Centrifuge - undervalued RWA infrastructure?

Long-form research reports published by the HFA Research Team. 100% Free.

Intro

We have spoken at length about our conviction in the “RWA” or tokenisation trend, a trend which in retrospect was a leading signal for a wider market recovery. Broad based uptrends in both $MKR price and RWA TVL were two early signals that Crypto was very much still alive at the application layer.

In a Crypto economy starved of real yield, cashflows streaming from tokenised forms of traditional assets represent one of the only positive sum games. While the RWA theme is now widely recognised, we still believe we are in the early innings of a wider macro trend towards tokenisation. Unlike MakerDAO which utilises RWAs to improve its own product offering, Centrifuge is a RWA facilitator - a picks and shovels play.

What is Centrifuge?

Centrifuge is a platform for the financing of real world assets. The vision is to create a transparent marketplace whereby borrowers and lenders can transact in a permissionless way without needing countless intermediaries - lowering the cost of borrowing while providing DeFi users with a stable source of yield.

They combine the Centrifuge Protocol (trustless consensus layer) with a real-world legal framework which links the on-chain to off-chain transactions. The Centrifuge protocol is a purpose-built Layer 1 blockchain for the financing of RWAs including securitisation, tranching, tokenisation, privacy, governance, and liquidity integrations. Having experimented with an implementation on Ethereum, the team decided on a Polkadot Parachain built on Parity Substrate with an initial bridge to Ethereum to allow for:

greater future scalability

more customisation (certain computations which asset issuers need are not possible on EVM)

upgradeability (e.g., Substrate comes with tools to do runtime upgrades)

the ability to define transaction ordering (e.g. ensuring redemption orders can always be submitted even in highly contested blocks)

Individual credit instruments can be very illiquid and have different maturities so pooling assets and securitising them is very common in traditional structured credit markets. This is a large part of what Centrifuge does with their asset pools being fully collateralised and affording lenders legal recourse. Assets are tokenised as NFTs and then pooled together and securitised by issuers. With integrations across the wider Crypto ecosystem, liquidity pools are used to allow users to invest from other blockchains. The asset pools are revolving which allows investment and redemption to occur at any time and assets to be financed and repaid continuously. This relies on an epoch mechanism and on-chain NAV calculation to allow for a dynamic and ongoing model which is distinct from the static securitisation seen in traditional finance.

The state of affairs

While the end goal is to bring all credit on-chain, let’s take a look at where Centrifuge are today:

The first RWA onboarded to Maker was a Centrifuge issued RWA and recently a $220m credit fund, deployed by MakerDAO, managed by BlockTower Credit and issued via Centrifuge, went live:

They are working with Aave, first starting with a treasury investment into T-Bills with the longer term goal to back GHO with RWAs issued via Centrifuge:

Centrifuge has financed a total of $494m assets with current TVL sitting at around ~$250m. The bulk of TVL is deployed into BlockTower structured credit pools behalf of Maker but there are additional pools open for investment across a variety of credit products:

It is clear that the Maker and BlockTower partnership significantly changed the short-term trajectory for Centrifuge. While there is some concentration risk, the fact that such large players chose Centrifuge is promising. The team are laser focused on achieving similar deals moving forward with their Centrifuge Prime initiative - allowing DAOs and protocols to seamlessly access RWAs.

CFG

CFG is the native token which is used in on-chain governance to manage development of the Centrifuge Protocol and as of July 2023, to pay transaction fees which flow to the treasury (controlled by token holders). Currently the treasury has accrued ~5.1m CFG or ~$3m at current prices:

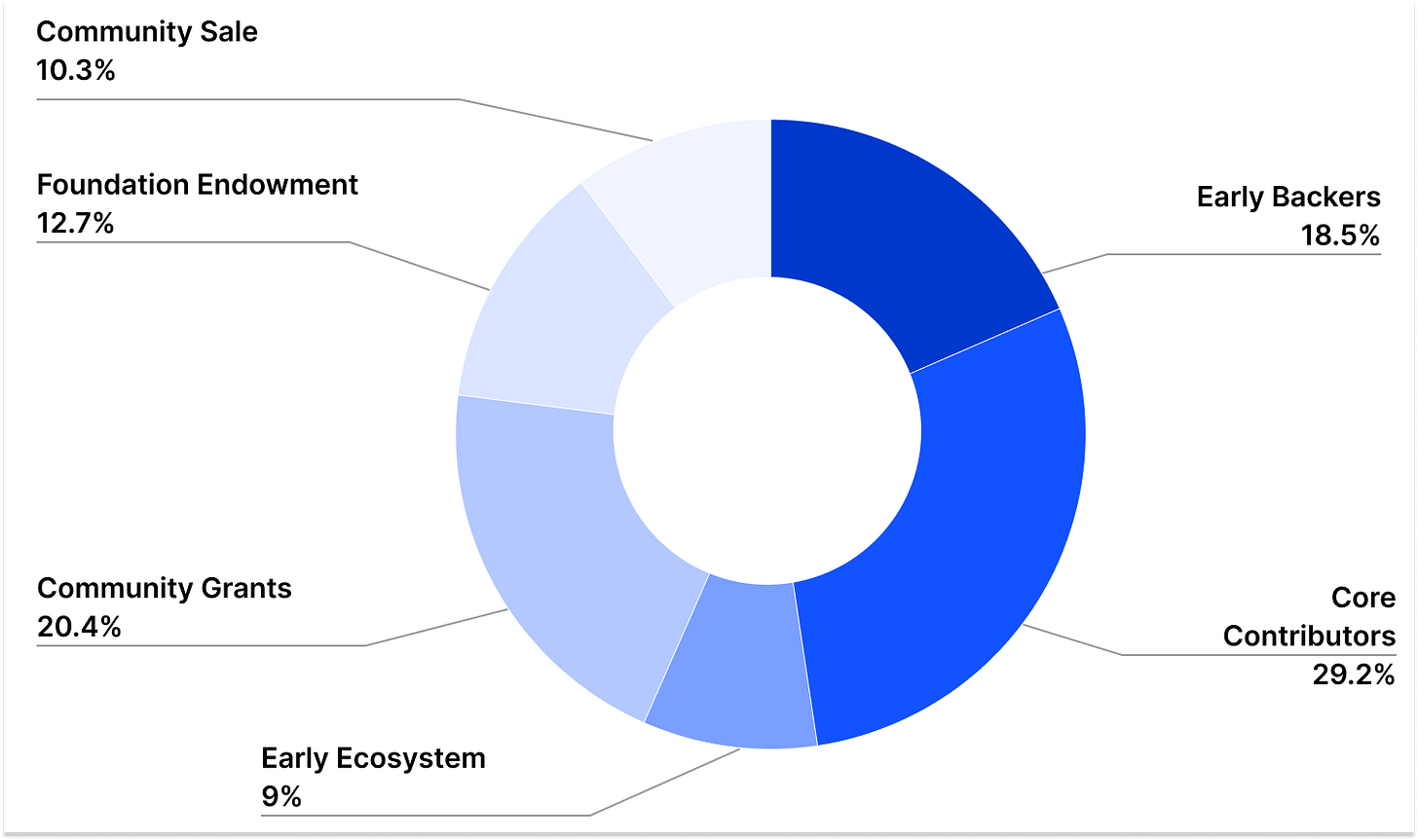

The initial supply of CFG was 425m and distributed as follows:

Team and investor tokens are fully vested with the remaining unvested tokens being in the grants and foundation endowment allocations. Total token supply is now ~519m and currently inflates by 3% a year - token holders can vote on where this is directed to: paying collators, rewards for liquidity providers, grants to contributors etc.

Note that Centrifuge is secured by Polkadot validators via Parachain slot leasing in the same way all Parachains are secured (although there are talks to change this model to a monthly fee). The founder Lucas has discussed that staking for CFG doesn’t make sense given there are no slashing condition for collators. These Collators are chosen by governance and play a block ordering role, being compensated in CFG from the treasury.

In the long term, the plan is to have fees be higher than issuance such that issuance would no longer be needed to maintain network sustainability. The notion of burning a portion of fees to achieve supply deflation has also been discussed but is not a reality in the short term as the network is very much still at an early stage.

A “stake-to-pool” model has also been proposed whereby users would stake tokens to a pool to signal that it is safe and then they would be slashed if losses materialised in said pool. It is not clear that such models work well given the fact that in a black swan scenario, CFG is likely performing very badly at exact the time it needs to be sold to cover losses.

Conclusion

Centrifuge is a promising piece of infrastructure whose recent heavy-hitting partnerships speak to the quality of their RWA financing stack (both on and off-chain). There are plenty of private companies building towards a similar end goal but CFG represents one of the few quality liquid bets on tokenisation. At a ~$225m fully diluted valuation without sustainable value accrual, the token does not scream cheap on an absolute basis but is certainly not richly valued in relative terms.

At this stage the path towards sustainable economics is unclear so CFG is very much a growth-stage bet on the team to capitalise on the infrastructure they have built through further partnerships and by capturing a piece of the wider tokenisation growth we expect.

With supply mostly circulating, strong growth efforts from the team and the chart showing signs of bottoming, there could be promise here:

If you enjoyed and want to see more content like this, feel free to check out the Humble Farmer Army premium discord here.

You’ll get access to:

Weekly Premium Content

An Exclusive Community

DeFi Yield Strategies

Degen Farms & New Launches

DeFi Education & Analysis

And Real-Time DeFi Alerts