One of the main points of focus for the crypto industry in recent years has been developing blockchains that are ready for mass consumer use. Ethereum showed what was possible as early as 2019 with DeFi, and into 2020 and 2021, it became very clear that there was product-market fit for such applications.

Fast forward to the latter part of 2021 - Ethereum fees priced users out and the “Layer 1” trade was in full swing, with market participants placing their bets on which ecosystem would most effectively compete with Ethereum. Examples of these chains include Avalanche, Solana, Luna (RIP), Polygon, and the focus of this piece, Fantom.

Fantom gained traction in late 2021, as ecosystem incentives programs began to gain popularity and protocols were playing the TVL game in an attempt to get users to bridge to their chain. In September of 2021, Fantom had roughly $700M in TVL, and six months later, it had over $7B in TVL.

Throughout 2021, one of the main drivers of valuations for Layer 1 blockchains was TVL. It was thought that if a chain could bring liquidity, it would be able to onboard more users and incentivize them to grow the ecosystem. This was reflected in the price of Fantom’s gas token, FTM, as it dwarfed even the return of SOL throughout 2020 and 2021.

The Andre Cronje Effect

In early 2022, the founder of Yearn Finance, Andre Cronje, proposed a new protocol on Fantom that would mimic the vote escrow functionality popularized by Curve, called “Solidly”. This became the basis for newer ve(3,3) protocols that have seen success such as Velodrome and Aerodrome.

We won’t go into detail here, but the Solidly hype caused TVL on Fantom to explode in early 2022, and Fantom became a top 5 chain by TVL. Not only that, but at its peak (around the same time), Fantom was doing $3-5 Billion in weekly volume.

The attention and flows that Solidly brought to Fantom ultimately contributed to FTM more than doubling from December 2021 to January 2022, when most other assets including BTC and ETH had already topped in November of 2021. FTM eventually doubled topped (the entire crypto market topped in November ‘21), but the Solidly launch highlights the idiosyncratic and event-driven moves that can happen when certain upgrades or catalysts are strong enough.

Fantom Sonic

One of the main themes to end 2023 and to begin 2024 has been the advancement of high-performance blockchains. For example, the “parallelized EVM” chain has been popularized and has created a lot of hype, with chains like Sei and Monad gaining attention. The market has gotten a taste of what a high-performance blockchain can provide, with Solana becoming a popular chain for meme coin and other trading and flipping Ethereum mainnet volume at times. There is clearly a need for cheap, fast blockchains, and the race is on to optimize and become the market leader.

Enter Fantom Sonic.

Sonic is the next iteration of Fantom, set to go live Spring 2024, which will replace the existing Fantom Opera network with Sonic’s tech stack. The upgrade comprises a brand new VM, improved database storage, and an optimized consensus mechanism. A detailed explanation of the upgrade can be found here.

In a closed testnet environment (Sonic Testnet), Fantom Sonic showed impressive metrics, with TPS over 2000 and time to finality under 1 second. Of course, as we’ve seen many times in the past, testnet success doesn’t necessarily translate to real-world success on mainnet. However, if Fantom Sonic achieves anything close to this, it will present interesting opportunities, being the first EVM chain with this level of performance.

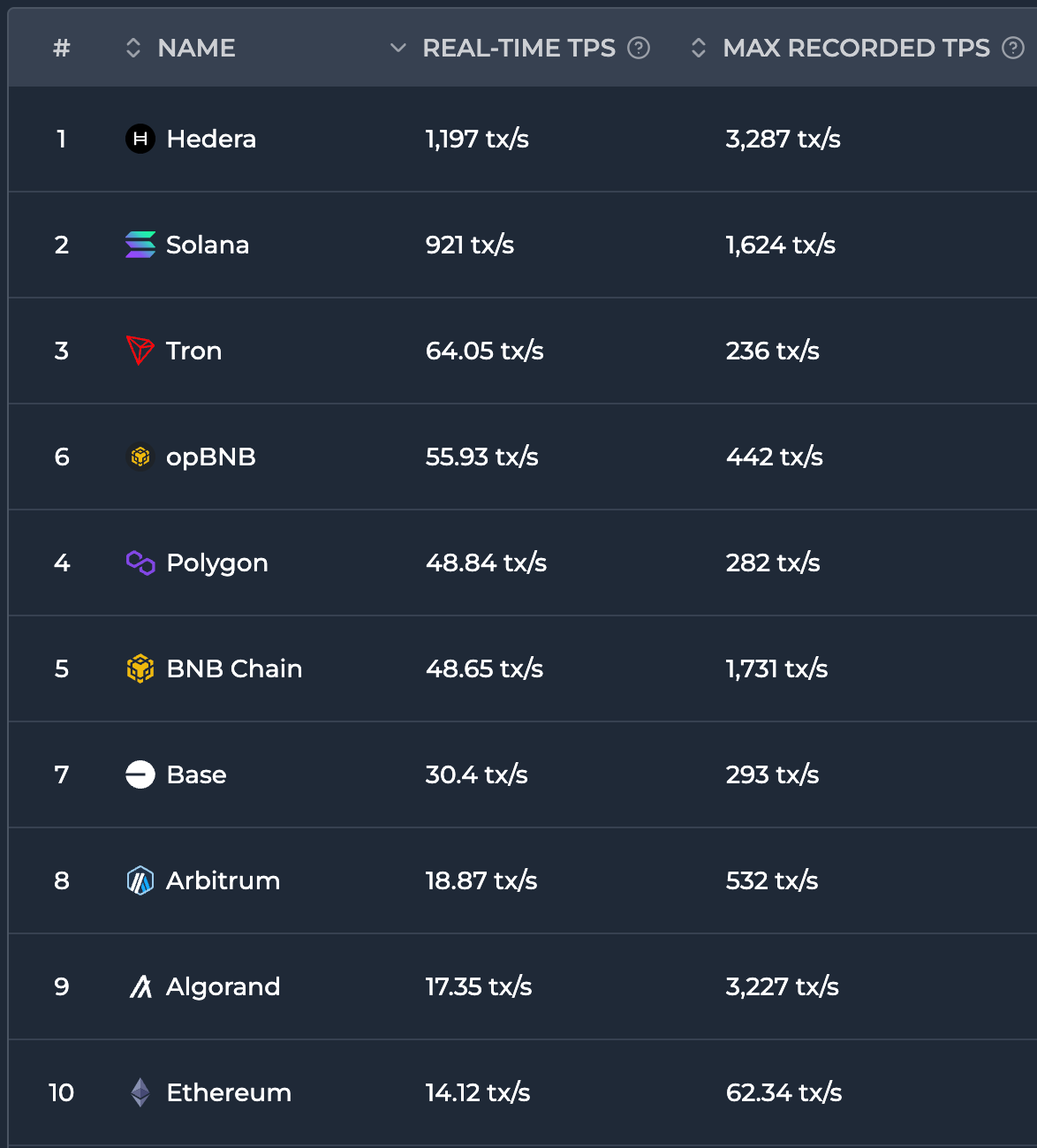

For reference, below is the current real-time TPS for the top 10 blockchains (according to Chainspect). If the Sonic upgrade delivers anything close to what has been advertised, it would put Fantom in the vicinity of the fastest chains in the space.

Liquid Bets for Fantom

FTM

The Sonic mainnet upgrade is set to be released in “Spring 2024” so there is still time to position. One of the most obvious ways to play the upgrade is to simply buy FTM. It recently broke out of a long accumulation range and is retesting the range highs. A $2.4B FDV for a highly performant EVM chain seems cheap, and the market may become more aware of that as the upgrade happens and activity picks up on Fantom again.

Equalizer

Equalizer is a DEX that incorporates concepts that originated from Solidly, the protocol that Andre Cronje launched. While Solidly’s success was short-lived, the concepts lived on and have been used to create powerful incentive mechanisms for protocols like Velodrome on OP Mainnet and now Aerodrome on Base.

EQUAL is the native token of the Equalizer DEX, currently trading at roughly a $60M FDV. One of the easiest bets on an ecosystem’s growth aside from the gas token is to bet on a native DEX’s token. If we see volume come into the Fantom ecosystem post-Sonic, valuations on DEXs should adjust accordingly. EQUAL could be a major beneficiary of that.

An important distinction for Equalizer when comparing it to something like Uniswap is that Equalizer employs a locking mechanism for EQUAL where 100% of the trading fees and bribes are distributed to locked (veEQUAL) voters. An entity that wants to increase liquidity for a pool can “bribe” voters to direct emissions to their pool, increasing liquidity as LPs come in to chase EQUAL emissions. Voters receive the trading fees and bribes from the liquidity pools they vote for, and LPs of the pools receive EQUAL emissions according to what share of the total votes they received for a specific epoch.

All of the above to say, Equalizer is a unique DEX design that has shown early proof of concept on other chains. If Fantom Sonic increases activity on the chain, simply holding EQUAL or locking it and earning rewards could be a lucrative trade over the coming months.

Tarot

Another project that has been building in the Fantom ecosystem (and others) for a while now is Tarot. Tarot describes itself as a multi-chain decentralized lending protocol, allowing users to lend, borrow, and leverage yield farm. The protocol’s roots are on Fantom, having in excess of $260M in TVL on Fantom in early 2022. If Sonic can bring more users back to Fantom again, Tarot is another project that will likely benefit.

Furthermore, Tarot recently announced TNX, an ultra-high performance order book fully on-chain, powered by Fantom Sonic. Expected over the coming months as Sonic goes live, TNX seems to be the first order book DEX of its kind on Fantom, and could offer a unique trading experience on the first high-performance EVM chain.

Trading at just over $20M FDV at the time of writing, one can expect a lot of volatility, and it is definitely further out the risk curve than just buying FTM. However, there is likely much more upside for assets like this that can continue building revenue and gaining momentum.

PaintSwap

I would be remiss not to mention another OG Fantom project that has been building for years, PaintSwap. The platform facilitates the trading of NFTs, including things like locked EQUAL (veEQUAL), Estfor Kingdom (medieval game native to Fantom) in-game items, and all kinds of art. PaintSwap’s native token, BRUSH, governs the protocol and also has many uses in the Estfor Kingdom game. For more detailed information regarding the BRUSH token, read here.

Conclusion

While this is not an exhaustive list of investable assets in the Fantom ecosystem by any means, hopefully it gives a general idea of how Fantom’s Sonic upgrade can change the game, as well as what types of assets can benefit.

Nobody knows exactly where Fantom will be even 6 months from now, or what assets will benefit the most. However, we don’t need a crystal ball to look at event-driven ecosystem growth that has happened in the past and extrapolate to predict some level of success for Fantom following the Sonic upgrade. Protocols stand to benefit, potentially immensely, from an influx of users and capital to a faster chain post-upgrade. Positioning oneself for this trade now (when market conditions are rocky) in anticipation of the upgrade, and being greedy when others are fearful, may yield very positive results.

Finally, a useful message and food for thought from the Messiah.

* Shoutout to the GOAT Messi, from whom I have learned so much