Blasting Off - The Blast Opportunity

Blast and how you can maximize your airdrop...

With new alternative L1s and L2s launching by the day, there is an evergrowing lack of differentiation between these up-and-coming blockchains. Why use Arbitrum over Optimism, or Base over Solana? Outside of relatively minuscule gas savings, users are currently driven to specific blockchains based on incentives at the application layer. Farming airdrops, earning yields, using applications, and trading tokens tend to be the ultimate drivers of a chain’s inflows, yet most chains don’t cater to these activities. Outside of the occasional ecosystem funds or token incentives, there’s no reason for a user to prefer one chain over another. Due to this reality, the application layer alone is often the deciding factor for any chain’s success.

But what if there were a chain that directly incentivized activity at the application layer, while also enticing user and developer activity through native yields and ecosystem rewards?

In today’s report, we’ll discuss Blast and how you can maximize your rewards.

What is Blast?

Before we get too deep, let’s quickly cover the basics. For those who may not be familiar, Blast is a Layer 2 blockchain with native yield built by the team behind Blur and backed by Paradigm. When you bridge to Blast, you begin to automatically earn yields on the idle assets in your wallet. But wait, where does the yield come from?

When using L1 —> L2 bridges, your bridged assets are held in a smart contract on the L1 while you receive a liquid representation on the L2. This means most L2s have billions of dollars of yield-bearing assets sitting idly by. Seems like a waste, right? This is where Blast aims to differentiate itself as the “L2 for native yield”.

When you bridge ETH/USDC to Blast, your underlying tokens are automatically used to earn the ETH staking/T-Bill yields (4-5% respectively), which are then rebased on the L2. Adding on to this, users can leverage these yield-bearing tokens on the Blast L2 for lending, borrowing, LPing, and more, theoretically creating a haven for farmers. But is this really enough? At the end of the day, Blast appears to just be a sDAI/stETH wrapper in an already crowded L2 landscape; but this is where things get interesting. Points, gold, airdrops, and yields, all of which are leveraged at the base layer to attract users and developers alike. Throw in some additional incentives at the application layer with protocol points, yields, and airdrops, and you have a strong case for a diverse L2 ecosystem.

How to Farm $BLAST

Before we get into our favorite points farming strategies, you should first have a basic understanding of the way that the Blast airdrop is structured.

By simply bridging tokens to Blast and holding them in your wallet, you will begin to accrue points which are visible on the Blast dashboard here. There will also be point multipliers available for using specific apps, which will begin on April 1st. Users can also boost their points by referring others, with 50% of the total Blast airdrop being allocated to points holders.

The other half of the Blast airdrop is allocated for developers through the use of Blast Gold, which is awarded to Big Bang competition projects as well as mainnet applications based on specific KPIs. Some projects have larger allocations than others (which can be seen here), and most of these applications are redirecting their Blast Gold airdrop back to users of their respective protocols.

While you only earn points on the ETH/USDC balance in your wallet, protocols can also distribute the points they earn from your deposited assets back to you. Similar to Blast Gold, most protocols are redistributing 100% of their points back to users of their protocols. This means that outside of smart contract risk, there is little reason to not deposit your tokens in one of these protocols, especially when you can earn more points for the project itself. Airdrops on top of airdrops on top of airdrops, what more could a humble farmer ask for?

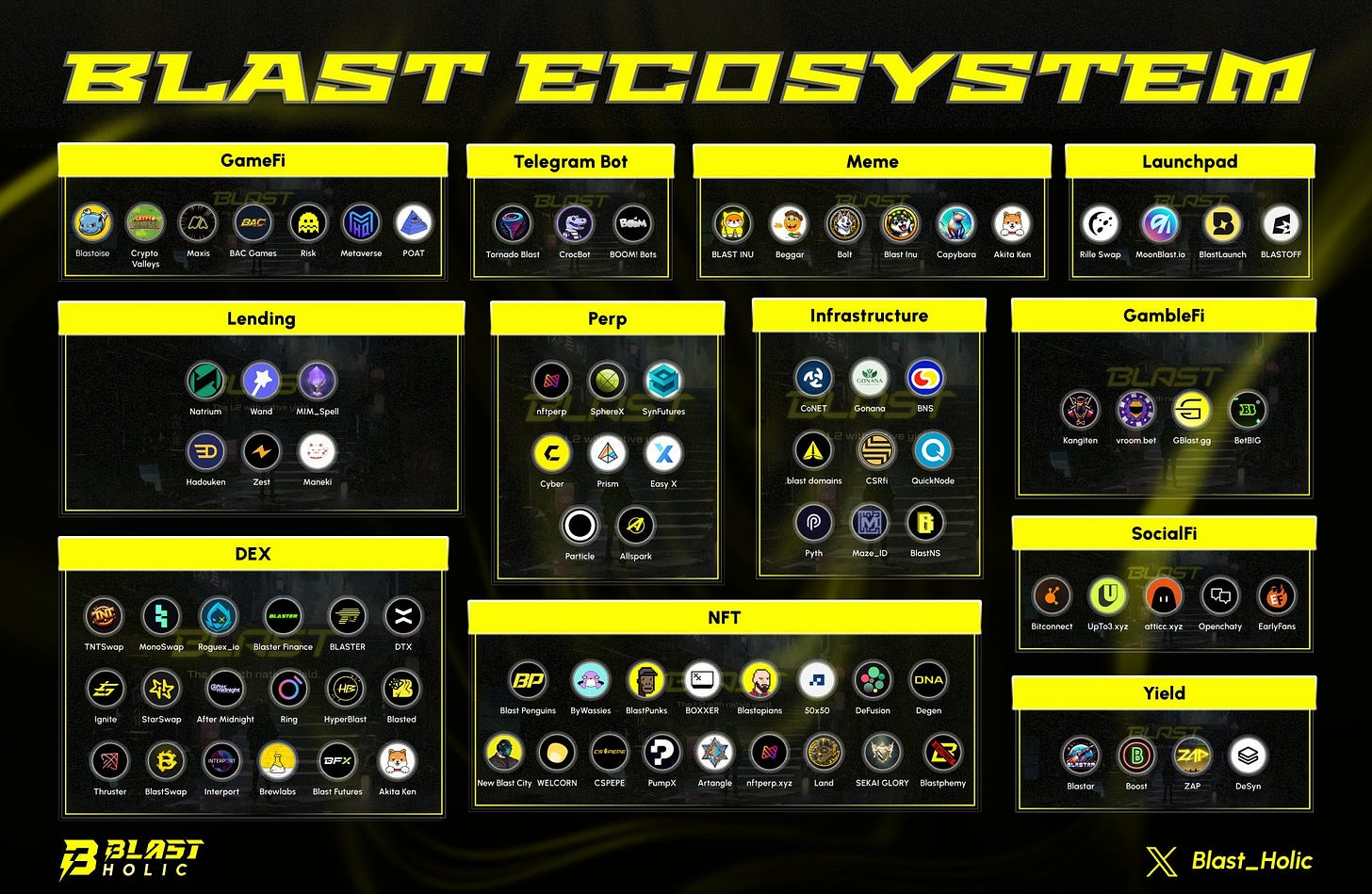

Ecosystem Opportunities

There are always opportunities on new chains for those who bridge early, and while there aren’t many tokens to ape, there are plenty of lucrative farming opportunities. We’ve already started to see a unique ecosystem develop on Blast, and while there are countless protocols that have already launched, here is what we’re looking at.

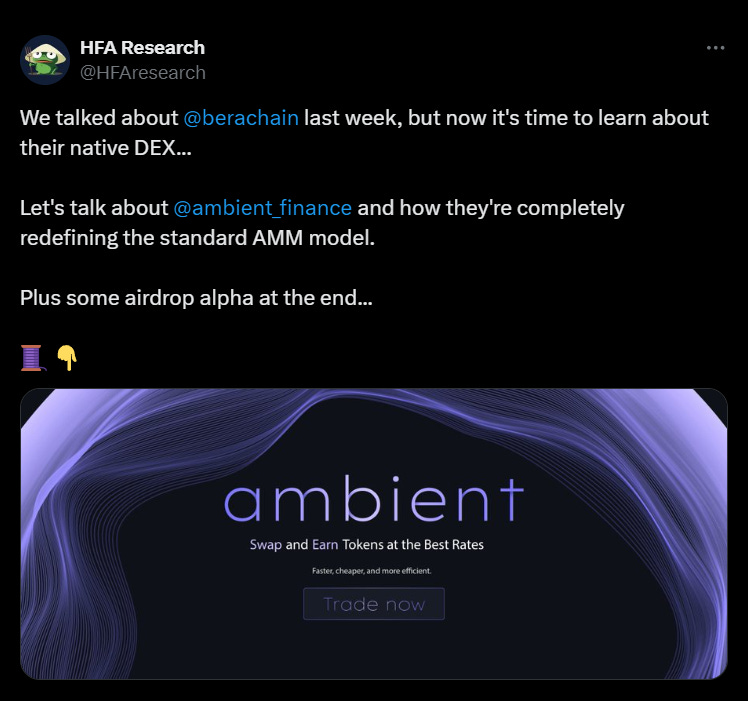

1. Ambient

TVL: $56M

Raised: $6.5M

Audited: ✅

Ambient is one of our favorite DEXs to farm at the moment, and they’ve recently launched on Blast with their very own points system. But why do we like Ambient so much? You can check out our full thoughts in the thread below, but in short, Ambient fixes the fragmented liquidity problem by combining concentrated and ambient liquidity into a single token pool. Ambient has also been quick to launch on other chains, and has made partnerships with large protocols like Berachain, Monad, and more…

2. Juice

TVL: $110M

Raised: $7M

Audited: ✅

Juice is a leveraged yield farming protocol on Blast, and seems to be one of the best places to maximize your Blast points, while also earning points for Juice and Thruster (Blast-native DEX). But how does it work? Users can participate as either a lender or borrower, both of which have their own range of benefits (which can be seen below). As a general rule of thumb, lending seems to be better for earning stable yields and maximizing Juice points, whereas borrowing is better for farming Blast/Thruster/Hyperlock points.

3. SynFutures

TVL: $22M

Raised $37.4M

Audited: ✅

Synfutures is a derivatives exchange that has recently launched on Blast along with their Oyster Odyssey points program. You’ll begin to passively accrue points on SynFutures for trading and providing liquidity, as well as Blast points/gold on top. For having raised such a ridiculous amount of money from well-known VCs over the past couple of years, Synfutures seems extremely underfarmed, especially given the additional Blast rewards.

4. nftperp

TVL: $5M

Raised: $3M

Audited: ✅

nftperp is an NFT perpetual exchange that has recently launched on Blast, where users can earn vNFTP token rewards for providing liquidity and trading. With the recent launch of v2, nftperp has transitioned into a hybrid AMM/orderbook-style exchange which has solved many of the issues plagued by their previous vAMM model. We’re big fans of nftperp, and you can currently qualify for vNFTP tokens by providing liquidity and trading. Given the relatively low TVL, this could be a lucrative farm worth monitoring.

5. Munchables

TVL: N/A

Raised: Unknown

Audited: ✅

Munchables is an upcoming NFT/GameFi project on Blast, and was a winner in the recently concluded Big Blast competition. Munchables will be running a lockdrop campaign where users will be able to lock up their ETH for a month in order to earn NFTs, Blast Gold/Points, Schnibbles, and more. With GameFi projects like Super Sushi Samurai and Crypto Farms picking up steam, Munchables could be a good place to park some ETH.

Conclusion

If you enjoyed and want to see more content like this, feel free to check out the Humble Farmer Army premium discord here.

You’ll get access to:

Weekly Premium Content

An Exclusive Community

DeFi Yield Strategies

Degen Farms & New Launches

DeFi Education & Analysis

And Real-Time DeFi Alerts

Humble Farmers Rejoice!