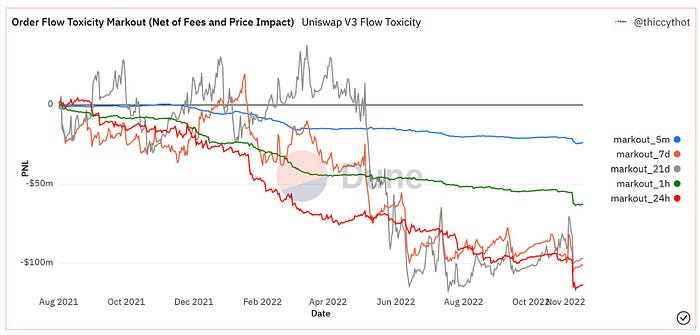

Most of us are familiar with Uniswap’s x * y = k curve for providing liquidity on decentralized exchanges. While this standard has been popularized due to its ease of use and simplicity for bootstrapping new markets, there are also severe drawbacks such as impermanent loss & toxic order flow. This article covers the problem more in-depth, but TLDR: Providing liquidity for an AMM is not as profitable as one may think.

While Uniswap V3 and concentrated liquidity did help alleviate this to some degree, the underlying issue was yet to be solved. Since then, many have attempted to build solutions (i.e. automated liquidity management, “impermanent gain” via borrowing LP tokens, etc…), but it’s clear that the issue lies with the underlying primitive itself.

This has led to the focus shifting to on-chain orderbooks, which are a far more common system in traditional markets. However, one of the problems that had always arisen was a lack of market-makers/liquidity, as the increased complexity of orderbooks forced retail users out. Thus began the chicken and the egg problem; users wouldn’t trade on an orderbook with bad pricing, and market makers wouldn’t make the orderbook without frequent trades/fees. While some on-chain orderbooks have taken off regardless (specifically perpetual exchanges like Hyperliquid, dYdX, etc…), we still see AMMs dominate spot markets all across DeFi.

But what if there were a way for users to become the market makers, all while retaining the ease of use that AMM-style pools provide?

This is where Elixir comes in.

What is Elixir?

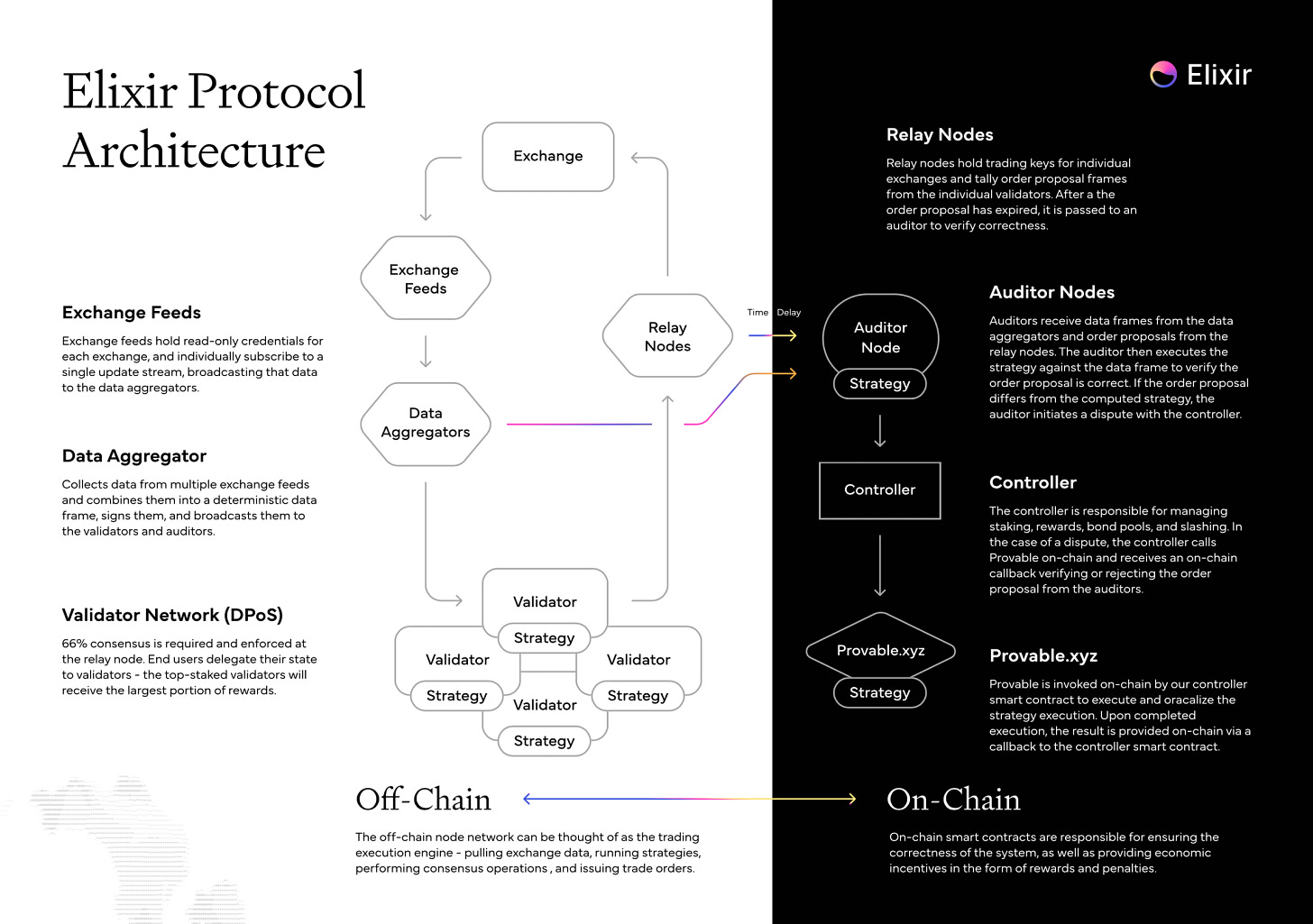

Elixir is a Delegated Proof of Stake (DPoS) network designed to power orderbook liquidity all across DeFi. Due to the protocol’s cross-chain and composable nature, Elixir can be integrated into a wide variety of orderbook exchanges and already boasts 30+ integrations. The network serves as a crucial underlying infrastructure allowing exchanges and protocols to bootstrap liquidity to their books easily.

But how does this all work behind the scenes?

In short, exchange data is aggregated and broadcasted to Elixir’s L1 network which is secured by users delegating their tokens to validators. These off-chain algorithms which are used for pulling data, facilitating orders, and running strategies are then pushed on-chain to ensure their correctness and fairness.

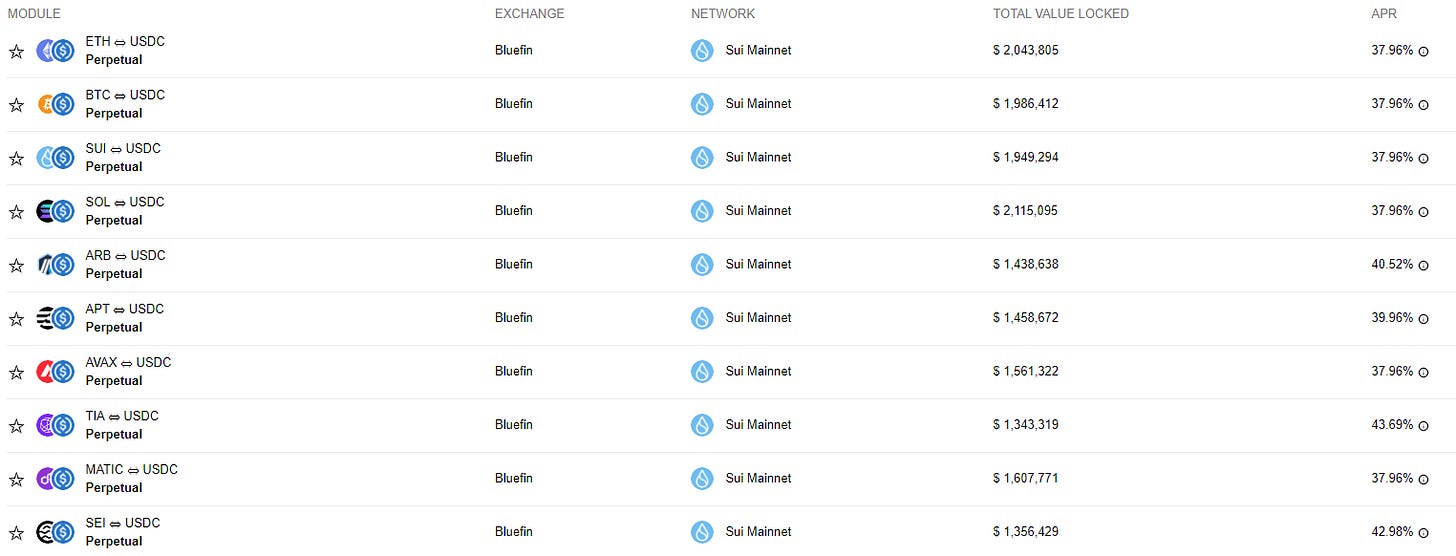

As we mentioned earlier, Elixir is already being integrated into dozens of exchanges such as Hyperliquid, dYdX, Orderly, and many others. While these integrations are expected to launch over the coming weeks/months, users can already deposit into Elixir’s market making vaults for Vertex, Rabbit, or Bluefin to earn trading fees and token incentives (more on this in a moment).

When depositing into Elixir’s vaults, LPs provide either stablecoins (for perp vaults) or a combination of two separate tokens (for spot vaults). While Elixir’s orderbook strategies have a similar risk/return profile to AMM LPs, the network utilizes a customized Avellaneda-Stoikov algorithm to prevent toxicity from being passed onto LPs.

How to Farm $ELX

In conjunction with the announcement of their raise at an $800M valuation, Elixir has launched its Apothecracy program where users can provide liquidity to earn potions, which will be redeemable for an airdrop in August.

Users can also pre-mint elxETH, which will become an omni-chain token backed by ETH that natively powers liquidity across all integrated exchanges. By minting elxETH, your liquidity is automatically locked until mainnet (August 15th), but you’ll also earn 50% more potions. There will also be social opportunities to boost your potions, which should roll out in the coming weeks.

On top of the potion earnings, you’ll also earn lucrative yields by depositing in any one of Elixir’s vaults. While you can deposit on EVM networks like Ethereum and Arbitrum, Sui seems to have some of the best yield opportunities (30-50% APR) plus potions.

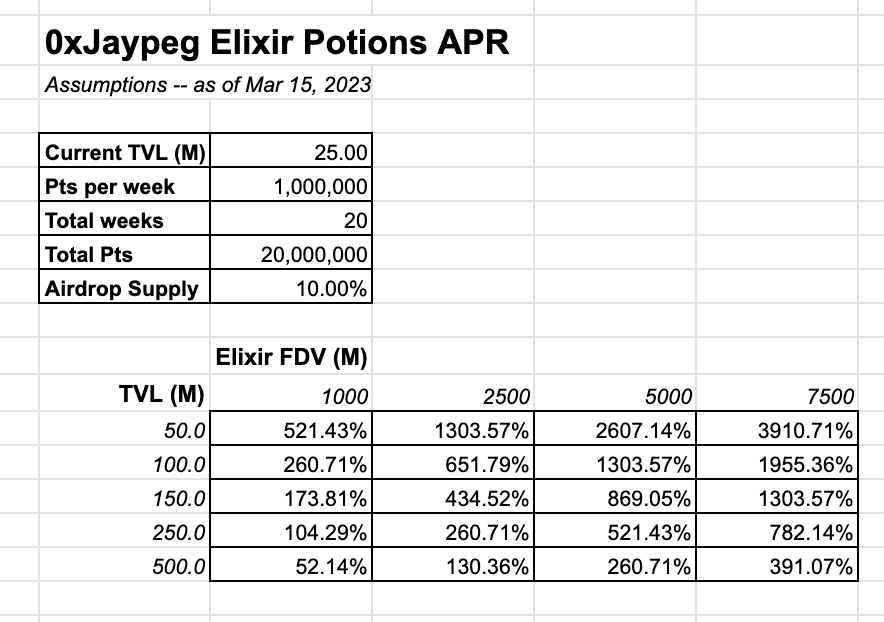

Additionally, Jay put together a useful sheet to help approximate your potential airdrop earnings. Elixir’s TVL is currently sitting around $100M, so you can put together the effective APR at certain valuations.

With Elixir having raised at such a high valuation, this seems like one of the more attractive airdrop farms currently available. Orderbooks will continue to play a massive role in spot/perpetual exchanges over the coming months/years, and Elixir has positioned itself as the underlying layer that powers these protocols.

As a farm, Elixir seems like a great place to park some stablecoins to earn token incentives while securing your future $ELX allocation.

Conclusion

If you enjoyed and want to see more content like this, feel free to check out the Premium HFA discord here

You’ll get access to:

Weekly Premium Content

An Exclusive Community

DeFi Yield Strategies

Degen Farms & New Launches

DeFi Education & Analysis

And Real-Time DeFi Alerts

Humble Farmers Rejoice!