In a market environment like the one we’re currently living through, generating yield on stablecoins is one of the best ways to survive and thrive. In this post, I’ll be reviewing some of the best opportunities which exist currently (note that these are adjusted for risk and are in no particular order.

HLP

With a current yield of 18.61%, the Hyperliquidity Provider (HLP) vault on Hyperliquid has been a consistently good source of returns. Using their own description, HLP “provides liquidity to Hyperliquid through multiple market making strategies, performs liquidations, and accrues platform fees”.

One thing we have noticed is that HLP returns tend to be quite lumpy, the vault will often be flat/slightly up for extended periods and then produce significant 1 day returns during liquidation events:

HLP does have relatively high “black swan” risk given that it acts as a black box and depositors are solely reliant on the competence of the vault operator (Hyperliquid team). What makes us more confident here is that on average traders are loss making so over time the vault should be profitable. One must also note that deposits into HLP are subject to a 4 day lock-up before withdrawal.

Sky Money

Sky Money is the rebrand of MakerDAO. Sky currently offers stablecoin depositors two options:

8.52% paid in SKY to depositors into the Rewards vault

6.5% paid in USDS to depositors into the Savings vault (this is the new DAI Savings Rate)

Naturally we prefer the higher yield option here as the risk is of equal magnitude. The Rewards vault also allows the depositor to accumulate SKY which we feel is undervalued, accumulating SKY rewards instead of farming and dumping could offer further upside to the headline yield.

Ethereal

Ethereal is a decentralised perpetuals exchange closely tied to and endorsed by the Ethena team. It seems as though this will be launching on “the Ethena Network” and will be where the Ethena team looks to hedge their long spot positions, thereby leaking less value to CEXs.

They are currently running a “Season Zero” points campaign whereby USDe depositors accumulate Ethereal points and 30x Ethena Rewards (this is arbitrary as we don’t know what the base is, so we can just assume some $ENA will be directed towards depositors).

At present the APR of this opportunity is not known, I would imagine it likely settles at 15-20% depending on where the Ethereal token launches. Given the lack of information about yield, this could be considered “risky” from an opportunity cost standpoint. Either way, I believe it is a strong addition to any stablecoin yield farming portfolio.

AO

AO has seemingly flown under the radar for many market participants. We actually wrote about it here back in May 2024. AO have been running a pre-deposit-like farming campaign for some time now but with the token generation event having taken place recently, the current APR is now known.

1 DAI earns 0.004424 AO on a yearly basis so the APR is 0.004424*AO Price (currently $32.49) = 14.37%

Similarly to the Sky opportunity and perhaps the Ethereal opportunity too, farming AO allows you to achieve a decent yield currently if you farm and dump but also allows you to accumulate AO which could perform well in the future, offering an upside case to the current APR.

Berachain

Not much to say here, there are some interesting opportunities on the Berachain native DEX such as the USDC.e/HONEY pool which is currently paying 13.79% in BGT. BGT is a soulbound token which can be burnt 1:1 for BERA, farmers can either farm and dump to realise the headline APR or accumulate BGT to speculate on the Berachain ecosystem (which is heating up a little as of late!).

Sonic

Sonic are deep into a huge airdrop farming campaign, distributing hundreds of millions of dollars worth of S to incentivise the ecosystem. This has created some interesting farming opportunities.

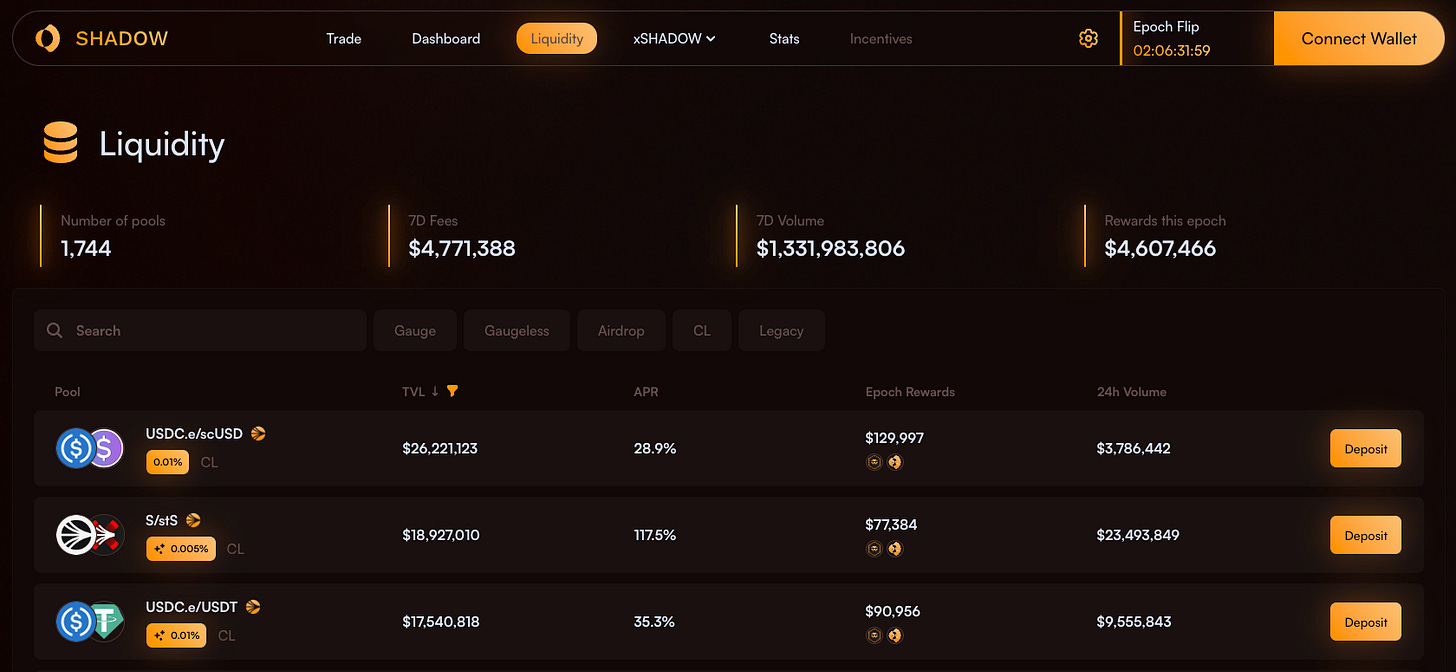

Shadow Exchange, one of the native DEXs has many attractive stablecoin opportunities, two look particularly interesting

USDC.e/scUSD paying 28.9%

USDC.e/USDT paying 35.3%

Navigator Exchange which is a GMX fork, is also offering an interesting GLP/JLP-style product called NLP (it’s worth noting this product does have some delta risk given the exposure to S, BTC and ETH), it is currently paying 35.60% in S and 131.71% in esNAVI:

If you enjoyed and want to see more content like this, feel free to check out the Humble Farmer Army premium discord here.

You’ll get access to:

Weekly Premium Content

An Exclusive Community

DeFi Yield Strategies

Degen Farms & New Launches

DeFi Education & Analysis

And Real-Time DeFi Alerts

Humble Farmers Rejoice!

Imo those are average farms regarding R/R:

- Anything below 12% is bad (coinbase rewards boost APR on your perp pf)

- HONEY-BYUSD at 20% is strictly superior than USDC.e/HONEY at 13.79%

- Talking about Ehtereal without mentioning Pendle LP with boosted APR + boosted points

I also like Pendle SuperUSDC LP at 17.46% APR + Superform points.