENDLE/ETH @ 238% APR

Conclusion

If you enjoyed and want to see more content like this, feel free to check out the Humble Farmer Army premium discord here.

You’ll get access to:

Weekly Premium Content

An Exclusive Community

DeFi Yield Strategies

Degen Farms & New Launches

DeFi Education & Analysis

And Real-Time DeFi Alerts

Humble Farmers Rejoice!