The Decentralized Exchange - DeFi’s best PMF

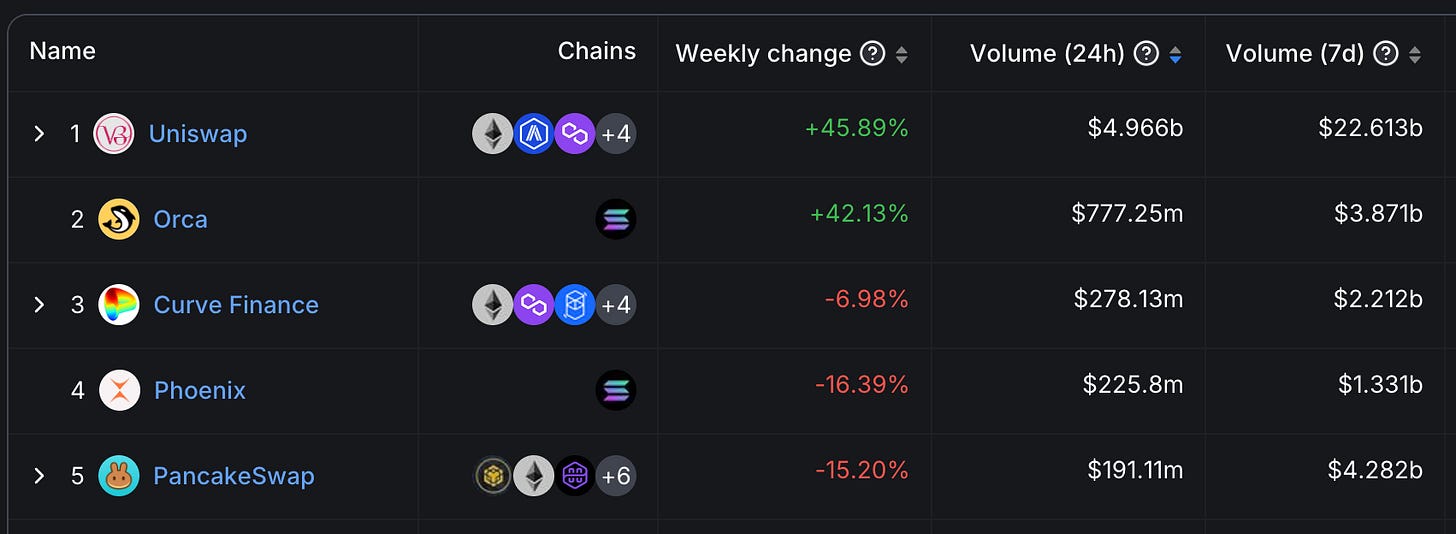

Since DeFi summer, there has been a lot of innovation and optimization in protocol design and token incentive systems for decentralized exchanges (DEXs). Throughout its short history, DeFi has had one major leader in the DEX space that everyone in crypto has likely used once or countless times - Uniswap. In its short history (~5 years give or take), Uniswap has facilitated trillions of dollars of volume on-chain. Yes, you read that correctly, trillions with a T. There is clearly a product-market fit for decentralized exchange of assets and value in crypto, and Uniswap has benefitted from that immensely and has provided tremendous value to market participants that desire to transact in a non-custodial, decentralized manner.

Curve was another important protocol that was born in DeFi summer, focusing on liquidity pools of similar assets, such that impermanent loss and fees are minimized. One of the primary use cases of Curve has been stablecoin trading, and it remains a top 5 protocol in DeFi in terms of volume, facilitating billions of dollars per week in volume. Curve popularized vote-escrow (a locking mechanism) tokenomics, being the first of its kind to give more voting power to those users who locked their CRV tokens for longer. This would become an important fundamental principle for Curve’s successors.

These protocols formed the primitives necessary and created what we now know as DeFi, arguably crypto’s best PMF to date.

Aerodrome Background and DEX Model

Toward the end of last cycle, in late 2021 and into 2022, the Fantom ecosystem began to gain attention due to Andre Cronje teasing a new DeFi primitive called Solidly that would combine aspects of traditional DEX’s like Uniswap and Curve to create a new design and incentive system. Long story short, the initial design that launched on Fantom in early 2022 did not pan out, partially due to poor market conditions and the bear market beginning. However, the idea lived on and was used to launch very similar protocols on other chains, such as Velodrome on OP Mainnet shortly after Solidly in 2022, and more recently, Aerodrome on Base.

Aerodrome launched in August 2023, and users that had locked their VELO (Velodrome’s governance token) received an airdrop in the form of veAERO (locked AERO). Lockers of AERO receive voting power proportional to how long they lock AERO for (1 AERO locked for the maximum of 4 years = 1 veAERO). More information can be found in the docs. More on this later.

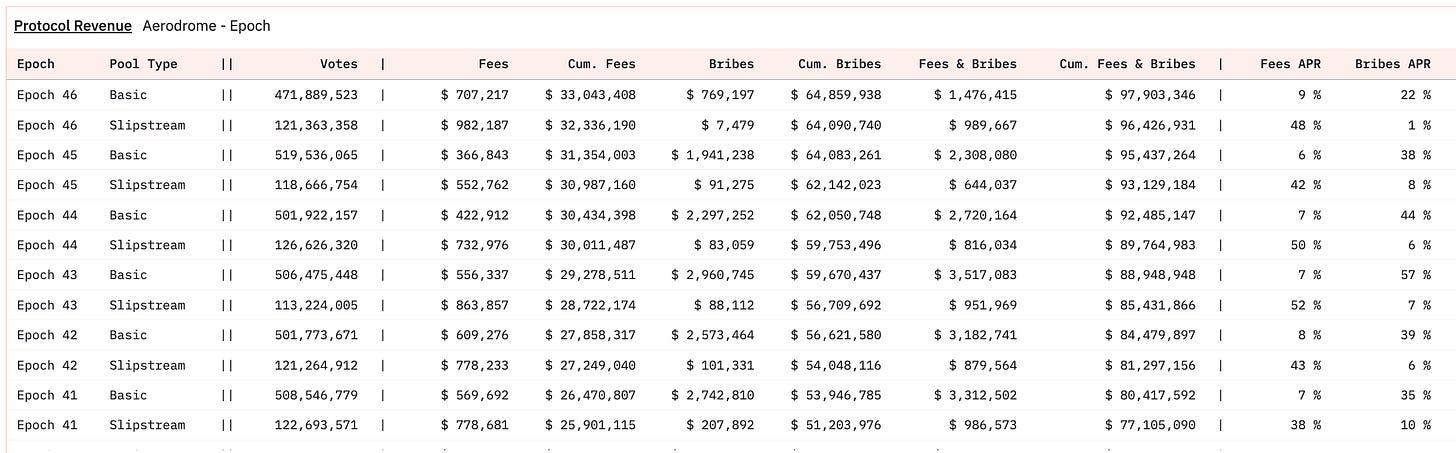

The user experience trading on a DEX like Aerodrome is very similar to that of something like Uniswap. However, the back end and the incentive system are very different. Rather than the LPs earning the trading fees, users that lock their AERO earn 100% of trading fees for the pool(s) they vote for each epoch (as well as bribes for said pool). This mechanism fundamentally gives the AERO token value, as locking it generates an APR in the form of fees and bribes. Furthermore, LP’s get paid in new AERO token emissions over time, dependent on how many votes their particular pool gets from veAERO voters. Therefore, protocols in need of liquidity can bribe veAERO voters to direct new AERO emissions to their specific pool, increasing the APR for liquidity providers.

Economics

While on paper, Aerodrome’s model (and the “Solidly” DEXs more broadly) seems like it benefits all market participants and aligns incentives well. Let’s get a sense of what both veAERO voters and LPs can expect to earn.

veAERO APR

As a reminder, holding AERO alone does not generate any sort of yield. One must lock AERO for a period of time to receive the vote-escrow token, veAERO, proportional to the lock time up to 4 years, in order to earn fees. As a veAERO voter, one may vote for a liquidity pool and earn their portion of the trading fees and bribes for that epoch. The sum of trading fees and bribes for a pool is split among all of the voters for said pool. In the below screenshot, “Incentives” are the bribes paid to incentivize veAERO voters to vote for this WETH-TOWER pool.

Looking at a random group of weeks from epoch 32 back through epoch 21, we can see that the combined fees + bribes APR ranged from 33% to 64%, with an average APR of ~44%.

It should be noted that as the price of AERO fluctuates, the dollar value of the yield is changing. However, AERO price is up significantly since launch (over 20x in 2024 alone at the time of writing), so someone that started the year with a $10k veAERO position now has a $200k veAERO position earning the same % APR. For this reason, owning veAERO can be very reflexive and lead to increased volatility on the upside or the downside.

Liquidity Provision APR

Unlike DEX’s like Uniswap, LPs do not earn trading fees on Aerodrome. Rather, LPs are paid in new AERO emissions based on the percentage of the total veAERO vote their pool receives.

Below is a snapshot from the recent epoch. The LP APR for the epoch is on the far right, “Yield APR”. Notice how pools containing long-tail assets that likely bribed larger amounts have higher APRs than something like WETH-USDC (toward the bottom of chart). Nominal yields for LPs can be triple digit percent, though real yields are highly dependent on any impermanent loss incurred.

source: https://dune.com/0xkhmer/aerodrome

Is Aerodrome a Better Model than Uniswap?

It is still very early in Aerodrome’s life cycle, however, growth has been steady and the Solidly DEX model has proven to show signs of staying power. Not only are LP’s profitable, but there is a legitimate utility for the governance token, which cannot be said for many other DEXs. This model has also shown to be highly effective for protocols in sourcing liquidity for tokens, as seen by triple-digit percent ROI on dollars used to bribe veAERO voters for protocols. All participants in the Aerodrome ecosystem seem to be satisfied thus far.

They are also creating a program called Flight School which may bring more attention back to the Aerodrome ecosystem, especially as the Base team continues to push “Onchain Summer.”

It remains to be seen if Aerodrome has sufficient product-market fit to justify a longer-term large valuation. Currently trading at just over $1 Billion FDV and seeing a slow grind up in volume, Aerodrome seems to have a lot of room to grow. For reference, leading DEXs reached valuations north of $20B FDV last cycle.

A lot of the success of a protocol is dependent on the success and growth of the underlying blockchain. Base has potential to be a massive success, and Aerodrome would be a major beneficiary of the influx of users. Not only that, but Aerodrome recently launched Slipstream (https://paragraph.xyz/@velodrome/slipstream), which is its version of concentrated liquidity pools. Over the past couple weeks, the volume for Slipstream has grown significantly, and it could potentially allow Aerodrome to catch up to (and surpass) Uniswap as the volume leader on Base. As Base continues to gain momentum and potentially even pass Arbitrum as the leading L2 by volume, Aerodrome certainly stands to benefit.

In addition, there are currently AERO lock bonuses, pushing the number of veAERO lcokers to over 18,000:

1 - current SuperFest opportunity lasts til Sep 4. every week, 8,750 OP are available for new AERO lockers to share.

2 - Flight School veAERO bonus https://x.com/AerodromeFi/status/1807049888271896977

We also saw Coinbase Ventures accumulate more AERO onchain: https://x.com/nansen_ai/status/1811072471388586076